India Consumer Storage Flash Memory Market Drops Down to 12.8M IN 4Q CY2017: CMR

Share This Post

- SanDisk continues to rule the market in Micro SD, SD cards and Flash Drives Categories.

- SD Cards category recorded huge 83% sequential growth in 4Q CY2017 in terms of units shipped.

- All the three categories added around 840 Petabytes memory to the overall Consumer Storage Flash Memory Market in CY2017.

- 2H CY2017 witnessed 16% sequential growth when compared to 1H CY2017 in terms of unit shipments.

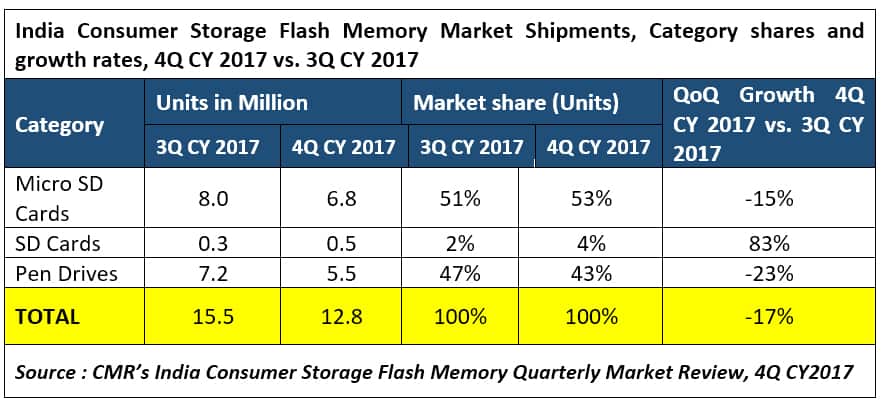

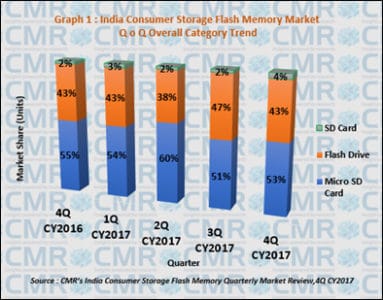

New Delhi/Gurugram, 7 March, 2018: The overall India Consumer Storage Flash Memory market, comprising Micro SD cards, SD cards and Flash drives, witnessed 17% decline in 4Q CY2017 as against 3Q CY2017, in terms of units shipped. However, on YoY comparison, the market recorded a 7% growth, in terms of units shipped. This was revealed in CMR’s India Consumer Storage Flash Memory Quarterly Market Review, 4Q CY2017.

End of the festive season marked the decline of the overall market in 4Q CY2017. Micro SD and Pendrive categories witnessed 15% and 23% decline respectively in terms of units shipped in 4Q CY2017. Alternatively, SD Cards recorded huge 83% growth predominantly because of the wedding season in 4Q CY2017

“Demand of superior quality photos by the customers during wedding season demands for high end cameras and high speed camera cards to store high resolution images. This led to surge in camera card demand in 4Q 2017”, said Shipra Sinha, Analyst, Cyber Media Research.

In CY2017, Micro SD cards Flash Drive and SD card categories added around 391 PB (Petabytes), 418 PB (Petabytes) and 31 PB (Petabytes) respectively accumulated 840 Petabytes of memory in 4Q CY2017.

Market Leadership

In the overall India Consumer Storage Flash Memory market, SanDisk continued to be the most favored vendor and contributed 50% market share in terms of units shipped. However, the vendor shipments witnessed 18% decline as compared to the last quarter. Sony and Strontium were other leading players. These top three players collectively made 65%contribution to overall consumer storage flash memory market.

Micro SD

SanDisk remained the top contributor with 37% market share in 4Q CY2017. The vendor shipments however witnessed 17% decline when compared to the last quarter. Strontium maintained its second position and Samsung was at the third spot in 4Q CY2017 in terms of unit shipments. Shipments of Unbranded Micro SD declined by 6% when compared to the last quarter.

Flash Drives

SanDisk was market leader with 63% market share in 4Q CY2017. Sony was at second position and Strontium captured the third spot in 4Q CY2017 in terms of unit shipments. Among the top ten Flash Drive models, SanDisk’s Cruzer Blade (SDCZ50) and Ultra Dual Drive (SDDD3) were the most favored models in 4Q CY2017.

USB 2.0 Flash Drives market captured 85% market share and USB 3.0 market share dropped down to 15% in 4Q CY2017 as against 17% in 3Q CY2017 in terms of unit shipments.

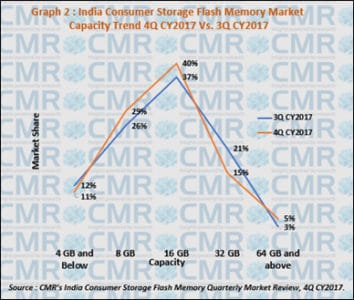

Capacity Trends

16 GB was the major contributor with 40% market share of the overall flash devices market in 4Q CY2017. 32 GB capacity segment contributed 15% of overall flash devices market in 4Q CY2017.This capacity segment witnessed 39% decline in terms of units shipped in 4Q CY 2017 when compared to the previous quarter.

64GB capacity segment contributed 4% of overall flash devices market in 4Q CY2017.This capacity segment recorded 3% sequential growth in terms of units shipped in 4Q CY 2017.

Future Trends

“Heavy memory consuming apps for various entertainment activitie in the smartphones, will keep the demand for Micro SD cards in the near future. However, growing trend of large internal memory smartphones will be a hindrance which will be offset by growth of entry level budget smartphones. The market will witness a shift towards higher capacity segments in coming quarters. Application Performance Class Standards 5.0 will be implanted in future which will specify a card to be fast enough to be used for starting apps and programs. Demand for dual Pen Drives providing hassle free data transfer between mobile and laptop at one go will also rise. With the start of the new year first quarter is expected to see an upward trend in sales. SD cards will continue to rise in the first quarter due to the wedding season,” Shipra concluded.

Share This Post

CyberMedia Research conducts the Budget Smartphones Channel Audit to capture the perspectives, preferences, challenges and dislikes of retailers around ‘value for money’ (INR <10,000) smartphone brands, capturing a compelling picture of smartphone brands in the market.

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

More To Explore

No posts found!