MOBILE MUSIC AND AUDIO EMERGE KEY FOR CONSUMERS POST COVID-19: CMR AND HMD GLOBAL STUDY

Share This Post

• Music consumption increases on both feature phones and smartphones as India emerges from the lockdown.

• Mobile audio quality emerges as #1 prerequisite for consumers seeking new feature phones.

• SEC A and B are open to buying a feature phone as a companion device for uninterrupted free music and calls.

12th June 2020 | NEW DELHI. A new study by CyberMedia Research (CMR), in partnership with HMD Global, the home of Nokia phones, takes stock of the COVID-19 impact on changing mobile usage habits and behaviors amongst Indians. As per the study findings, consumers are now giving more preference to audio over the digital screen. They are, for instance, spending increased time on listening to high quality music.

“There is a clear undeniable shift in the way we operate, with COVID-19 hastening the speed of change. There is a lot written about increase in digital and screens; we wanted see what else is happening in the world of a consumer in India and found that audio is ruling, for music consumption and beyond,” said Prabhu Ram, Head-Industry Intelligence Group, CMR.

The prolonged lockdown and the move to work-from-home has led to both smartphone and feature phone users highlighting high quality music and audio capabilities as the most important feature in their phones.

“As we move from a homebound economy to a ‘neo normal’, mobile audio will remain key for consumers – think, communication, music and content consumption or team collaboration. For instance, in situations involving low bandwidth, the importance of audio becomes even more critical. All said, music is what drives our lives, and a good quality experience is what consumers hold dear,” Prabhu added.

For smartphone users, audio quality now ranks higher than their smartphone’s camera, battery life or even overall phone reliability. On the other hand, battery drainage and internet consumption are two important factors that impede high music consumption on smartphones. These are two key factors that makes them open to buying a feature phone as a companion device that can be used primarily for music and calls.

“Amongst consumer cohorts, feature phone users are now seeking to upgrade to better quality feature phones that promise long battery life and music storage. This is driven by the need for a potentially elevated consumer experience when it comes to listening to music on FM and MP3. On the other side, the significant digital overload with blurring work-life boundaries are pushing smartphone users to seek ‘digital detox’. As such, they are now open to a reliable companion phone,” added Satya Mohanty, Head-Industry Consulting Group, CMR.

Here are the few excerpts and the key findings of the study:

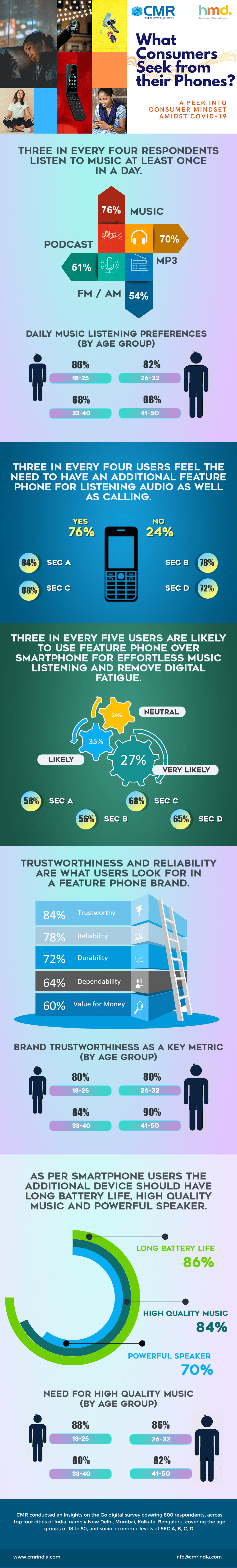

• COVID-19 drives increased music consumption. Three in every four respondents listen to music, at least once in a day. Beyond music, smartphone consumers also tune to podcasts, while 81% feature phone cohorts prefer FM and MP3.

% of Consumers listening to Music (By Age Group):

18-25: 82%

26-32: 85%

33-40: 71%

41-50: 68%

• Freemium audio content rules. One in every three users prefer freemium audio content. Average time spent on listening to music and other content is around 7 hours in a week.

Time Spent by Consumers (By Age Group):

- 18-25: 8 hours

- 26-32: 8 hours

- 33-40: 6 hours

- 41-50: 6 hours

• Consumers seek digital detox. 76% of the consumers indicate the need for digital detoxing.

Three in every four users feel the need to have an additional feature phone for listening to audio content and communication. This trend is more pronounced amongst higher SECs (SEC A-84% and SEC B-78%).

Three in every five users are likely to use feature phone over smartphone for effortless music listening and remove digital fatigue. Acceptance is higher among lower SECs (SEC C-68% and SEC D – 65%).

• Effortless music and strong battery life key. As per smartphone users the additional device should have long battery life (86%), high quality music (84%) and powerful speaker (70%).

% of Consumers looking for high quality music (By Age Group):

- 18-25: 86%

- 26-32: 88%

- 33-40: 82%

- 41-50: 78%

• Brand trust and reliability are paramount. Trust (84%) and reliability (78%) are what users look for in a feature phone brand.

% of Consumers emphasising on Brand Trust (By Age Group):

- 18-25: 78%

- 26-32: 84%

- 33-40: 82%

- 41-50: 90%

Share This Post

CyberMedia Research conducts the Budget Smartphones Channel Audit to capture the perspectives, preferences, challenges and dislikes of retailers around ‘value for money’ (INR <10,000) smartphone brands, capturing a compelling picture of smartphone brands in the market.

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

More To Explore

No posts found!