- Around $2Bn worth of 5G smartphones shipped in Q1 2023

- Cumulative 5G smartphone shipments are set to cross the 100 million mark in Q2 2023.

- India smartphone shipments declined by 21% YoY

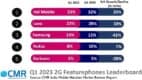

- Both the 2G and 4G feature phone shipments dropped by 15% and 35% YoY, respectively.

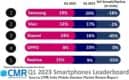

New Delhi/Gurugram, 5th May 2023: According to CyberMedia Research (CMR)’s India Mobile Handset Market Review Report for Q1 2023 released today, the 5G smartphone shipment share in India increased to 41%, with 5G smartphone shipments growing 14% YoY. India’s 5G smartphone momentum continued through Q1 2023 with 34 new 5G launches. Samsung led the 5G smartphone market in India with a 23% market share, followed by Apple with a 17% market share. During Q1 2023, India’s smartphone market shipments declined 21% YoY, while the overall mobile market in India declined 20% YoY.

Commenting on the overall market conditions in Q1 2023, Shipra Sinha, Analyst- Industry Intelligence Group, CyberMedia Research (CMR), “The decline in smartphone shipments during Q1 2023 marks the first ever Q1 decline since 2019 and is attributed to extended inventory, weakened demand, and inflation. The overall feature phone segment declined by 19% YoY, driven by muted demand and an increase in feature phone to smartphone upgrades. 5G smartphone shipments are all set to surpass the cumulative 4G smartphone shipments done in CY2022.”

Smartphone Segment

Challenging economic conditions and slow demand contributed to a 38% YoY decline in the Affordable smartphone segment (sub-INR 7000), a 25% YoY decline in the Value-for-money smartphone segment (INR 7000

– INR 25,000), and a 23% decline in the Premium smartphone segment (INR 25,000 – INR 50,000).

However, the Super-premium smartphone segment (INR 50,000-INR 1,00,000) and the Uber premium segment (>INR 1,00,000) shipments saw remarkable growth of 96% and 208% YoY respectively.

Samsung (20%), Vivo (17%) and Xiaomi (16%), captured the top three spots in the smartphone leaderboard in Q1 2023, followed by Oppo (10%) and Realme (9%).

Feature Phone Segment

Both the 2G and 4G feature phone shipments dropped by 15% and 35% YoY, respectively.

The feature phone segment is likely to continue its decline in CY2023. However, there could be pockets of growth for feature phones in rural India.

Key Smartphone Market Highlights in Q1 2023

Samsung held the top spot in the smartphone market with a 20% market share. The company was also the leader in the 5G smartphone segment with a 23% share, and its 5G shipments increased by 16% YoY. Furthermore, Samsung led the Premium smartphone segment (INR 25,000-INR 50,000) with a 24% share.

Vivo secured the second spot with a 17% market share thanks to its robust channel marketing. Its 5G smartphone shipments were largely driven by the vivo Y75 5G, vivo T1 and vivo V23E models, accounting for 42% of its total 5G shipments.

Xiaomi slipped to the third position in the smartphone leaderboard with a 16% share, mainly due to the stock build-up and muted demand. Redmi A1, Redmi 10A and Redmi 10 (2022) were the top three models. Xiaomi’s sub-brand, Poco, saw a 4% YoY decline in its shipments.

OPPO secured the fourth position with a market share of 10%. Its top three shipped models were the OPPO A16k, OPPO A16e, and OPPO A76.

Realme held the fifth position with a market share of 9%, and its shipments saw a YoY decline of 55%. The top three models shipped by Realme were Realme C33, Realme 10 Pro, and Realme C55.

OnePlus recorded a 39% YoY growth in smartphone shipments, with the OnePlus Nord CE 2 Lite and Nord CE 2

models accounted for 69% of its 5G smartphone shipments.

Apple maintained its steady growth with a 7% market share in the smartphone market in Q1 2023, recording a significant YoY increase of 67% in its shipments.

Transsion Group brands (Itel, Infinix and Tecno) overall (Smartphone + Feature Phone) shipments increased by 9% YoY.

Future Market Outlook

According to CMR’s estimates, market conditions are expected to remain moderate with muted growth in Q2 2023. Smartphone shipments for the entire year are projected to grow in single digits YoY.

According to Menka Kumari, Analyst-Industry Intelligence Group, CyberMedia Research (CMR), “The smartphone market is expected to bounce back in H2 2023, especially in the run-up to the festive season. All said the smartphone market is going to post muted growth. The overall foldable smartphone shipments grew 125% YoY in Q1 2023. This growth in the foldable smartphone market will bolster the overall smartphone market in CY2023 and beyond.”

– ENDS –

About CyberMedia Research and Services Ltd

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

A part of CyberMedia, South Asia’s largest speciality media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of the Market Research Society of India (MRSI).

For queries, please contact releases@cmrindia.com