Over 15.8 mn LTE devices shipped in 1Q 2016 in India

Share This Post

Smartphones still dominate the scene; DataCards start to show increase in contribution

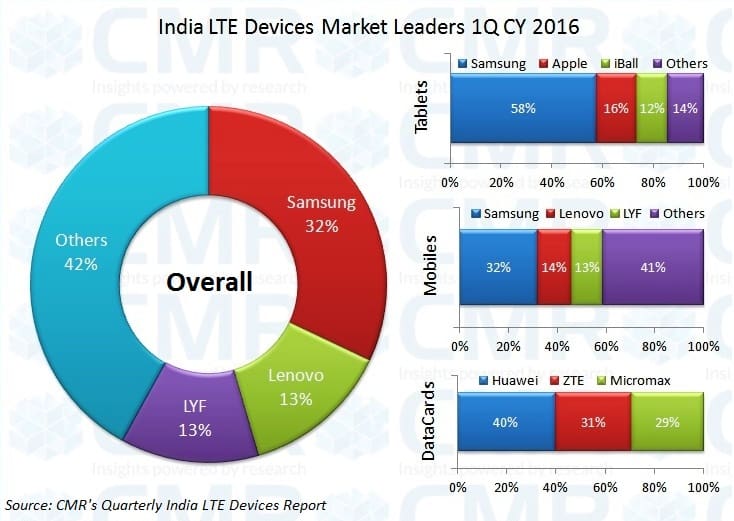

- Samsung, Lenovo and LYF lead the market with 32%, 13.4% and 12.6% market shares, respectively.

- 42 brands shipped Smartphones, DataCards and Tablets with LTE support.

- Micromax the only brand having presence in all the three product categories.

- LeEco makes an impressive entry in first quarter with 2.4% share in 4G Smartphones.

- Huawei to gain the most as LTE DataCard shipments are on the rise.

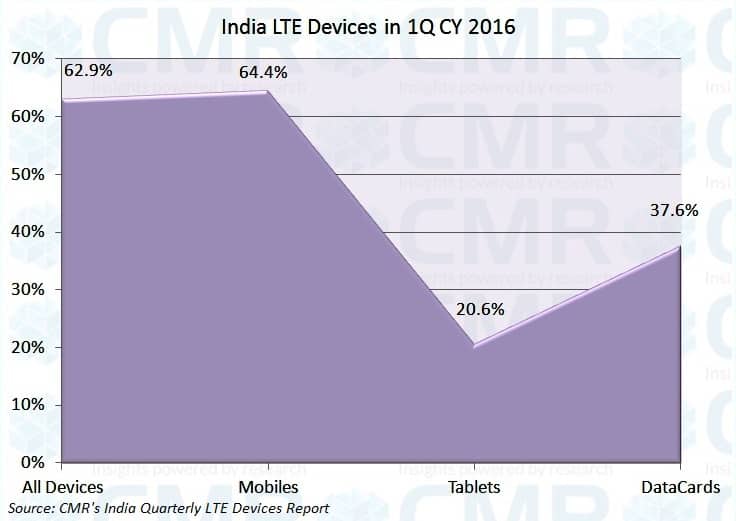

Gurugram: As per the CMR’s 1Q CY report of India LTE Devices, over 15.8 million 4G devices were shipped in the first quarter of 2016. Of these, 97.9% were Smartphones followed by DataCards at 1.5% and the remaining 0.6% were Tablet PCs. This amounts to 63% of the cellular devices shipped through the quarter.

Commenting on the findings, Faisal Kawoosa, Lead Analyst for Telecoms at CMR, said, “The Smartphone industry was the first to bank upon the 4G wave. Now as the services go live with multiple operators, it is the time for other devices to ride on the growth path.”

“DataCards have already started showing this trend as in the first quarter of 2016, itself, we saw 0.5% increase in its contribution to the overall LTE devices compared to 1% of CY 2015. We see this strengthening more as the year progresses. However, tablets are lagging behind and they need to ramp up at the earliest,” Faisal added.

The overall devices leadership is skewed towards the leadership rankings in the 4G Smartphones as close to 98% of the LTE devices are Smartphones. In the Mobile phones, Samsung, Lenovo and LYF are the three leaders with 32%, 14% and 13% market shares respectively. In Tablets, Samsung, Apple and iBall are the three leading brands with 58%, 16% and 12% market shares. However, within DataCards, Huawei, ZTE and Micromax were the only three players shipping 4G devices in the 1Q of 2016. There shares were 40%, 31% and 29%, respectively.

CMR analyst for Telecoms, Krishna Mukherjee, commenting on the 4G brands in India said, “While every emerging devices brand in India prefers Smartphones for obvious potential growth reasons, we see number of brands shipping Tablets and DataCards on the decline. This is leading to the lesser option for consumers in Tablets and DataCards in particular.”

“There’s headroom for growth for other 4G devices as well and it is time for India brands to emerge strongly in these device categories too,” Krishna concluded.

Share This Post

CyberMedia Research conducts the Budget Smartphones Channel Audit to capture the perspectives, preferences, challenges and dislikes of retailers around ‘value for money’ (INR <10,000) smartphone brands, capturing a compelling picture of smartphone brands in the market.

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

More To Explore

No posts found!