- +91-98123456789

- info@cmrindia.com

- Subscribe to CMR Connect

- Reactive Recovery is History; Predictive Protection is the Way Ahead for Indian Companies

- How AI Solutions Are Democratizing Enterprise Software Creation?

- Beyond the Single Pane of Glass: Why True Convergence Requires a Single Pane of Action?

- The Next Frontier of IT Growth: Mitrahsoft Solutions Unlocking the Potential of Tier-2 India

- AI is the “Game Changer” for Enterprises, But ROI and Data Readiness Remain the Biggest Hurdles

READ THROUGH THE INSIGHTFUL MINDS OF CMR'S ANALYSTS

ANALYST VIEWPOINT

India’s Telcos Clock Steady Gains as 5G and FWA Expand Footprint

Subscriber growth, ARPU uplift, and digital infra investments mark a defining quarter in Indian telecom. India's telecom industry has entered

IBM Think 2025: A Pragmatic Blueprint for Enterprise AI

At IBM Think 2025, IBM reinforced its commitment to enabling enterprise-scale AI grounded in real-world operational and technological complexity. Rather

The Future of Gaming is Female!

As International Women's Day 2025 approaches, there’s no better time to celebrate the women who are redefining the gaming industry.

India’s Role in the Global AI Ecosystem: Key Insights from NVIDIA AI Summit 2024

As India cements its status as a technology powerhouse, Artificial Intelligence (AI) is rapidly transforming industries across the board, reshaping

RESEARCH AND SERVICES

OFFERINGS

Intelligence

The Industry intelligence Group (IIG) provides timely market and technology insights through an extensive portfolio of proprietary market and channel trackers around the dynamic devices ecosystem in India, APAC.

Read More

Marketing Services

Leverage from our custom and industry platforms to make a decisive pitch. Tell others why you outshine the competition.

Subscribe to our newsletter

Sign up for our Newsletter and get the Research Insights.

LATEST PUBLISHED INDUSTRY INSIGHTS

MEDIA RELEASES

India’s Premium Manufacturing Shift Delivers 8% Export Growth in Q3 2025: CMR

Apple crosses 50% export share as OEMs deepen integration into India’s supply chain; Samsung holds steady despite softer global demand

Indian Families Seek Phone Free Dinner Tables – Finds vivo Switch Off Study 2025, A Reminder to Prioritize Real Life Connections

The survey encourages people to use technology mindfully and build deeper connections with loved ones. 72% parents and 30% children

India’s Enterprise Storage Market Sees 350% YoY eSSD Boom, Even as eHDD Shipments Decline 21% YoY, as per CMR

Gurugram/New Delhi, December 8, 2025: India’s enterprise storage market is entering a phase of renewed acceleration, according to CyberMedia Research’s

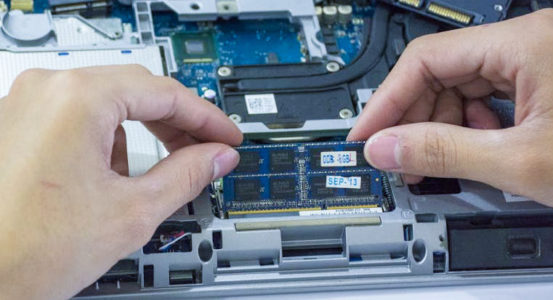

Consumer Internal SSDs Sustain Strong Momentum With 48% YoY Growth: CMR

SATA SSDs accounted for 65% of the market, while NVMe SSDs grew 28% sequential. External SSDs shipments growth 18% QoQ

MARKET UPDATES

CMR ON SOCIAL MEDIA