Fast food segment is the leading consumer of PoS printers, with 23% market share in terms of units shipped in 2H CY2015

Share This Post

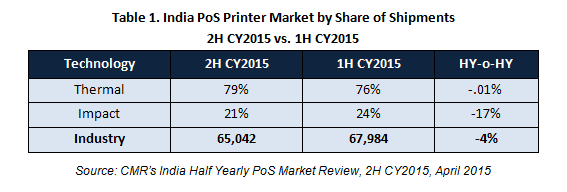

India PoS Printer market records 65,042 unit shipments for 2H CY2015, registering a 4% decline.

Epson retains leadership with 56% share of shipments.

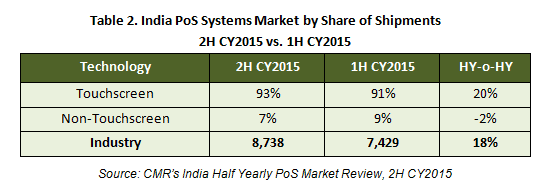

PoS System shipments grow 18% sequentially in 2H CY2015.

New Delhi / Gurgaon: The India PoS (Point of Sale) Printer market witnessed a decline of 4% in unit shipments (sales) for 2H CY2015 compared to the previous half year. However, PoS systems recorded 18% growth in unit shipments for the same period. This was revealed in the CyberMedia Research report CMR’s India Half Yearly PoS Market Review, 2H CY2015.

India PoS Printer Market Trends

The India PoS Printer shipments were driven by thermal printers and their market share increased from 76% in 1H CY2015 to 79% in 2H CY2015. However, in terms of units shipped, they remained almost static during the period.

Impact printers, which contributed 21% to total shipments during the same period, observed 17% sequential decline over the previous half-year, majorly due to decreased shipments by WeP.

Epson led the PoS Printer category with a 56% market share in terms of units shipped, and the vendor registered a growth of 7% on its shipments in 2H CY2015 vis-à-vis 1H CY2015. TVSe maintained its position at the second spot.

“WeP witnessed a sharp decline in 2H CY2015 in comparison to 1H CY2015 due to seasonality factor, the vendor is likely to reinstate its shipments to normal level in the coming half year,” said Amit Sharma, Analyst, IT Products and Systems, CyberMedia Research.

Epson’s thermal printer model TM-T81/T82 was the top-selling PoS printer during 2H CY2015 with a 25% market share in terms of unit shipments, followed by the impact printer model TM-U220D.

“Traction towards thermal technology based printers was evident in 2H CY2015 largely on account of growing fast food and fine dining segments. Fast food segment remained leading consumer of PoS printers with 23% market share in terms of unit shipments in 2H CY2015,” added Amit Sharma.

India PoS Systems Market Trends

India PoS Systems market grew by 18% sequentially to 8,738 units in 2H CY2015, with vendors such as FEC, Retail PoS recording the maximum growth. Touch Screen models were seen trending in the market, with a 20% sequential rise in 2H CY2015.

Posiflex maintained its market leadership in PoS Systems with 52% market share during 2H CY2015, followed by FEC and Essae. Hypermarkets/Supermarkets were leading consumers of PoS Systems, accounting for almost half of PoS Systems shipments in 2H CY2015.

In the near future, expansion in retail sector (such as Reliance brands launched Hunkemoller and also opened its first airport store in India for Hamleys at the Delhi airport) can also magnify the demand for PoS Systems. New entry of internationally established players like Burger King, Starbucks etc, can further add to the growth story of PoS Systems in India. However, absence of large deals from the Government may affect the market.

Average sales price for 2H CY2015 increased sequentially by 3% due to market movement towards touch screen based systems, which are costlier compared to non-touch based systems.

“PoS systems market recorded growth in 2H CY2015 as vendors such as FEC, Retail PoS posted stupendous performance as compared to previous half year. However, Posiflex sealed the numero uno position. The market is likely to see growth owing to improved demand from growing fine dining and fast food segments which are also leading drivers of touch screen based PoS systems,” Amit Sharma concluded.

Share This Post

CyberMedia Research conducts the Budget Smartphones Channel Audit to capture the perspectives, preferences, challenges and dislikes of retailers around ‘value for money’ (INR <10,000) smartphone brands, capturing a compelling picture of smartphone brands in the market.

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

More To Explore

No posts found!