- Samsung led the overall India mobile market in Q1 2022

- Xiaomi led the overall smartphone market with 24% market share, followed by Samsung at 19%

- Affordable smartphone segment (INR <7000) declined 29% YoY.

New Delhi/Gurugram, 11 May 2022: According to Cyber Media Research (CMR)’s India Mobile Handset Market Review Report for Q1 2022 released today, 5G shipments grew >300% YoY, with overall smartphone shipments growing 1.6% YoY. Samsung led the 5G smartphone segment with 23% market share, followed by Xiaomi with 18% market share.

New Delhi/Gurugram, 11 May 2022: According to Cyber Media Research (CMR)’s India Mobile Handset Market Review Report for Q1 2022 released today, 5G shipments grew >300% YoY, with overall smartphone shipments growing 1.6% YoY. Samsung led the 5G smartphone segment with 23% market share, followed by Xiaomi with 18% market share.

According to Menka Kumari, Analyst-Industry Intelligence Group, CMR. “5G smartphone shipments posted a robust growth in Q1 2022. The overall smartphone market has posted a considerable growth of 16% compared to the pre-pandemic levels of Q1 2019. However, the smartphone industry continues to face major headwinds, including prevailing supply side dynamics, and resultant raw material shortages. While the initial two months of the quarter remain muted, March bucked the trend, with growth picking-up.”

Smartphone Segment

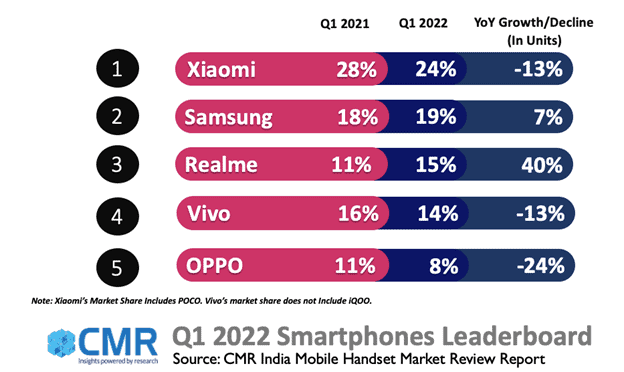

Xiaomi (24%), Samsung (19%) and Realme (15%) captured the top three spots in the smartphone leaderboard in Q1 2022 followed by Vivo (14%) and OPPO (8%).

While affordable smartphone shipments (sub-INR 7000) declined, premium smartphones (>INR 25000) grew 58% YoY, indicating strong consumer appetite to switch and upgrade.

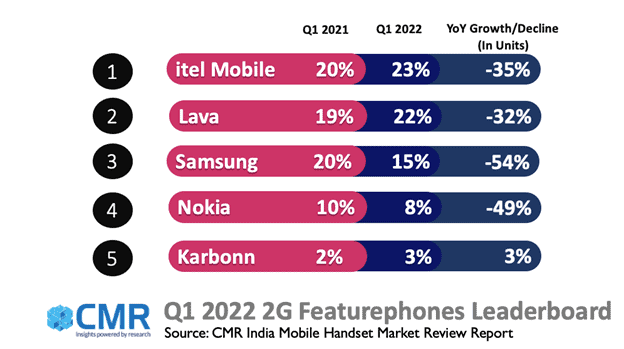

Feature Phone Segment

In Q1 2022, the overall feature phone segment declined 43% YoY, driven by supply side constraints, increase in operator tariff plans as well as rising inflationary trends. The 2G feature phone and 4G feature phone segment declined by 42% and 50% YoY respectively.

Q1 2022: Key Smartphone Market Highlights

Xiaomi captured the top spot with 24% market share. Redmi 9A Sport and Note 11 were the most popular models. Xiaomi’s shipments declined by 13% YoY owing to tough competition. Its sub-brand Poco recorded a 52% YoY decline in its shipments in Q1 2022.

Samsung was placed second with 19% market share in the smartphone market overtaking realme. Samsung topped the 5G smartphone leaderboard with its new 5G offerings including the Samsung F23, Samsung A23, amongst others. Samsung was NO 1 in 5G Value for money Price Band(7000-25000K).

Realme was placed third with 15% market share with its shipments growing 40% YoY, the most amongst the top five players. realme C11(2021), realme 9i and realme C21Y were the top selling models and accounted for most of realme’s market share.

Vivo garnered 15% market share along with its sub-brand iQOO. The vivo Y72 and vivo Y75 models accounted for the bulk of its 5G shipments.

OPPO was placed fifth with 8% market share. The OPPO A54 and A16 series were highest shipped models. OPPO captured 5% share in the overall 5G shipments.

OnePlus shipments witnessed 50% YoY increase. The OnePlus Nord series accounted for > 75% of OnePlus market share.

Apple shipments recorded 20% YoY growth. It topped the Super-premium (INR 50000-100000) segment with 77% market share.

Transsion Group brands (Itel, Infinix and Tecno) overall (smartphone + featurephone) shipments declined 12% YoY. Its smartphone shipments declined by 3% YoY. However, its online exclusive brand, Infinix shipments increased by a whopping 60%.

Future Market Outlook

CMR estimates the overall smartphone shipments topping the 170+Mn mark in CY2022.

“Going forward in Q2 2022, CMR estimates point to a potential 5-8% YoY growth in smartphone shipments. We anticipate H2 2022 to potentially see some easing of supply-side constraints. Consumer demand at the premium smartphone end will continue to remain robust, with demand remaining muted at the affordable end of the market,” added Menka.

– ENDS –

About CyberMedia Research and Services Ltd

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

For queries, please contact releases@cmrindia.com