India Small and Medium Business Enterprises’ Adoption of IT Solutions

Share This Post

Even as the global economy recovered last year from an unprecedented economic crisis, India was one of the few countries that grew at a healthy pace. A significant proportion of all Indian businesses fall under the small and medium enterprise segment. Needless to say, the sustained growth in the Indian economy was in large measure due to the growth of these ’emerging’ enterprises. Unfortunately, these are also the businesses that faced the brunt of the economic crisis. In this ‘Catch 22’ type situation lies a great opportunity – that of metamorphosing into world class players and leaders in the global supply chains of tomorrow.

The challenges that Indian SMB enterprises face are manifold. They start with the lack of accurate and timely business information and go on to larger issues like funding, marketing, talent management and so on. Unless these challenges are identified and addressed well and in time, these emerging businesses will remain just that, and will never be able to realise their full potential and promise. While each one of these is well worth a full term course at a management school, CMR’s research reports and events on the subject attempt to identify the root causes, suggest a range of available solutions and help the entrepreneur community connect with solution providers to find answers to their problems with least wastage of time and valuable resources.

The key challenges we have identified for Small and Medium Business (SMB) enterprises are:

- Effective business strategy

- Smart operations and financial control

- Ramping up customer service and support

- Human resource management

- IT Awareness and Adoption

- Vertical- and Industry Cluster-specific technology solutions

- Optimising investment: ‘Capex’ versus ‘Opex’

- Marketing: Effective reach to and communication with customers and stakeholders

- Lack of customer access and sales

- Understanding and tracking RoI

- Value chain efficiency, through streamlined business processes and external integration

CMR research studies track how SMB enterprises are trying to appreciate the benefits of ICT solutions and implement those that afford most relevance, to help them achieve their business goals faster, at the least possible cost.

Both IT vendors and entrepreneurs / CIOs would benefit from CMR research by understanding how they can provide innovative, ‘quick RoI’ solutions that would help their customers reduce costs, develop more effective marketing and sales channels and adopt world class business practices.

So, here’s an invitation…do write in with your specific problems and business concerns if you are an entrepreneur / owner-manager or SMB CIO?

Vendor executives, please write back with new, innovative solutions or best practices that you can provide to the India SMB community.

“Faced with personal and economic uncertainties, consumer spending will remain muted for the better part of the year. Unless absolutely necessary, such as replacing a mobile phone, consumers may choose to conserve. However, we expect the market to recover lost ground in the run-up to the festive season,” added Anand Priya Singh, Analyst- Industry Intelligence Group, CMR.

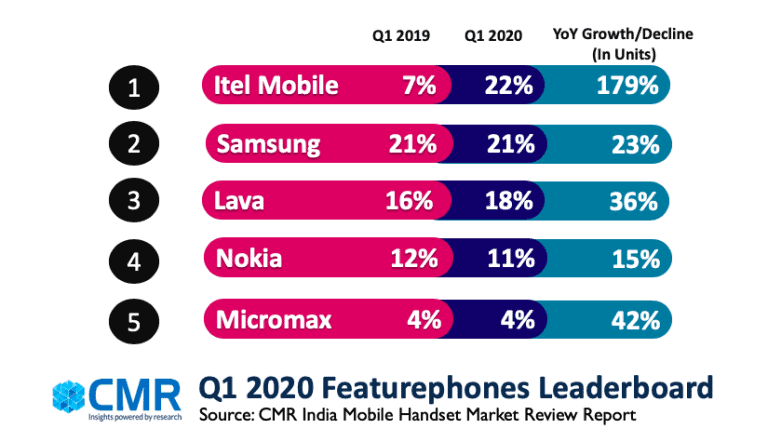

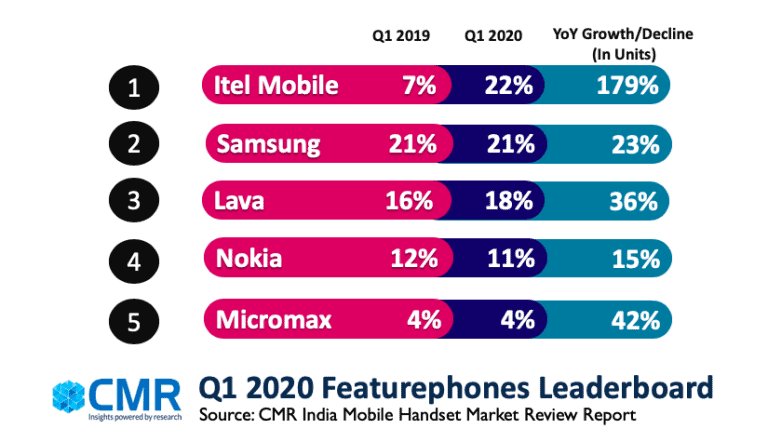

The feature phone segment declined 20% YoY. This is primarily due to migration of consumers from feature phones to smartphone segment. The 2G feature phone segment grew 6% YoY, with itel (22%), Samsung (21%) and Lava (18%) accounting for the top three spots in feature phone shipments.

Q1 2020 – Key Market Highlights

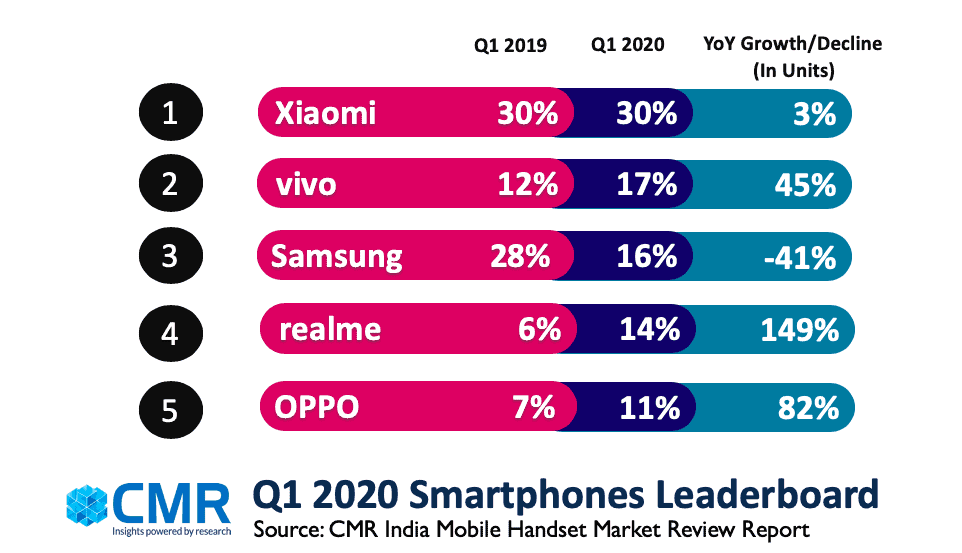

Xiaomi continued to be the market leader in the India smartphone market, increasing its market share by 3% YoY. The Redmi Note 8 series performed exceptionally well and contributed to a majority of the shipments. Xiaomi continued to attract consumers with its affordable offerings and strong offline push.

Vivo grew 45% YoY, with the Y91i and Y series accounting for the majority of the shipments in Q1. With good control of the inventory situation, vivo will seek to grow in the post-lockdown scenario with its upcoming flagship V series.

Samsung continued to see a sharp decline of 41% YoY as it seceded space in the affordable smartphones segment (< INR 10,000) to the likes of Xiaomi and realme. In Q1 2020, Samsung’s shipments were driven by the likes of A51, A20s, and M30s series. Samsung will potentially seek to use India as an exports hub in the post-pandemic scenario.

realme continued its strong performance, growing by 149% YoY. Realme has been able to offer more value proposition for consumers with interesting product mix, aggressive marketing and offline forays. During Q1, realme accounted for 98% of all 5G shipments with the realme X50 Pro. realme 5i, C2 and C3 accounted for the majority of realme shipments.

OPPO grew by 82% YoY, on the back of the strong performance of its A series (including the A5s, A31 and A9 2020). The Reno 3 Pro series also did well, with OPPO making a strong mark in the premium smartphone segment.

Transsion Group (itel, Infinix and Tecno brands) increased their market share by 125% in smartphone segment, mainly in the sub- INR 7000 price band. Itel was able to attract consumers in Tier II and III cities with its entry-level smartphones offering attractive specs.

Apple increased its market share in India, growing by 71% YoY. The iPhone XR and 11 accounted for 70% of iPhone sales in India with its prudent pricing, attractive discounts and strong shipments getting consumer acceptance.

“Going forward, we remain cautious about the speed of recovery in India’s smartphone market this year. We are keeping a close tab on the macroeconomic factors and how it plays out from here on. Our best-case scenario suggests a potential decline of 11-12% in overall smartphone shipments for 2020,” added Prabhu.