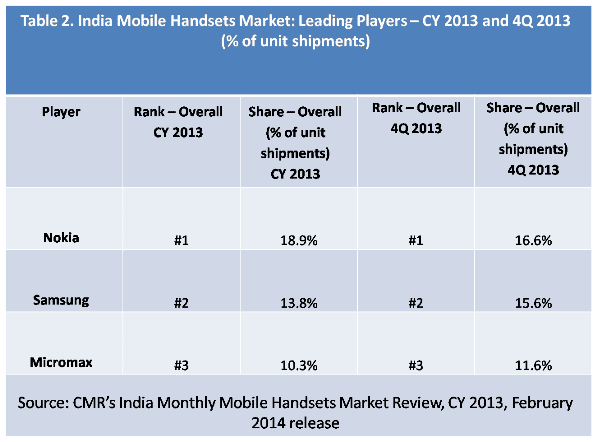

Nokia retains overall leadership followed by Samsung and Micromax at #2 and #3 respectively

Smartphone shipments cross 41 million units, a Y-o-Y growth of 172.2%; over 14 million Smartphones shipped in 4Q 2013 alone

Samsung leads the smartphone market followed by local handset players Micromax and Karbonn at #2 and #3 spots, respectively

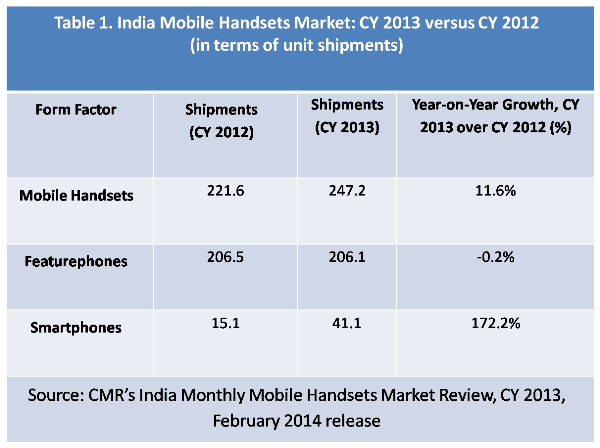

According to CMR’s India Monthly Mobile Handsets Market Review, CY 2013, February 2014 release, India recorded 247.2 million mobile handset shipments for CY (January-December) 2013. During the same period, 41.1 million smartphones were shipped in the country.

A comparison of overall mobile handset shipments for CY 2013 and 4Q 2013 shows similar rankings for the top three players, as shown in Table 2.

India Smartphones Market

The India smartphones market during 2H 2013 saw a rise in shipments by 60.3% over 1H 2013, taking the overall contribution of smartphones to 16.6% for the full year. Further, 65.8% of the total smartphones shipped in the country were 3G smartphones during CY 2013.

Commenting on these results, Tarun Pathak, Lead Analyst, Devices, CMR Telecoms Practice said, “CY 2013 was primarily the year of smartphones for the India market, particularly for local handset vendors. A first for the India market was a marginal decline in featurephone shipments on a year-on-year basis. This trend is likely to continue with more vendors focusing on entry level smartphone offerings aimed at the consumer segment.”

“Nearly 70 vendors operated in the highly competitive India smartphones market in CY 2013, with ‘Tier One’ brands like Apple, Samsung, Nokia, Sony, HTC,LG and Blackberry capturing close to 53% of the total smartphones market, followed by India brands capturing close to 43% of total smartphone shipments. The remaining market of roughly 4% smartphone shipments was captured by China OEM brands, where we expect a few more players to enter the India market directly, instead of continuing as ODM partners to Indian brands”, Tarun added.

Notes for Editors

- This release is a part of the CyberMedia Research (CMR) Smart Mobility Market Programme.

- CyberMedia Research (CMR) uses the term “shipments” to describe the number of handsets leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term shipments has been replaced by ‘sales’ in the press release, but this reflects the market size in terms of units of mobile handsets and not their absolute value. In the case of handsets imported into the country it represents the number leaving the first warehouse to OEMs, distributors and retailers. CyberMedia Research does not track the number of handsets brought on their person by individual passengers landing on Indian soil from overseas destinations or ‘grey market’ handsets. These are, therefore, not part of the CyberMedia Research numbers reported here.

- CyberMedia Research (CMR) tracks shipments of mobile handsets on a monthly basis. However, as per convention, the market size is reported on a calendar quarter basis where appropriate to the context; in all such cases this refers to an aggregated number for the three calendar months in the quarter to which the press release refers.