India sells 3.11 million Tablets in 2012 with 1.09 million shipped in the October-December quarter alone

New ‘Phablet’ category emerges as a distinct segment

CY 2012 Highlights

- Samsung, Micromax and Apple emerged market leaders

- 72 vendors shipped Tablets in India during the year

- Android is the dominant OS, iOS following with Windows making inroads

- Samsung Note registers the inception of a new segment, ‘Phablets’

4Q 2012 Highlights

- Samsung, Micromax and Karbonn led the market in the last quarter

- 47 vendors shipped Tablets in India during this period

- Android leads the OS share followed by iOS with traces of Windows as well

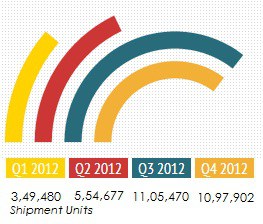

In its 4Q (October-December) 2012 report for Tablet devices announced today, CMR reported that India sold 1.09 million units for the period, which accounted for 35.33% of the total shipments for the entire year. At the same time, shipments for the full CY 2012 clocked 3.11 million units.

Figure 1: India Quarter-wise Tablet Shipments for CY 2012 (units)

Source: CMR’s India Tablet Market Review, CY 2012, March 2013 release

Commenting on the results, Faisal Kawoosa, Lead Telecoms Analyst, CMR said, “The year 2012 and particularly the last two quarters (3Q 2012 and 4Q 2012) were significant for the India Tablets market. We have seen the market for these devices grow substantially in 2012, particularly in the second half which made up for over 70% of the total sales.”

Market Paradigm Shift

CMR (CyberMedia Research) was the first market intelligence and consulting services firm in India to launch a Market Review Programme for Tablet devices and has been pursuing this since October 2010, when Tablets were first launched in India. Since then, the Tablets market has seen rapid changes particularly with the emergence of the ‘Phablet’ segment. In 2012, ‘Phablets’ constituted around 16.5% of total sales and this trend is expected to strengthen in the coming quarters. Moreover, the user profiles, market dynamics and the product orientation of ‘Phablets’ are very different from that for Tablets. In the light of these trends, CMR has decided to red-segment the Tablets market into two separate segments – Phablets and Tablets – starting CY 2013.

Commenting on this decision Faisal Kawoosa, Lead Telecoms Analyst, CMR stated, “At CMR we used to consider Tablet as a device with screen size of 5-inch or larger. But, with the definite emergence of ‘Phablets’ as a sustainable form factor in its own right, we will now consider only devices of 7-inch screen size and above as Tablets for the purpose of market analysis. Other parameters of the CMR definition of Tablet devices will remain unchanged. Moreover, we will continue to track and report ‘Phablets’ as a separate category of mobile device in the hands of individual consumers and enterprise users.”

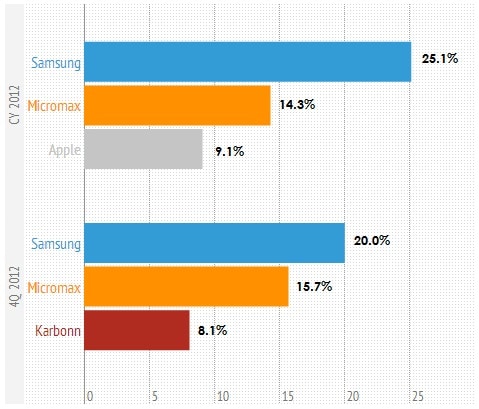

Current Market Rankings

As per the existing CMR definition, the rankings for the India Tablet Device market (5-inch screen size and above) for CY 2012 and 4Q 2012 are given in Figure 2 below, listing out the shares of top three brands.

Figure 2: India Tablet Device Vendor Market Rankings, CY 2012 and 4Q 2012 (% of unit shipments): 5-inch and above screen size

Source: CMR’s India Tablet Market Review, CY 2012, March 2013 release

Commenting on the rankings Tarun Pathak, Telecoms Analyst, CMR said, “Samsung has been able to maintain the lead in the market only because of the first-mover advantage with the Galaxy Note and the Galaxy Note II. But this is not a sustainable strategy in the long term, as it has resulted in creation of the new ‘Phablet’ form factor, attracting competitors at both ends of the price spectrum to follow suit. With the entrance of Apple at the top end and multiple Chinese and Indian players at the entry-level, the Phablet segment is only going to see increased competition in the foreseeable future.”

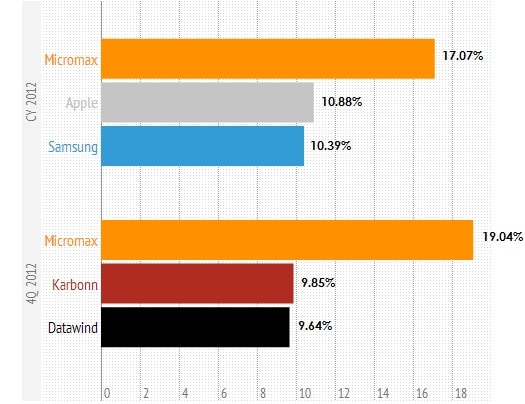

“This is also proved if we look at the same market with the new perspective of ‘Phablets’ being a separate and distinct category, based on the revised CMR definition for Tablets starting CY 2013. The market rankings for CY 2012 and change altogether with Samsung witnessing a major change in its standing. So if Samsung has to be a strong brand in the Tablet market, it has to adopt a long term sustainable strategy along with nurturing the ‘Phablets’”, concluded Tarun.

Figure 3: India Tablet Device Vendor Market Rankings, CY 2012 and 4Q 2012 (% of unit shipments): 7-inch and above screen size

Note: Datawind numbers reported here exclude shipments of ‘Aakash’ Tablets

Source: CMR’s India Tablet Market Review, CY 2012, March 2013 release

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

Share This Post

More To Explore

No posts found!