CMR MICI: When it Comes To Smartphones, Consumers Prefer ‘Experimentation’ Over ‘Brand Pull’

Share This Post

- Consumers are increasingly becoming brand-agnostic in their smartphone buying preferences

- Smartphone brands that invest in product quality and other softer aspects, win big

Gurugram, 7 March, 2019: CyberMedia Research recently released its latest, large-format CMR Mobile Industry Consumer Insight (MICI) Survey that provides a compelling picture of the changing dynamics of the Indian Smartphone Market. The latest edition of the MICI focused on smartphone product quality and associated factors, with a clear intent to capture consumer perspectives.

The CMR MICI survey results underline the fact that consumers are increasingly becoming brand-agnostic, and their smartphone preferences are increasingly driven by factors, such as overall product quality (92%), product performance (90%), product aesthetics (82%), and reliable after-sales service, with fast turnaround time (76%).

“In a hyper-competitive market, marked by the smartphone sea of sameness, smartphone brands that invest in ensuring product quality and other softer aspects, win big. Indian consumers, especially post-millennials and Gen-Z are very demanding. For them, smartphone product design, product quality, and overall value for money are of critical importance,” said Narinder Kumar, Lead Analyst – IIG, CMR.

The CMR MICI survey was conducted across top eight Indian cities, in February 2019, covering teens and youth, in the age group of 15 to 30. The survey covered respondents from various backgrounds, and income/socioeconomic levels.

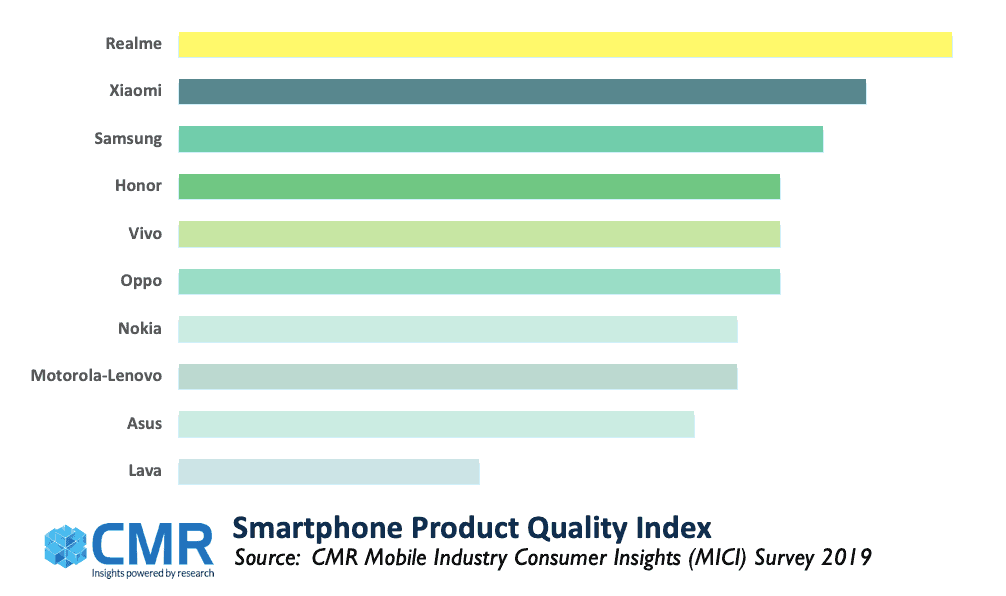

According to Satya Mohanty, Head- User Research Practice, CMR, “The CMR MICI Survey results affirm the importance and passion that consumers invest in, and associate with their smartphones. While bigger smartphone brands continue to hold onto their pockets of strength, it is interesting to see Realme outperform the competition, and emerge as the ‘No.1 Quality Smartphone Brand’ in the CMR MICI Survey. I believe, this can be attributed to the nimble and success-hungry DNA of Realme, a nascent smartphone brand.”

Here are the key highlights from the CMR MICI Survey findings:

- Indian Consumers put a premium on factors, such as “product reliability” (76%), “product innovation” (72%), and “customer centricity” (68%) over “smartphone brand equity and imagery”.

- The key smartphone specs that consumers consider during purchase include smartphone camera (89%), battery life (87%), RAM (79%), and internal memory (72%).

- When it comes to brand loyalty, users of smartphone brands, including the likes of Xiaomi, Realme, and OPPO, are the most loyal (88%).

- Realme (94%) stood first in terms of overall performance, followed closely by Xiaomi (93%).

- Realme was preferred by customers for its product quality (96%), and its value-for-money (96%).

- In Smartphone Product Quality Index, Realme emerges as the ‘No.1 Quality Smartphone Brand’.

- When it comes to product aesthetics, OPPO was placed first (94%), followed by Realme (93%), with Samsung and VIVO tied at third position (92%).

- Samsung, with its vast retail network, scores big on after-sales services (84%).

Share This Post

CyberMedia Research conducts the Budget Smartphones Channel Audit to capture the perspectives, preferences, challenges and dislikes of retailers around ‘value for money’ (INR <10,000) smartphone brands, capturing a compelling picture of smartphone brands in the market.

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

More To Explore

No posts found!