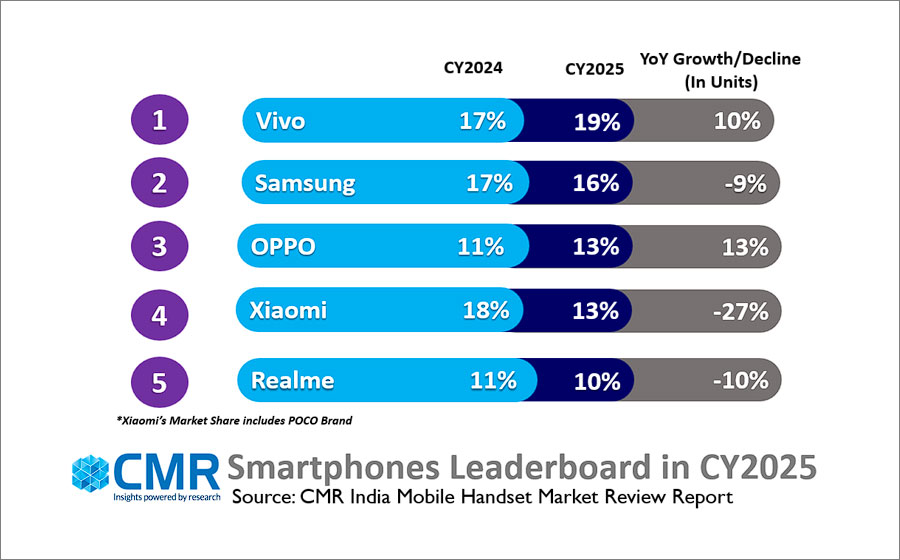

- Vivo led the India smartphone market with 19% share, followed by Samsung (16%) and OPPO (13%).

- Apple led growth in the premium segment, registering a solid 25% YoY growth despite a challenging market environment.

- iQOO emerged as the fastest-growing smartphone brand, recording a stellar 81% YoY growth, making it the breakout performer of CY2025.

- CMF clocked a robust 78% YoY growth on the back of rising consumer traction.

New Delhi/Gurugram, 09 Feb 2025: According to CyberMedia Research’s (CMR) India Mobile Handset Market Review for CY2025, India’s smartphone market entered a phase of structural transition in CY2025, marked by explosive growth in affordable 5G devices and sustained premium demand, even as overall shipments declined marginally by 1% YoY.

The most significant shift came from the INR 6,000–8,000 price segment, where 5G smartphone shipments surged over 1900% YoY, steered by aggressive pricing, enhanced availability of entry-level 5G chipsets, and expanding nationwide 5G network coverage.

Despite short-term headwinds from post-festive demand normalisation and rising component and memory costs, the market demonstrated strong underlying resilience. 5G smartphones accounted for 88% of total shipments, up 12% YoY, underscoring how 5G has moved decisively from a premium feature to a market default.

Vivo emerged as the market leader in CY2025 with a 19% share, followed by Samsung (16%), OPPO (13%), and Xiaomi (13%). Vivo also led the 5G smartphone segment with a 19% share, reflecting its strong execution in the mass-market 5G category.

Commenting on the market dynamics, Menka Kumari, Senior Analyst – Industry Intelligence Group (IIG), CyberMedia Research (CMR) said, “CY2025 was a year of recalibration rather than contraction for India’s smartphone market. While overall volumes softened marginally, the fundamentals remained strong. The rapid scaling of affordable 5G, resilient premium demand, and the rise of challenger brands point to a market that is evolving structurally, not weakening.”

In CY2025, smartphones with 6.7-inch and larger displays accounted for nearly 80% of shipments, firmly establishing large screens as the standard consumer preference. At the same time, almost one in three smartphones shipped with a ≥6000mAh battery, reflecting heavier daily usage and changing performance expectations.

Smartphone Market Highlights

Vivo captured the top spot with 19% market share. The Vivo T4X, Vivo Y19, Vivo Y29 and Vivo Y39 models accounted for 34% of their 5G shipments, reflecting successful mass-market positioning.

Samsung secured second spot with 16% overall market share. Samsung’s uber-premium segment (>INR 1,00,000) witnessed an impressive 45% YoY growth in shipments during CY2025, driven by robust demand for its flagship Samsung Galaxy S and Galaxy Z series smartphones.

OPPO secured the third positionwith 13% market share, with shipments increasing by 13% YoY, led by the OPPO A3X, OPPO A5 Pro, and OPPO A5X models. This strong performance was driven by a refreshed portfolio that successfully catered to both value-for-money (INR 7,000 -INR 25,000) and premium consumers (>INR 25,000).

Xiaomi garnered a 13% market share, declining 27% YoY, as competition in the premium segment intensified and consumer preference shifted to other brands.

Apple delivered 25% YoY growth in India, reaching ~9% market share. The base iPhone 16 accounts for 47% of 16-series volumes, underscoring strong preference for the value-led base model over Pro/Plus variants. iPhone 16 and 15 series together contribute 81% of CY2025 shipments, while the iPhone 17 series at 10% indicates early traction for new premium launches.

OnePlus recorded a 32% YoY decline in CY2025; however, the new OnePlus 13 series contributed 30% of shipments, while the Nord lineup drove volume with a dominant 67% share. Early traction for the 15 and 15R indicates clear headroom for premium series expansion.

iQOO (+81%), CMF (+78%), and Motorola (+50%) emerged as the fastest-growing players, driven by aggressive super-premium offerings (INR 50,000 – INR 1,00,000) and strong channel expansion, even as the overall market declined 1% YoY.

Lava recorded an 8% YoY growth in CY2025, standing out as one of the few brands to grow in a flat market, driven by steady traction in the value and affordable smartphone segment.

Feature Phone Segment

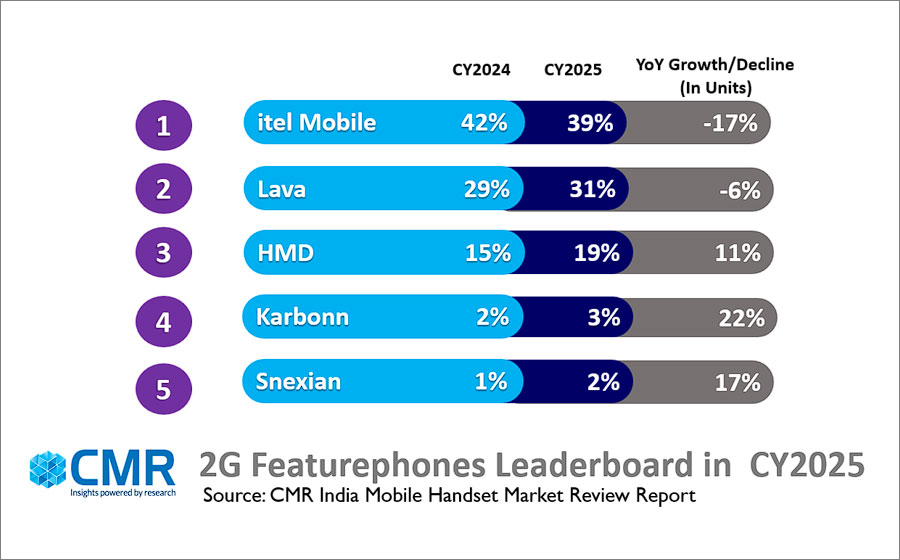

The feature phone market continued to decline, with 2G feature phones down 12% YoY and 4G feature phones down 48% YoY. The 2G segment remained led by Itel (39%), Lava (31%), and HMD (19%), though shipment volumes for leading players declined amid intensifying competition.

Chipset Landscape

MediaTek led India’s smartphone chipset market with 45% market share. Qualcomm led the premium smartphone segment (>INR 25,000) with a 34% share.

Future Outlook

CMR expects the Indian smartphone market to witness a single-digit decline in CY2026, with demand recovery expected through the year as pricing pressures ease.

“In CY2026, elevated component and memory costs are expected to keep pricing under pressure, leading to more measured purchasing behaviour through the year. Consumers have not stepped away from the smartphone market; instead, they are becoming increasingly selective, extending device lifecycles and upgrading only when the value proposition is compelling. This reflects a shift in mindset rather than a loss of demand. As cost pressures gradually ease and new launches align more closely with accessible price points, demand is expected to recover progressively. CY2026 will be less about short-term volume wins and more about disciplined execution and a deeper understanding of evolving consumer priorities,” added Pankaj Jadli, Analyst – Industry Intelligence Group at CyberMedia Research (CMR).