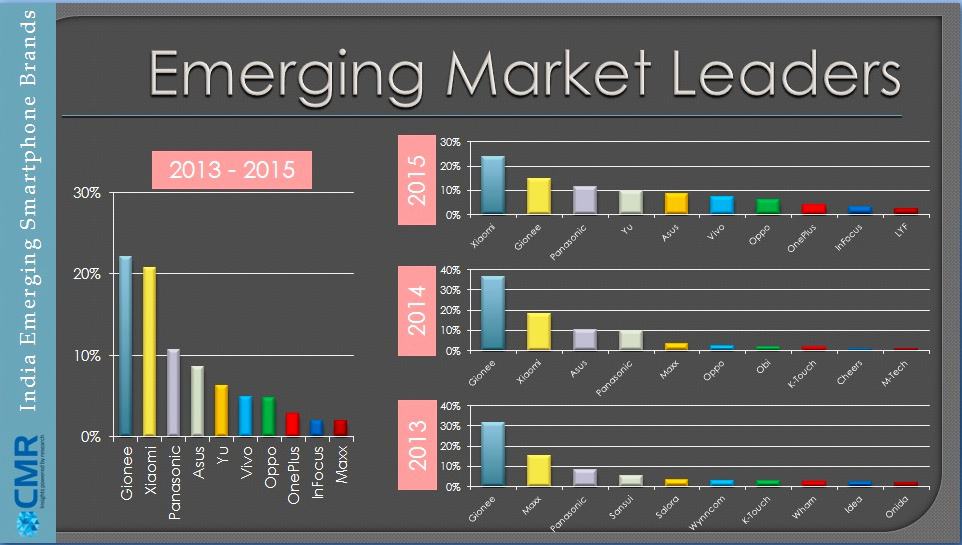

Xiaomi, Gionee and Panasonic were the leading emerging Smartphone brands in 2015.

- From a mere 3% contribution in 2013, emerging brands contributed 16% to the Smartphone shipments.

- Micromax’s Yu and Reliance’s LYF only two Indian brands in top 10 emerging Smartphone brands in 2015.

- 21 new Smartphone brands launched in 2015 in India. Prominent ones include InFocus, LYF, Qiku and Meizu.

- By the end of first quarter of 2016, 7 new brands were launched by LeEco that helped it gain prominence.

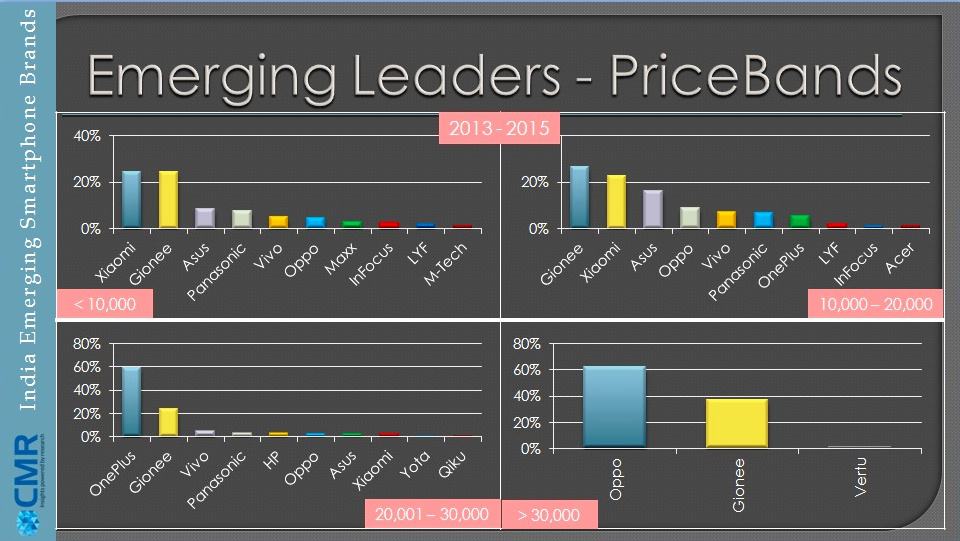

- Gionee and Oppo only two brands in leadership positions in all price segments.

New Delhi / Gurugram: As per CMR’s India Emerging Smartphone Brands Report 2016, announced today, the emerging brands are gaining momentum rapidly in the burgeoning Indian Smartphone market.

As per the report, 15.2 million Smartphones shipped in 2015 were from emerging brands which is set to double this year at 32.5 million units, representing 25% of the market. CMR defines ‘Emerging’ brands as those which were launched in India not before 2013.

While releasing the report, Faisal Kawoosa, Lead Analyst Telecoms at CMR said, “The emerging brands do not remain confined only up to giving competition to the incumbents and offering a wide variety of options for prospective buyers to choose from. But these brands are also focusing on offering value for money products, so that buyers could get more and best of specifications at affordable price points.”

“Further these brands have been trend setters like – Xiaomi introducing the concept of flash sales, OnePlus going by invitation mode only and Oppo boldly focusing on the camera feature and calling its phone as the camera phone,” Faisal added.

In 2015, Xiaomi led the market followed by Gionee and Panasonic with 23.6%, 14.7% and 11.3% market shares, respectively, within the emerging brands. Micromax’s Yu was the only existing Indian brand in the leadership ranks with Reliance’s LYF as the latest entry.

Krishna Mukherjee, Analyst Telecoms at CMR, while highlighting the trends, said, “One of the important trends to witness is the decline in the number of new brands getting launched every year. As compared to 74 brands in 2013, there were only 21 new Smartphone brands added in 2015. But, at the same time their contribution to the overall pie increased exponentially.”

“We expect in 2016, there could be further decline in the new brand additions in the country and there could be around 15 Smartphone brands added this year, but this does not mean the India market turning unattractive for the Smartphone industry. Rather, India will continue to attract all such brands that intend to go global and it would definitely remain the second largest market for several brands after they successfully play in their home markets.” Krishna concluded.

The cumulative leadership rankings for 2013-2015 were led by Gionee, Xiaomi and Panasonic. By price bands, the cumulative leaderships are represented in the below figure. Gionee and Oppo are the only two brands that were in leadership positions in all the four major price brackets.

Download the complete report here.

Notes for Editors

- CMR defines ‘Emerging’ Smartphones as those brands which were launched not before 2013 in India.

- This release is a part of the CyberMedia Research (CMR) Emerging Smartphone Brands Market Review.

- CyberMedia Research (CMR) uses the term “shipments” to describe the number of handsets leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term shipments is sometimes replaced by ‘sales’ in the press release, but this reflects the market size in terms of units of mobile handsets and not their absolute value. In the case of handsets imported into the country it represents the number leaving the first warehouse to OEMs, distributors and retailers. CyberMedia Research does not track the number of handsets brought on their person by individual passengers landing on Indian soil from overseas destinations or ‘grey market’ handsets. These are, therefore, not part of the CyberMedia Research numbers reported here.

- CyberMedia Research (CMR) tracks shipments of mobile handsets on a monthly basis. However, as per convention, the market size is reported on a calendar quarter basis where appropriate to the context; in all such cases this refers to an aggregated number for the three calendar months in the quarter to which the press release refers.

About CyberMedia Research

A part of CyberMedia (www.cybermedia.co.in), South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front runner in market research, consulting and advisory services since 1986.

CMR offers research-based insights and marketing consultancy services – market intelligence, market sizing, stakeholder satisfaction, growth opportunity identification, incubation advisory, and go-to-market services – covering the Information Technology, Telecommunications, Semiconductors, Electronics & Smart Infrastructure, Government, Energy & Utilities and LifeSciences sectors, as well as the large enterprise, SMB and consumer user segments.

CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. CMR’s forthcoming studies include stakeholder satisfaction surveys, mega spender assessments and market mapping studies for these domains.

CyberMedia Research, a division of Cyber Media Research and Services Ltd., is a member of the Market Research Society of India (www.mrsi.in).

For more details, please visit http://www.cmrindia.com.

For queries, please contact:

Media

Krishna Mukherjee

91-9871072319

releases@cmrindia.com

Industry

Faisal Kawoosa

GM – Industry Intelligence Group

fkawoosa@cmrindia.com