Epson retains leadership with 52% share of shipments

PoS System shipments decline 10% sequentially

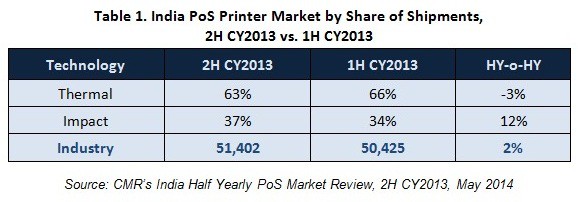

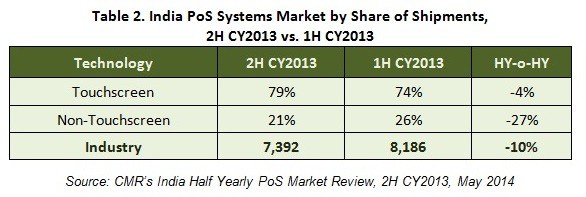

The India PoS (Point of Sale) Printer market witnessed growth of 2% in unit shipments (sales) for 2H CY2013 compared to the previous half year. However, PoS systems recorded 10% sequential decline in unit shipments for the same period. This was revealed in the CyberMedia Research report CMR’s India Half Yearly PoS Market Review, 2H CY2013, May 2014 release.

India PoS Printer Market Trends

The India PoS Printer market shipments were driven by thermal printers which contributed 63% of overall shipments in 2H CY2013. Impact printers, which contributed 37% of shipments during the same period, observed a 12% sequential growth over the previous half-year due to increased shipments by market leaders Epson and TVSe.

“The second half of 2013 witnessed a hike in average sales value of PoS printers by 7% when compared to the previous half year. This rise in ASV slightly impacted the sales of thermal printers, which are priced relatively higher than impact printers. However, the market for thermal printers is expected to pick up again with greater acceptance of revised prices by consumers in one-two quarters” stated Narinder Kumar, Analyst, InfoTech Practice, CyberMedia Research.

Epson strengthened its leadership in the PoS Printer category with a 52% market share in terms of unit shipments, registering a 29% sequential growth in its numbers in 2H CY2013 vis-à-vis 1H CY2013. TVSe maintained its position at the second spot.

Epson’s thermal printer model TM-T81 was the top-selling PoS printer during 2H CY2013 with a 19% market share contribution in terms of unit shipments, followed by the TVSe impact printer model RP-45. Thermal technology based printers captured six spots out of the ‘Top 10’ fast moving PoS printer models during 2H CY2013.

India PoS System Market Trends

The PoS Systems market witnessed a sequential decline of 10% in 2H CY2013 vis-à-vis 1H CY2013. This decline can be attributed to absence of major deals from the Government vertical. The market was also impacted by the imminent exit of Wincor-Nixdorf from India, which resulted in a 27% sequential decline in non-touchscreen based PoS Systems shipments in 2H CY2013. Touchscreen based PoS Systems led the market with a 79% share of unit shipments during 2H CY2013.

Hypermarkets/Supermarkets were leading consumers of PoS Systems, accounting for more than half of PoS Systems shipments in 2H CY2013. Contribution from the Government vertical reduced to 4% of unit shipments in 2H CY2013 compared to 15% in 1H CY2013.

Posiflex maintained its market leadership in terms of PoS System shipments with a 33% contribution during 2H CY2013, followed by NEC and Essae. The Average Sales Value (ASV) of PoS Systems increased sequentially by 10% due to upward price revision by all the major vendors.

Market Outlook

“The mandate to compulsorily implement BIS certification for PoS Printers shipped in India resulted in a temporary decline in shipments. This was further accentuated by the exit of ‘unbranded’ vendors from the India market. As a result, the market opportunity for major vendors is likely to expand. ‘Unbranded’ vendors were dumping products in India at irregular intervals, at comparatively lower price points. This was resulting in a noticeable distortion the market operating price or MOP”, Narinder added.

“Customers who had purchased ‘unbranded’ PoS Printers also faced service and warranty issues. These concerns are likely to see a decline as mainly respected brands remain in the fray in the next few quarters”, Narinder concluded.

Notes for Editors

- CyberMedia Research (CMR) is a pioneering market intelligence and consulting firm that runs a comprehensive half yearly market update on the India PoS market. CMR’s India Half Yearly PoS Market Review tracks and studies shipment trends for PoS Printers and PoS Systems. The numbers reported in this study do not include ‘parallel’ imports or ‘grey’ market sales for the above-mentioned form factors.

- CMR uses the term “shipments” to describe the number of PoS systems and PoS printers leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term shipment is sometimes used interchangeably with ‘sales’ in the press release, but this reflects the market size in terms of units of PoS systems and PoS printers. In the case of PoS systems and PoS printers imported into the country, “shipments” refers to the numbers leaving the first warehouse to OEMs, distributors and retailers.

- CMR tracks shipments of PoS systems and PoS printers for the India market on a half-year basis.