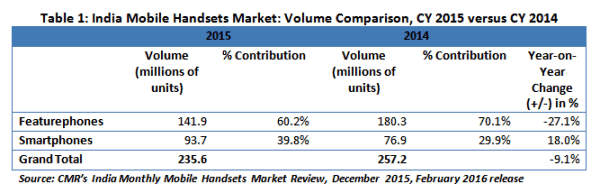

Market clocks 235.6mn unit shipments, down 9.1% from CY 2014

- 40% of the handsets sold were Smartphones

- Samsung, Micromax and Intex lead, in that order, for overall as well as Smartphones segment; Lenovo makes significant gains

- 2G Smartphones now a ‘dead’ segment with just 9% contribution to overall smartphone shipments in 2015; 4G growing fast

- Market expected to settle at 250 mn units in 2016, including 130 mn Smartphones

New Delhi/Gurgaon: Tuesday, February 2, 2016 – Announcing the annual report card for the India Mobile Handsets market for CY 2015 today, a CMR report said that the country sold 235.6 million units in the year as compared to 257.2 million units in 2014, down 9.1% year-on-year.

Smartphones, which constituted 39.8% of the total sales, grew at 18% while Featurephones registered a sharp decline of 27.1% in annual shipments.

Commenting on the highlights of the report, Faisal Kawoosa, Lead Telecoms Analyst, CMR said, “We are witnessing a transition period for the industry. Transition from mass to niche, featurephones to Smartphones, 2G and 3G to 4G, ‘offline only’ to hybrid, that is, a combination of offline and online, and ‘imports only’ to domestic manufacturing with imports. This transition phase is bound to result in a contraction of the market in volume terms, which is what we saw towards the end of calendar year 2015, in particular.”

“Once this transition is over and vendors adopt the right mix of sourcing and marketing, and develop competencies to address the emerging/niche segments rather than the mass market, we should see the market rebound back,” Faisal added.

Year 2015 saw the entry of twenty (20) Smartphone brands into the India market, taking the total options a consumer could choose from to 161. Overall, there were 431 brands selling mobile phones in the country.

Commenting on this trend, Karn Chauhan, Analyst for the India Mobile Device market at CMR said, “This year the ‘Top 10’ Smartphone brands contributed to 82.9% of shipments, compared to 85.1% in 2014. We expect the market to fragment further and while this is a healthy sign, ending the dominance of a few players, what is worrying is the ability of new entrants to sustain their performance.”

“We have observed that most brands lose vigour after a quarter or two of their entering the market. Unfortunately, they are not able to keep up the momentum in terms of shipment volumes that they initially disrupt the market with. This leads to fluctuations in overall shipments and market shares – one of the results and inconsistencies that we saw in 2015,” Karn concluded.

Notes for Editors

- This release is a part of the CyberMedia Research (CMR) Smart Mobility Market Review Programme.

- CyberMedia Research (CMR) uses the term “shipments” to describe the number of handsets leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term shipments is sometimes replaced by ‘sales’ in the press release, but this reflects the market size in terms of units of mobile handsets and not their absolute value. In the case of handsets imported into the country it represents the number leaving the first warehouse to OEMs, distributors and retailers. CyberMedia Research does not track the number of handsets brought on their person by individual passengers landing on Indian soil from overseas destinations or ‘grey market’ handsets. These are, therefore, not part of the CyberMedia Research numbers reported here.

- CyberMedia Research (CMR) tracks shipments of mobile handsets on a monthly basis. However, as per convention, the market size is reported on a calendar quarter basis where appropriate to the context; in all such cases this refers to an aggregated number for the three calendar months in the quarter to which the press release refers.