Introduction and Market Overview

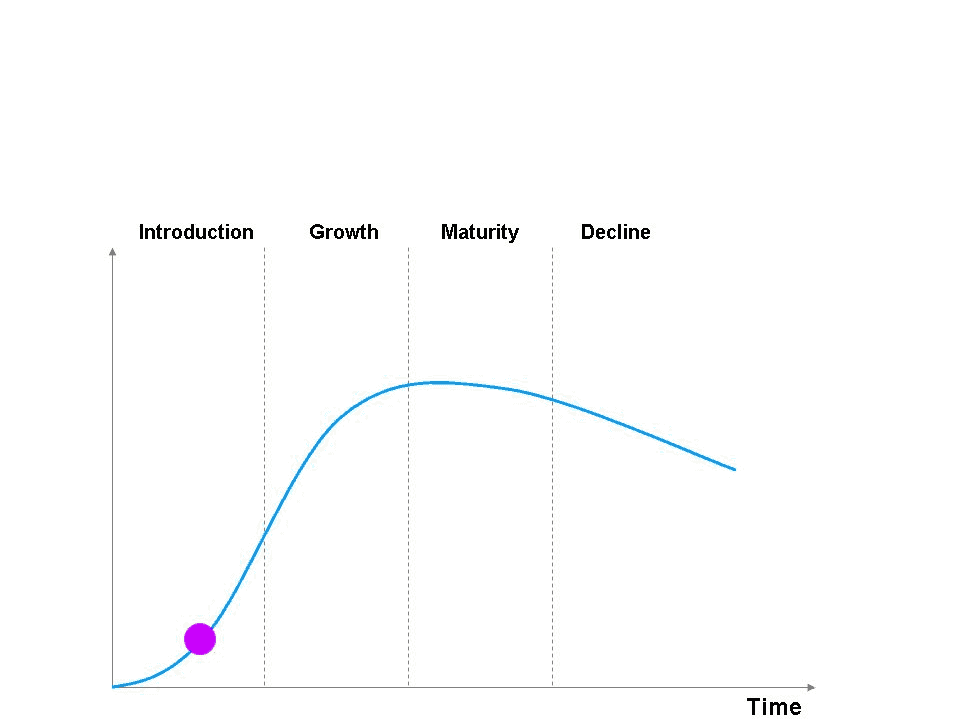

India represents a huge market opportunity for probiotics.Indiais a nascent market which saw the launch of probiotics only around 2006-07. This is in sharp contrast to other Asian countries likeJapanandSouth Korea, and western countries like theUSandUKwhich have had a probiotics market since the 1980s.

The intake of probiotic drinks as a food supplement is yet to gain significance in the mind of the Indian consumer who is accustomed to home-grown dahi (yoghurt).

CMR’s estimate for the global probiotics drinks market during 2011 stands at US$ 18 billion. As per initial estimates by the CMR Healthcare & Lifesciences Practice, India represents a market of only US$ 11 million in 2011, with competition being limited to a couple of homegrown giants and two foreign entrants. The market is estimated to be growing at 23% p.a.

Figure 1. The Probiotic Drinks S-Curve

Source: CyberMedia Research, 2012

Market Drivers and Potential Inhibitors

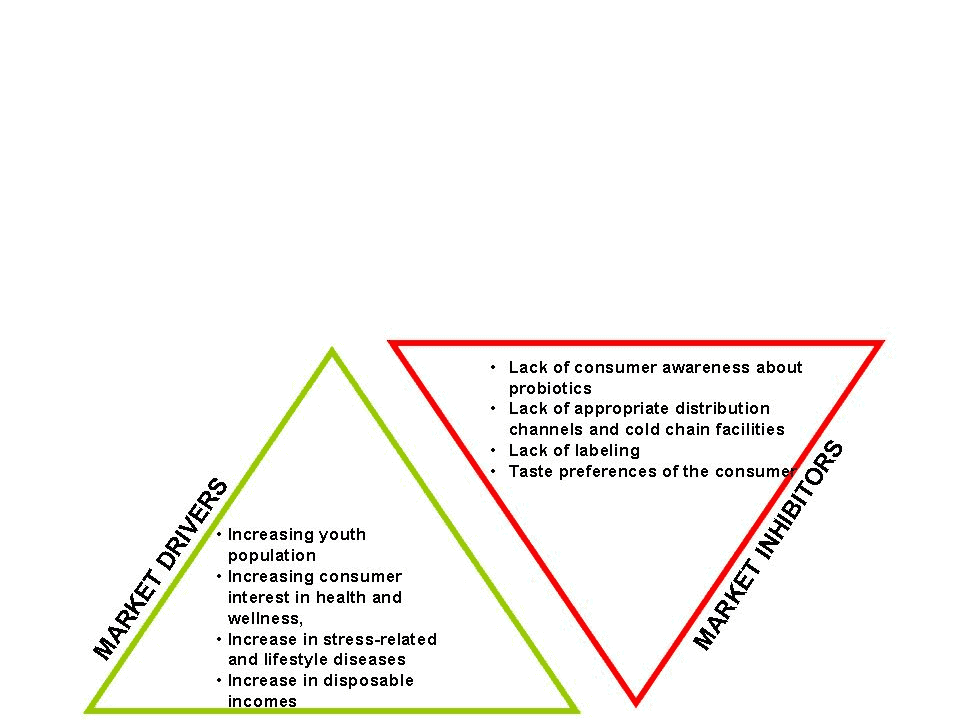

Figure 2. India Probiotic Drinks Market: Drivers and Inhibitors

Source: CyberMedia Research, 2012

While theIndiaprobiotic drinks market is driven by increasing affluence, greater emphasis on preventive healthcare, changing demographics, and the emergence of wellness related retail chains, the key challenges include lack of standardization, product stability at room temperatures and the need for validating product claims.

Regulatory Framework

InIndia, probiotics are currently regulated by a set of food laws that aim to regulate general food items including:

- The Prevention of Food Adulteration Act, 1952 (“PFA Act”) and corresponding Rules of 1955 (“PFA Rules”),

- Certain food product specific orders under the Essential Commodities Act, 1955, and

- The Standards of Weights and Measures Act, 1976 and corresponding Rules of 1977

There are multiple authorities that oversee probiotics, and these include the Ministry of Health and Family Welfare, the Ministry of Food Processing Industry, the Ministry of Consumer Affairs, Food and Public Distribution, and the Ministry of Agriculture.

With the objective of creating a single regulatory authority, the Government of India enacted the Food Safety and Standards Act of India, 2006. Under the provisions of this act, an apex regulatory authority, the Food Safety and Standards Authority of India (FSSAI) has been created for regulating food related issues inIndia.

In 2011, the Indian Council for Medical Research (ICMR) constituted a Task Force comprising leading experts from varied fields to develop detailed guidelines for evaluation of probiotics in food in India. The Task Force came up with a set of guidelines taking into consideration the guidelines available in different parts of the world and on the various related issues[1].

Market Landscape

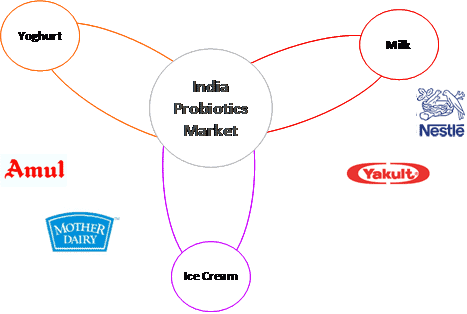

Figure 3. India Probiotics Market, 2012: Major Players

Source: CyberMedia Research, 2012

Key Developments in 2012

- Policy initiatives are being directed at promoting probiotics. The Indian Budget for FY 2012-2013 has reduced the basic customs duty on probiotics.

- Yakult-Danone has expanded into South India.

- Amul has launched new probiotic-based yoghurts and ice-creams in the market.

- The Indiamarket has seen new product launches, and these include the launch by Upsher-Smith Laboratories of their probiotic dietary supplement for women, Provella.

- AnandAgriculturalUniversityhas developed two Indian probiotic cultures for commercial use in nutritional supplements and diary products.

The Road Ahead

While the current market size is very modest, there is a vibrant growth and all key trends indicate that probiotics inIndiawill experience a boom in the near future.

Marketing initiatives of probiotic drinks companies are directed at engaging with and educating the Indian consumer. In some instances, companies are providing direct sampling to consumers at their homes, explaining the health benefits, as well as through roadshows hosted at malls during weekends.

Through these engagement initiatives, probiotic drinks companies should be able to capture consumer interest in key the Tier-I cities. It will be sometime before companies are able to make headway beyond the Tier-I cities, into Tier-II and Tier-III cities.

[1] ICMR-DBT GUIDELINES FOR EVALUATION OF PROBIOTICS IN FOOD http://icmr.nic.in/guide/PROBIOTICS_GUIDELINES.pdf