India Mobile Handsets market grows 25% in 3Q CY 2015; Smartphones disappoint with just 11% growth compared to the previous quarter

Share This Post

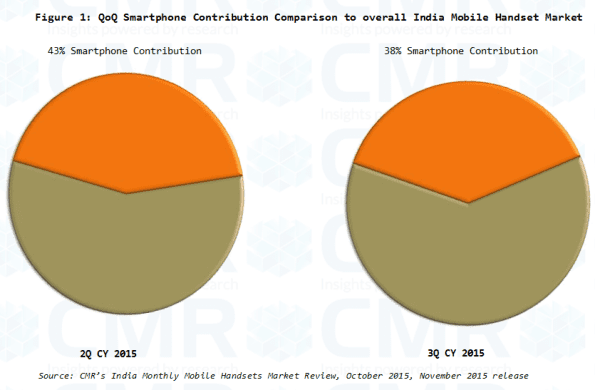

Smartphone contribution to total sales dips for the first time in 3Q CY 2015to 38% against 43% in the previous quarter

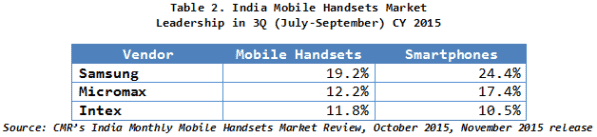

- Samsung, Micromax and Intex are ‘top three’ players in overall market as well as the Smartphone segment

- 1 in every 3 Smartphones sold in 3Q CY 2015 was a 4G handset with shipments jumping over 74% compared to the previous quarter

Oppo, Vivo, Lava, Karbonn and Intex grew its shipments by 3290%, 2729%, 1310%, 995% and 627% respectively becoming the fastest growing brands among ‘Top 20’ 4G handset vendors in India - Featurephones exhibit 35% growth QoQ after a long spell of negative growth, thanks to strong increase in sales by Intex (94%), Lava (69%) and Zen (54%)

- Qualcomm emerges leading 4G chipset partner in India with more than 50% share, Mediatek continues to lead in the overall Smartphones segment

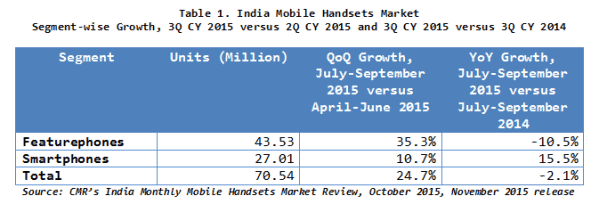

New Delhi/Bangalore: Contrary to market expectations, CMR’s India Mobile Handset Report for 3Q CY 2015, November 2015 release through up some surprises. The growth witnessed in the overall India mobile handsets market was attributed to the featurephones segment after a spell of multiple quarters.

Commenting on the results, Faisal Kawoosa, Lead Analyst CMR’s Telecom Practice said, “While the general belief at the moment is that Smartphone is the growth catalyst for the India mobile handsets market, the results announced today reveal a contrarian view. To the surprise of everyone, it has been the featurephones segment that recorded a 35% growth over the previous quarter, bettering the smartphones growth of 11%.”

“Companies like Intex, Lava and Zen Mobiles continued their focus on achieving growth by penetrating deep into the heartland, serving the mass markets that still exist in much of rural India. This helped them serve both ends of the market extremely well, resulting in a comeback of the featurephones segment, at least during the current quarter,” Faisal added.

“However, this should not be seen as some kind of a permanent reversal in technology adoption trends; the future of mobile handsets continues to lie with the Smartphones segment”, Faisal concluded.

Market Leadership

Mulling on the leadership positions, Karn Chauhan, Analyst, CMR’s Telecom Practice said, “This is for the second consecutive quarter that Samsung, Micromax and Intex have maintained their rankings in the overall India mobile handsets market as well as the Smartphones segment. Vendor market shares have also remained stable and have not witnessed major shifts.”

“There are two factors common to the marketing and sales strategy adopted by the top three players that can be attributed to their rankings – a wide portfolio of models and SKUs for the consumer to choose from, and a strong distribution network reaching out deep into the nook and corner of the country,” Karn added.

As far as leadership positions are concerned for the 4G handsets segment, the CMR report concludes that this is still volatile and keeps changing with every passing quarter. For instance, in the 3Q CY 2015, although Samsung and Lenovo were able to maintain their 1st and 2nd positions intact, the 3rd spot was taken over by Micromax from Xiaomi. While Micromax managed to increase shipments 137% quarter-on-quarter (3Q CY 2015 versus 2Q CY 2015), Xiaomi witnessed a decline of 29% in the shipments of their 4G handsets during 3Q CY 2015.

Share This Post

CyberMedia Research conducts the Budget Smartphones Channel Audit to capture the perspectives, preferences, challenges and dislikes of retailers around ‘value for money’ (INR <10,000) smartphone brands, capturing a compelling picture of smartphone brands in the market.

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

More To Explore

No posts found!