Reliance Jio Beats Huawei To Grab Top Position In Data Cards Market In 2H FY 2016-2017

Share This Post

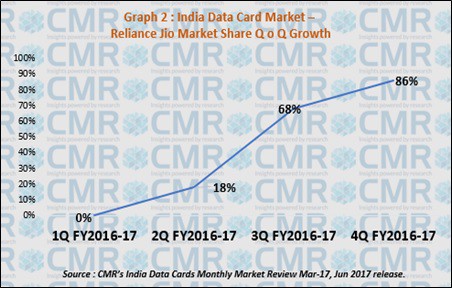

• Market share of Reliance Jio grew from 12% in 1H FY2016-2017 to 77% in 2H FY2016-2017.

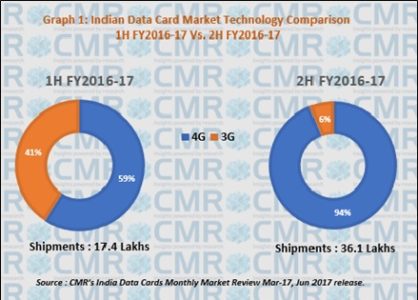

• LTE/4G Data Cards became mainstream with 228% sequential jump in 2H FY2016-2017, in terms of units shipped.

• Market share of Mi-Fi based LTE devices rose from 71% in 1H FY2016-2017 to 94% in the second half.

Gurugram/New Delhi, Thursday, June 22,2017: The Indian Data Cards market registered 107% jump in 2H FY2016-2017 to 3.6 million over 1H FY2016-2017, in terms of units shipped, according to CMR’s India Data Cards Monthly Market Review Mar-17, June 2017 release.

LTE/4G Data Card shipments witnessed 228% sequential rise to 3.3 mn in 2H FY2016-2017. LTE/4G replaced 3G as the most favored technology in the Data Cards market. 3G Data Card shipments declined sequentially by 67% in 2H FY2016-2017, when compared to the first half of FY2016-2017.

“Mi-Fi devices headed the growth of LTE/4G technology in 2H FY2016-2017. LTE based Mi-Fi devices jumped sequentially by 333% in 2H FY2016-2017,” stated Shipra Sinha, Lead Analyst, Industry Intelligence and Channels Research Practices, CyberMedia Research.

“Reliance Jio replaced Huawei as the most favored vendor in 2H FY2016-2017 in terms of market share (Unit shipments). Market share of Reliance Jio grew from 12% in 1H FY2016-2017 to 77% in 2H FY2016-2017 in terms of units shipped due to free data services along with comparatively lower price of its Mi-Fi Data Cards,” Shipra added.

Huawei shipments plunged sequentially by 36% in 2H FY2016-2017. The vendor’s market share decreased from 33% in 1H FY2016-2017 to 10% in 2H FY2016-2017.

ZTE shipments witnessed 6% sequential growth in 2H FY2016-2017, while other vendors like Alcatel, D-Link saw fall in 2H FY2016-2017.

Reliance Jio model JioFi 3 was the fastest moving model followed by its JioFi 2 on number two position.

Huawei E3372H-607 was on the third spot.

Data Cards with data rate of 150 Mbps contributed around 92% to overall shipments in 2H FY2016-2017.

Around 59% of data cards were sold with operator bundling in 1H FY2016-2017 that increased to around 95% in 2H FY2016-2017.

“Mi-Fi devices is expected to show a rapid growth in the future. In-built battery with anywhere, anytime data connectivity because of the various affordable data plans in Mi-Fi devices are the key features contributing to its growth. Large number of user support with a single device is one of the reasons for the growth in Mi-Fi devices. Significant push by telecom service providers is also making and continue to make Mi-Fi cards the most favored option in India,” Shipra concluded.

Share This Post

CyberMedia Research conducts the Budget Smartphones Channel Audit to capture the perspectives, preferences, challenges and dislikes of retailers around ‘value for money’ (INR <10,000) smartphone brands, capturing a compelling picture of smartphone brands in the market.

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

More To Explore

No posts found!