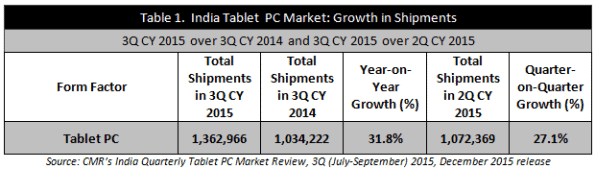

India Tablet PC shipments touch nearly 1.36 million units in July-September 2015; overall shipments record an increase of 31.8% year-on-year and 27.1% quarter-on-quarter

Share This Post

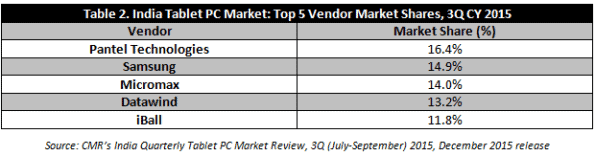

Pantel Technologies emerges as the leader, with Samsung, Micromax, Datawind and iBall in top 5

Top 5 vendors make up nearly 70% of Tablet PC shipments

Gurgaon/New Delhi, December 18, 2015: According to CMR’s India Quarterly Tablet PC Market Review, 3Q (July-September) 2015, December 2015 release announced today, nearly 1.36 million Tablet PCs were sold (shipped) in the quarter by as many as thirty-eight (38) domestic and international vendors. However, only twelve (12) vendors shipped in significant volumes of more than 20,000 units each during the period. The overall increase in shipments of Tablets in the India market registered a 31.8% growth year-on-year (3Q CY 2015 over 3Q CY 2014) and a 27.1% growth quarter-on-quarter (3Q CY 2015 over 2Q CY 2015). This increase can be attributed mainly to the aggressive approach by Pantel Technologies, which earlier used to be exclusively packaged with BSNL mobile services. The vendor has now broadened focus to target both the Government and Retail sectors. Further, on account of the festive season in India, a number of vendors pre-stocked shipments for sale during the month of October. Players that saw a good growth in this quarter versus the previous quarter were Pantel Technology, Samsung, Micromax, Datawind, iBall and Lenovo.

Commenting on the performance of the India Tablet PC market, Faisal Kawoosa, Lead Analyst CMR Telecoms Practice said, “We have been of the firm view that Tablets need an enterprise-government segment orientation. This is what players like Pantel have been able to roll out successfully. With the volumes growth in sales of consumer Tablet PCs being ‘tepid’ at best and private enterprises not very bullish on deploying mobility solutions via the Tablet route, bulk procurements by the public sector have helped the category to re-surface.”

“However, as government purchases primarily go by cost per unit as the key decision-making criterion, we expect low-priced brands like Pantel, Datawind and others to have an edge vis-a-vis the likes of Micromax, Samsung and Xiaomi. For the latter category of vendors to see substantial growth in their shipments, Tablets have to offer a compelling value proposition to both consumers and enterprises,,” Faisal added.

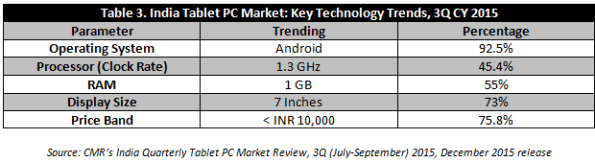

Adding on to the findings for 3Q CY 2015, Tanvi Sharma, Analyst for Tablet Devices at CMR said, “The most sought after specifications of Tablets remained broadly the same in the current quarter, and we did not observe any major shift in trending parameters. However, it is worth noting that in the sub-Rs. 10,000 segment, the Rs.5,000-10,000 price bracket recorded significant growth. This is a healthy indication that while the consumer is looking out for low priced devices, she is also willing to pay a premium for quality. This trend has helped to push the device cost above Rs. 5,000 since sub-Rs. 5,000 devices had quality issues and consumers were not too happy with the performance.”

“We expect 2016, to see some major shifts in the trending specifications as Tablet PCs follow the Smartphone trend of improved specifications over a period of time. Tablets have perhaps reached a stage where a positive ‘correction’ such as this is only waiting to happen,” Tanvi concluded.

Share This Post

CyberMedia Research conducts the Budget Smartphones Channel Audit to capture the perspectives, preferences, challenges and dislikes of retailers around ‘value for money’ (INR <10,000) smartphone brands, capturing a compelling picture of smartphone brands in the market.

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

More To Explore

No posts found!