- Samsung leads the overall India mobile market in Q3 2021

- Xiaomi led the smartphone market in Q3 2021 with 23% market share, followed by Samsung at 18%

- Consumer demand remains robust, with smartphone shipments growing 47% QoQ in Q3 2021

New Delhi/Gurugram, 8 November 2021: According to CMR’s India Mobile Handset Market Review Report for Q3 2021 released today, 5G smartphone shipments continued to gain momentum across price tiers. Over the course of the quarter, >20 5G-capable smartphones were launched, and with 5G now accounting for 22% market share of the overall smartphone shipments.

New Delhi/Gurugram, 8 November 2021: According to CMR’s India Mobile Handset Market Review Report for Q3 2021 released today, 5G smartphone shipments continued to gain momentum across price tiers. Over the course of the quarter, >20 5G-capable smartphones were launched, and with 5G now accounting for 22% market share of the overall smartphone shipments.

According to Shipra Sinha, Analyst-Industry Intelligence Group, CMR, “Across price tiers, 5G smartphone shipments are gaining in strength, and contributing to increased affordability, availability and accessibility. With smartphone brands, such as OnePlus, OPPO, realme, Samsung and vivo prioritizing 5G, and consumers seeking to future-proof themselves, 5G continues to gain momentum. Together, these five brands shipped 5G smartphones in excess of $3Bn during Q3 2021.”

In Q3 2021, smartphone shipments in India posted a 47% sequential Quarter-on-Quarter (QoQ) growth, on the back of robust consumer demand, and despite persistent supply constraints.

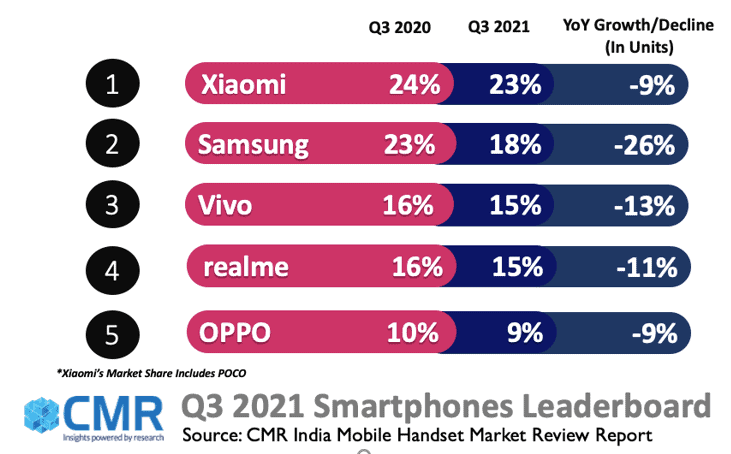

Xiaomi (23%), Samsung (18%) and Vivo (15%) captured the top three spots in the smartphone leaderboard in Q3 2021 followed by realme and Oppo. Vivo led the 5G smartphone segment with 18% market share followed by Samsung at 16%.

Xiaomi (23%), Samsung (18%) and Vivo (15%) captured the top three spots in the smartphone leaderboard in Q3 2021 followed by realme and Oppo. Vivo led the 5G smartphone segment with 18% market share followed by Samsung at 16%.

“For consumers, smartphones remain essential life drivers. As India emerged from the second pandemic wave, consumer demand for smartphones continued to remain strong. Smartphone brands sought to navigate the prevailing supply chain dynamics, by augmenting their stock supply. In doing so, they were able to offer attractive promotions and deal offers in the extended festive season sales,” added Shipra.

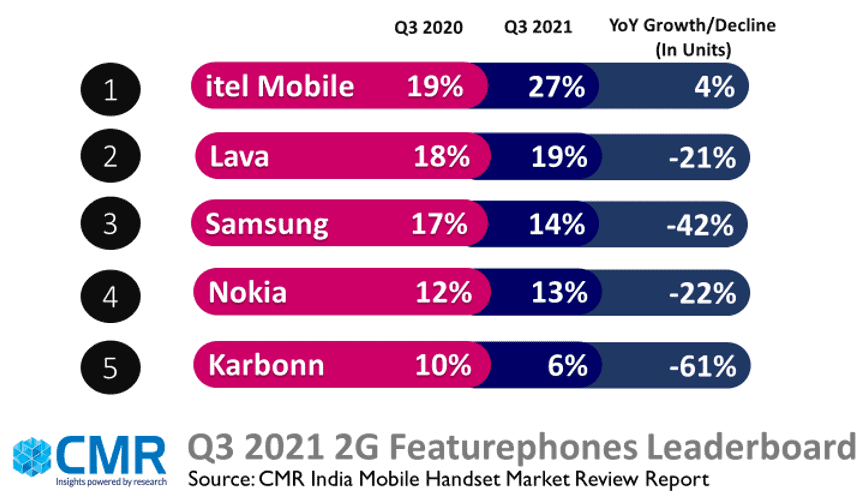

The feature phone segment declined 21% YoY, driven by continued consumer transition to smartphones. The 2G feature phone segment declined 27% YoY, with itel (27%), Lava (19%) and Samsung (14%) capturing the top three spots.

Q3 2021: Key Smartphone Market Highlights

Xiaomi captured the top spot with 23% market share. Redmi 9A, Redmi 9 Power and 9 were the most popular models accounting for 44% of its overall shipments. During Q3 2021, Xiaomi accounted for 20% of the Value for money smartphones (INR 7000-25000) shipped during Q3. POCO shipments recorded 97% YoY growth in Q3. The Poco M3 accounted for 32% of its shipments. One in every ten POCO phones shipped during Q3 were 5G-capable.

Samsung registered a 18% market share and stood at second spot in the smartphone market. During Q3 2021, Samsung launched ten new smartphone models including 7 5G smartphone models. ~20 % of all Samsung smartphones were 5G capable. The Samsung Galaxy M02, M02s, and Galaxy A12 accounted for 34% of its shipments. With its strong horizontal product depth, Samsung captured the second position in both the Premium (INR 25000-50000), and Value for money (INR 7000-25000) smartphones segment. Samsung’s third-generation foldable phones, Galaxy Z Fold3 and Galaxy Z Flip3 performed well during 3Q 2021, with >60K foldables shipped during the quarter.

Vivo garnered 15% market share. Vivo topped the overall 5G shipments driven by the vivo Y72 and vivo Y21 series. Vivo continued to build its presence in the premium smartphone segment, with the X70 series. Its sub-brand, iQOO posted a stellar performance clocking 0.8Mn shipments. The iQOO Z3 was the most selling model.

realme was placed fourth garnering 15% market share. realme launched nine new models, with the realme C11 and realme C21Y contributing >25% of its market share. realme continued to drive 5G affordability in the value for money smartphone segment. realme was placed at the top spot in the Value for money 5G smartphone segment (INR 7000-25000) with >80% 5G smartphone shipments.

OPPO was at the fifth spot with 9% share. OPPO launched four new models, including the OPPO Reno 6 Series, OPPO F19s and OPPO A16. OPPO captured 11% share in the overall 5G shipments, with the OPPO A54 and OPPO A15 Series accounting for a majority of its shipments.

OnePlus shipments recorded a significant growth of >68% YoY. OnePlus Nord 2 accounted for 40% of OnePlus’s market share and was the top selling overall phone in the Premium segment (INR 25000-50000). The OnePlus Nord series accounted for 75% of OnePlus market share. It was ranked first in the Premium (INR 25000-50000) segment at 21% and a distinct second behind Apple in the Super Premium smartphone (INR 50000-100000) segment.

Apple shipments recorded 32% growth YoY. Apple topped the Super-premium (INR 50000-100000) segment with 84% market share. The strong market performance by older-generation iPhones, including the Apple iPhone 12 and iPhone 11, contributed to Apple’s success. The iPhone 12 and 11 together accounted for three-fifths of iPhone shipments.

Transsion Group brands (Itel, Infinix and Tecno) overall mobile handset shipments grew 18% YoY. Its smartphone shipments grew 36% YoY. itel led the affordable smartphone segment (INR Sub 7000). Itel smartphone shipments grew 44% YoY with itel A23 contributing the most. Similarly, Tecno and Infinix smartphone shipments grew 33% and 32% respectively YoY.

Future Outlook

For the entire year, CMR estimates point to a potential 5-8% YoY growth in smartphone shipments. In Q4 2021, CMR anticipates the ongoing supply constraints, high components and logistics costs, and consequent high retail costs, to continue challenging smartphone brands.

On the demand side, aided by the availability of attractive affordability schemes, smartphone upgraders are seeking better specced 5G capable phones. In the festive season sales, the strong consumer demand for smartphone upgrades has been met by aggressive offers in the value for money and premium smartphone segments from smartphone brands.

“In Q4 2021 and beyond, the supply chain constraints will continue to persist. Smartphone brands that are able to augment their component supplies, and plan in advance their market outreach strategies, will be able to succeed. CyberMedia Research (CMR) anticipates consumer sentiment to remain robust during this period, driven by India’s growing digital transformation,” added Anand Priya Singh, Analyst- Industry Intelligence Group, CMR.

– ENDS –

About CyberMedia Research and Services Ltd

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

For queries, please contact Shipra Sinha, ssinha@cmrindia.com