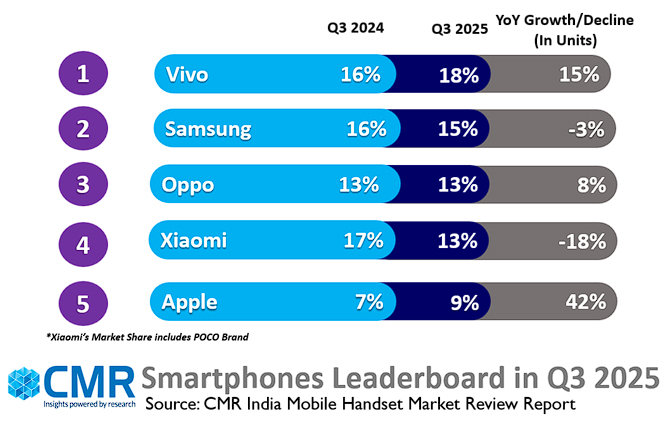

- Vivo led the India smartphone market with 18% share, followed by Samsung (15%) and OPPO (13%).

- Apple entered the top five smartphone brands in India for the first time.

- The super-premium segment (>INR 50,000) grew 45% YoY, driven by Apple and Samsung. , while uber-premium 5G Models (>INR 1,00,000) surged over 280% YoY

- Feature phone shipments fell 14% YoY.

New Delhi/Gurugram, 07 Nov 2025: According to the CyberMedia Research (CMR) India Mobile Handset Market Review Report for Q3 2025 released today, India’s smartphone market grew 7% year-on-year (YoY) growth, driven by festive cheer, accelerated 5G adoption, and a strong premium push led by Apple, Vivo, and Motorola. Vivo led the 5G smartphone market with a 18% market share, followed by Samsung at 16%. In overall smartphone market, Vivo (18%) retained the top spot, followed by Samsung (15%), OPPO (13%), Xiaomi (13%) and Apple (9%).

5G smartphones accounted for 89% of total shipments in the quarter, up 16% YoY. Interestingly, 5G smartphones in the INR 6,000–INR 10,000 price band surged over 1600% YoY, underscoring rising demand for affordable 5G.

Commenting on the market dynamics, Menka Kumari, Senior Analyst – Industry Intelligence Group (IIG), CyberMedia Research (CMR) said, “The democratization of 5G connectivity, especially in the sub-INR 10,000 segment, is reshaping consumer upgrade trends and will steer the next wave of smartphone growth in India. The festive season, along with aggressive promotional campaigns and easy EMI schemes, drove consumer upgrades reshaping India’s value-for-money and affordable 5G smartphone segment. While premium smartphones continued double-digit growth, feature phones declined as users increasingly transitioned to smartphones.”

Apple led India’s smartphone market by value in Q3 2025 with 30% share, and Samsung followed with 22%, together accounting for over a bulk of the market.

Feature Phone Segment

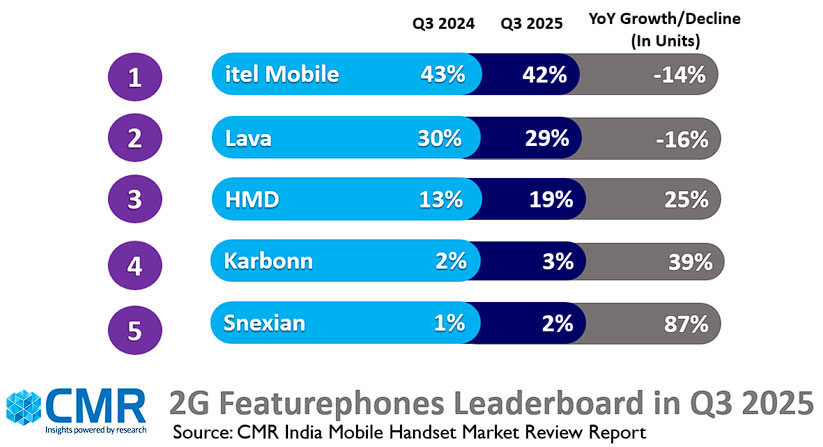

In Q3 2025, the 2G feature phone segment declined 14% YoY, while 4G feature phones declined sharply by 24% YoY.

The 2G feature phone segment was dominated by Itel Mobile (42%), Lava Mobile (29%) and HMD (19%).

Despite their leadership, both Itel and Lava saw a YoY decline in shipments, with shipments declining 14% and 16% respectively, as overall competition intensified from emerging players.

Q3 2025: Key Smartphone Market Highlights

Vivo captured the top spot with 18% market share. The Vivo Y19, Vivo T4X, Vivo Y39 and Vivo T4 Lite models accounted for 42% of their 5G shipments.

Samsung secured second spot with 15% overall market share. Samsung’s uber-premium segment (>INR 1,00,000) witnessed an impressive 151% YoY growth in shipments during Q3 2025, driven by robust demand for its flagship Samsung Galaxy S and Galaxy Z series smartphones.

OPPO secured the third positionwith 13% market share, with shipments increasing by 8% YoY, led by the OPPO K13X, OPPO A5 Pro, and OPPO A5X models. This strong performance was driven by a refreshed portfolio that successfully catered to both value-for-money (INR 7,000 -INR 25,000) and premium consumers (>INR 25,000).

Apple posted strong double-digit growth in India, capturing a 9% market share, fueled by strong demand for premium smartphones. Apple entered the top five smartphone brands in India for the first time.The older generation iPhones (iPhone 16 and 15 series) together accounted for 82% of Apple’s portfolio in Q3 2025. The iPhone 17 series and iPhone 16e, each contributed 8%.

OnePlus recorded a 13% YoY decline in Q3 2025, with the new OnePlus 13 series contributing 40% of shipments, while the Nord lineup drove growth with a 60% share.

Xiaomi garnered a 13% market share, declining 18% YoY, driven by fewer launches, weak offline presence within the affordable and value-for-money segments.

Motorola registered a stellar 57% YoY growth driven by its strong 5G portfolio, expanded offline presence, and focused play in the value-for-money and premium segments..

Transsion Group recorded a 4% YoY growth in Q3 2025, driven by an enhanced product mix and strong demand in the value-for-money segment, despite softness in the affordable category.

Lava emerged as one of the top two fastest-growing brands on a QoQ basis in the overall market. In the sub-INR 10,000 segment, Lava stood out as the fastest-growing brand recording a whopping 114% YoY shipment growth.

MediaTek led the India’s smartphone chipset market with 44% market share. Qualcomm led the premium smartphone segment (>INR 25,000) with a 36% share.

Future Outlook

In CY2025, CMR anticipates the Indian smartphone market to witness moderate growth, with shipments growing in single digits.

“The India smartphone market is poised for sustained momentum driven by 5G upgrades, rising premiumization, and growing consumer demand for connected device ecosystems. The ongoing festive and year-end sales will further accelerate shipments, with premium and uber-premium segments remaining key growth engines, led by flagship models from Apple, Samsung, and OnePlus,” added Pankaj Jadli, Analyst – Industry Intelligence Group at CyberMedia Research (CMR).