Multi-SIM handsets account for two-thirds of total sales; 3G phone sales still below 10 per cent of total sales

The overall India mobile handsets market registered sales of 50.2 million units during January-March 2012. This was reported in the CyberMedia Research India Monthly Mobile Handsets Market Review for 1Q 2012 released today.

In the overall India mobile handsets market, Nokia retained leadership position with 23% share, followed by Samsung at second position with 14.1% and Micromax at third position with 5.8%, in terms of sales (unit shipments) during January-March 2012.

Table 1. India Monthly Mobile Handset Shipments (millions of units), January-March 2012*

| Device Type | January-March 2011 | October-December 2011 | January-March 2012 | QoQ Growth (Jan-March 2012 vs. Oct-Dec 2011) | YoY Growth (Jan-March 2012 vs. Jan-March 2011) |

| Featurephones | 43.7 | 45.2 | 47.5 | 5.1% | 8.7% |

| Smartphones | 2.3 | 3.4 | 2.7 | -20.6% | 17.4% |

| Total | 46.0 | 48.6 | 50.2 | 3.3% | 9.1% |

*Source: CyberMedia Research India Monthly Mobile Handsets Market Review for 1Q 2012, June 2012 release

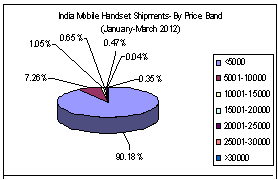

Overall India Mobile Handsets Market by Price Band

Figure 1. India Mobile Handsets Market by Price Band

Source: CyberMedia Research, 2012

Table 2. India Mobile Handsets Market by Price Band: Leading Vendors in the sub-INR 5,000 Category

| Vendor Name | Jan-March 2012 (Price Band < INR 5,000) |

| Nokia | 21.80% |

| Samsung | 10.70% |

| Micromax | 6.40% |

Source: CyberMedia Research, 2012

India Smartphones Market: The Shape of Things to Come

Total India smartphone sales touched 2.7 million units during January-March 2012. Samsung emerged as the leader in the smartphone segment with a 40.4% share, followed at No. 2 and No. 3 by Nokia with 25.5% and RIM with 12.3% share respectively.

Table 3. India Mobile Handsets Market: Shares of leading Vendors in Smartphones*

| Vendor Name | Jan-March 2012 |

| Samsung | 40.4% |

| Nokia | 25.5% |

| RIM | 12.3% |

*Source: CyberMedia Research India Monthly Mobile Handsets Market Review for 1Q 2012, June 2012 release

In 1Q 2012, Samsung launched seven new smartphone models in India, further tightening its grip on sales in different price bands between INR 7,500 to INR 27,000. This is the range in which the company sells its portfolio of smartphones currently. It excludes products like the Samsung Galaxy Note, which, with a 5″ screen is categorized under the category of media tablets / tablet PCs. Indian mobile handset vendors have also started aggressively widening their Android-based smartphones portfolio.

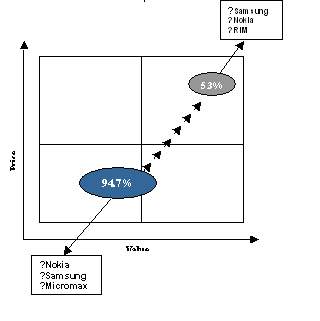

Figure 2. India Mobile Handsets Market by Price Band in 1Q 2012: Converging Towards Two ‘Poles’

Source: CyberMedia Research, 2012

“As the India mobile handsets market grows in maturity, the needs of users are clearly seen to be converging around two major form factors – high-power, high-speed smartphones vis-à-vis value-plus, content-enabled featurephones. While most players are strong in a particular category, Samsung and others have been able to maintain a strong presence across the spectrum, driven mainly by innovation, quick time-to-market and a segmented approach”, stated Anirban Banerjee, Associate Vice President, Research and Advisory Services, CyberMedia Research.

“Players like Motorola and Sony have clearly chosen to stay in the ‘high value’ smartphones segment, which accounts for just 5.3% of shipments but added up to as much as 23.4% of the market value in 1Q 2012. Currently, large, international players like Nokia and RIM, as well as relatively new entrants like Micromax, Karbonn, Lava and Spice are faced with the challenge to enhance their portfolio of products, models and services, to stay relevant and profitable in the long run”, added Naveen Mishra, Lead Analyst, CMR Telecoms Practice.

India 3G Phones Market: Decline in Data Tariffs to Trigger Increase in Shipments?

Shipments of multi-SIM handset category continued its rise, accounting for as much as 67.7% of total shipments in 1Q 2012. However, even more significantly, total shipments of 3G-enabled mobile handsets in the country touched 4.7 million units during 1Q 2012 (January-March 2012). While this was a decline of (-)7.8% over the 4Q 2011 (October-December 2011) ‘festival quarter’, it was a growth of 34.3% over 1Q 2011 (January-March 2011).

“With the recently announced reduction in tariffs of 3G services by as much as 70% by leading India telecom service providers, the market for both 3G-enabled devices and mobile broadband-driven content is likely to see an upward trend in adoption in the forthcoming quarters”, stated Tarun Pathak, Analyst, CMR Telecoms Practice.

Notes for Editors

1) CyberMedia Research, India uses the term “shipments” to describe the number of handsets leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term shipments has been replaced by ‘sales’ in the press release, but this reflects the market size in terms of units of mobile handsets and not their absolute value. In the case of handsets imported into the country it represents the number leaving the first warehouse to OEMs, distributors and retailers. CyberMedia Research does not track the number of handsets brought on their person by individual passengers landing on Indian soil from overseas destinations or ‘grey market’ handsets. These are, therefore, not part of the CyberMedia Research numbers reported here.

2) CyberMedia Research, India tracks shipments of mobile handsets on a monthly basis. However, as per convention, the market size may be reported on a calendar quarter basis where appropriate to the context; in all such cases this refers to an aggregated number for the three calendar months in the quarter to which the press release refers.