- Samsung led the smartphone market followed by Xiaomi in Q3 2023.

- 5G smartphones worth $11Bn shipped in Q3 2023.

- Premium smartphone (INR >25,000) shipments recorded 37% YoY growth.

- 4G feature phone shipments recorded remarkable >300% YoY growth in Q3 2023.

New Delhi/Gurugram, 3rd Nov 2023: According to CyberMedia Research’s India Mobile Handset Market Review Report for Q3 2023 released today, India’s 5G smartphone shipment share rose to 57%, marking a 78% YoY growth. Samsung led the Indian 5G smartphone market with a 23% market share, followed by Vivo at 16%. While India’s smartphone market remained flat year-on-year, the overall mobile market saw a slight 1% decline.

Commenting on the overall market conditions in Q3 2023, Shipra Sinha, Analyst- Industry Intelligence Group, CyberMedia Research (CMR), “In the run-up to the festive season, the India smartphone market showed signs of recovery, on the back of a slew of new smartphone launches and attractive deals. 5G smartphone segment continued to headline the market growth, with 44 new launches, and a 57% market share. Foldable smartphones experienced remarkable growth, doubling YoY. Furthermore, 4G feature phones showed tremendous growth, driven by Aspirational India and the demand for companion devices in Urban India.”

Smartphone Segment

The Value-for-money smartphone segment (INR 7000-INR 25,000) constituted the largest share at 69%. Notably, out of the 59 smartphones launched in Q3 2023, a significant 36 were part of this segment. Despite this, its shipments decreased by 11% YoY.

The Affordable smartphone segment (<INR 7000) experienced substantial growth, surging by 78% YoY. This growth was driven by models like Redmi A2, Poco C50, and Itel A27, collectively capturing a 50% market share.

The Premium segment (INR 25,000- INR 50,000) witnessed an 11% YoY growth. Additionally, the Super-premium smartphone segment (INR 50,000 – INR 1,00,000) and the Uber premium segment (>INR 1,00,000) experienced outstanding YoY growth rates of 87% and 136% respectively.

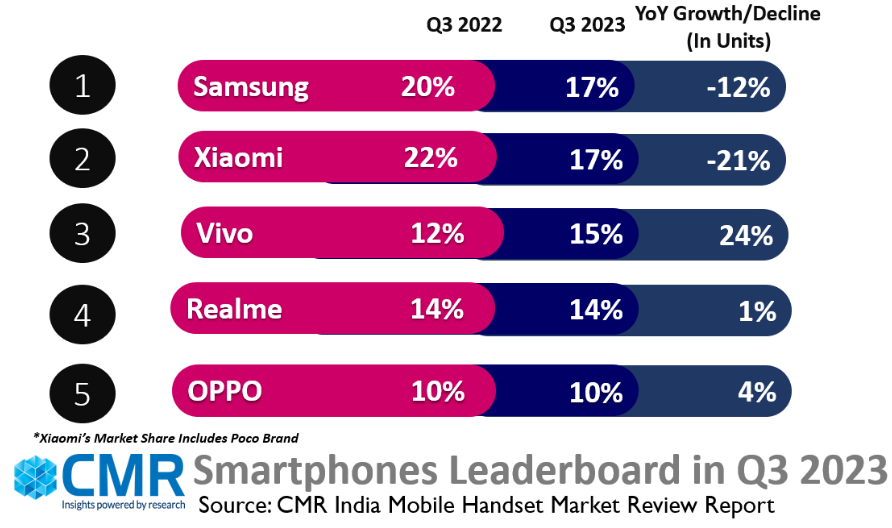

Samsung (17%), Xiaomi (17%) and Vivo (15%) captured the top three spots in the smartphone leaderboard in Q3 2023, followed by Realme (14%) and OPPO (10%).

Feature Phone Segment

The 4G feature phone shipments experienced an exceptional >300% YoY growth during the quarter. This growth was driven significantly by JioBharat K1 Karbonn and JioBharat V2 collectively capturing 63% market share.

The overall feature phone market saw a decline of 6% YoY. Notably, 2G feature phone shipments decreased by 27% YoY.

Key Smartphone Market Highlights in Q3 2023

Samsung dominated the smartphone market with a 17% share, leading both the Premium (INR 25,000-50,000) and Uber-Premium (>INR 1,00,000) segments with 28% and 68% shares respectively.

Xiaomi secured the second spot in the smartphone market with a 17% share, featuring top models like Redmi 12, Redmi A2, and Redmi 12C. Additionally, Xiaomi’s sub-brand, Poco, experienced an impressive 74% YoY growth in shipments.

Vivo was placed third with a 15% market share. Vivo secured the second spot in 5G smartphone shipments, holding a 16% share, driven by models like vivo T2x, vivo T1, and vivo T1 Pro.

Realme held the fourth position with a 14% market share, experiencing a modest 1% YoY growth in shipments. The top models shipped by Realme were Realme C53, Realme 11x 5G, and Realme C55.

OPPO was placed fifth with a market share of 10%. Its top three shipped models were the OPPO F23, OPPO A16k and OPPO A16e.

OnePlus recorded a notable 13% YoY growth in its smartphone shipments. OnePlus Nord CE 3 Lite, OnePlus Nord CE 2 Lite and OnePlus 11 were the top 3 models shipped.

Apple captured 6% market share in the smartphone market in Q3 2023. Attractive deals on its previous-generation phones resulted in a 44% YoY growth in Apple’s shipments.

Transsion Group brands, including itel, Infinix, and Tecno, saw a 12% YoY increase in shipments (combined for smartphones and feature phones). Tecno and Infinix recorded individual YoY growth rates of 15% and 6% respectively in market shipments.

Future Market Outlook

CMR estimates a slight overall decline of 1-2% in smartphone shipments for the entire year.

According to Menka Kumari, Analyst-Industry Intelligence Group, CyberMedia Research (CMR), “The smartphone market is showing encouraging signs of stabilization, with relatively lesser headwinds as we look forward to 2024 and beyond. Compared to a year ago, smartphone OEMs will exit 2023 with better inventory levels. As we move forward, OEMs will look to maintain a leaner product portfolio, backed by aggressive marketing to gain market share.”

CMR estimates the overall smartphone shipments for the entire 2024 to potentially grow by 8-9%, with 5G shipments anticipated to grow >40% YoY.