- 5G tablets accounted for 95% YoY of the overall market.

- Apple posted a solid 78% QoQ growth

- Xiaomi grew a whopping 86% YoY.

- Value for Money (under INR 20,000) tablet grew 65% YoY

New Delhi/Gurugram, 14 Aug 2025: The Indian tablet market recorded a robust 20% year-on-year (YoY) and 28% quarter-on-quarter (QoQ) growth in Q2 2025, according to CyberMedia Research (CMR)’s Tablet PC India Market Report Review for Q2 2025. This strong performance was underpinned by rising digital adoption, greater availability of 5G-enabled devices, and strategic channel expansion by market leaders. 5G tablets remained the key growth catalyst, accounting for 95% of shipments YoY — a clear indicator of India’s accelerating move toward next-generation connectivity.

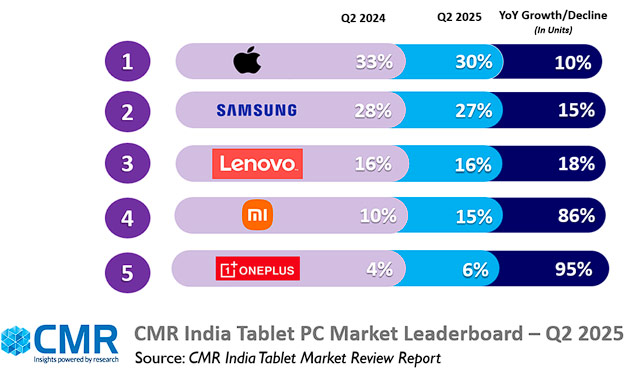

Market leaders continued to gain ground by leveraging diverse portfolios, competitive pricing, and deeper online-offline reach. In Q2 2025, Apple led with a 30% share, followed by Samsung (27%) and Lenovo (18%).

“India’s tablet market is advancing along two complementary growth paths — value-for-money and premium,” said Menka Kumari, Senior Analyst – Industry Intelligence Group (IIG), CMR. “The strong double-digit growth in the value-for-money segment highlights robust demand from students, gig workers, and value-conscious users seeking reliable performance, and new compelling Android value-for-money tablets from brands, such as Xiaomi and OnePlus. Meanwhile, the premium segment, led by Apple and Samsung, is seeing heightened traction from professionals and ecosystem loyalists who prioritize seamless integration, security, and superior experience.”

Market Dynamics in Q2 2025:

- Apple maintained the leading position in India’s tablet market in Q2 2025, with a market share of 30%, supported by a 78% QoQ and 10% YoY growth. This performance was driven by strong demand for the newly launched iPad 11 Series, which accounted for 70% of Apple’s total shipments during the quarter, alongside improved availability across both online and offline channels.

- Samsung held the second position with a 27% market share, growing 15% YoY. The company’s broad portfolio enabled it to sustain performance across both affordable and enterprise segments. The Galaxy Tab A9 Plus 5G was the primary contributor, representing 81% of Samsung’s tablet shipments during the quarter.

- Lenovo ranked third with a 16% share in Q2 2025, driven by shipments of the Lenovo Tab K11 and IdeaPad Pro Series, each accounting for 15% of its total shipments. Lenovo’s position was reinforced by targeted institutional demand, particularly within the education sector.

- Xiaomi accounted for 15% of the market, posting an 86% YoY growth. The Xiaomi Pad 7 significantly contributed to the premium segment, representing 32% of premium tablet sales. Xiaomi’s performance was supported by its competitive value-for-money tablet offerings and strategic expansion across online and offline retail channels.

- OnePlus achieved the fastest year-on-year growth at 95%, reaching a 6% market share. The brand’s recent product introductions have positively influenced consumer adoption in the Indian market.

India Tablet Market Outlook for CY2025

CyberMedia Research (CMR) forecasts a steady 10-15% growth for the tablet market in 2025.

“India’s tablet market momentum is clearly shifting toward 5G-enabled premium and better-specced value-for-money Android tablets, delivering enhanced productivity and entertainment. As we move into the festive quarter — a traditionally strong period for consumer electronics — CMR’s analysis points to a sustained momentum and consistent growth, driven by demand from both urban centers and the expanding base of Aspirational India. This growth is fueled by the rapid adoption of affordable 5G connectivity, deeper rural-urban penetration, and a growing base of digitally savvy consumers. In this evolving landscape, vendors with diversified product portfolios, localized content strategies, and strong distribution networks are best positioned to capitalize on the next phase of market expansion,” added Menka.

Notes for Editors

- This release is based on the CyberMedia Research (CMR) India Quarterly Tablet PC Market Review published at the conclusion of every calendar quarter.

- The figures captured are of both enterprise and consumer shipments.

- CyberMedia Research (CMR) uses the term ‘shipments’ to describe the number of Tablets leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term ‘shipments’ is sometimes replaced or used interchangeably with “sales” in the press release, but this reflects the market size in terms of units of Tablets and not their absolute value. In the case of Tablets imported into the country it represents the number leaving the first warehouse to OEMs, distributors and retailers. CyberMedia Research does not track the number of Tablets brought on their person by individual passengers landing on Indian soil from overseas destinations or ‘grey’ market Tablets (if any).