CY 2016 shipments set to grow further as 3G and 4G smartphones become mainstream

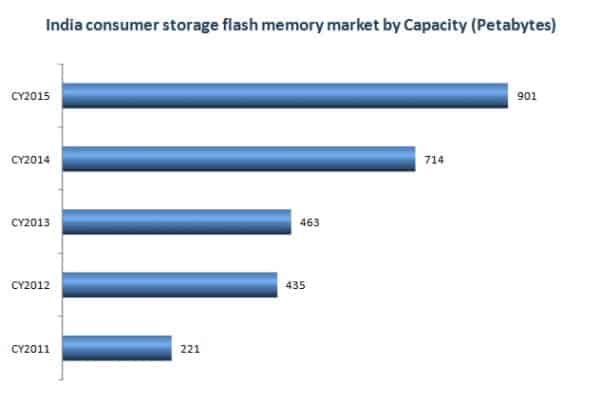

New Delhi/Gurgaon: The India Consumer Storage Flash Memory market comprising Micro SD cards, SD cards and Flash drives grew at a CAGR of 42% over the period CY 2011-CY 2015 in terms of capacity. This was revealed in CMR’s India Quarterly Consumer Storage Flash Memory Market Review, 4Q CY 2015, February 2016 release.

“This clearly points to the growing acceptance and adoption of a ‘digital lifestyle’ by the Indian consumer, which has good long term implications for the overall growth of the ESDM sector in the country,” stated Narinder Kumar, Lead Analyst, InfoTech and Channels Practices, CyberMedia Research.

Figures 1: India Consumer Storage Flash Memory Market Growth by Capacity (Petabytes), CY 2011-CY 2015

Source: CMR’s India Consumer Storage Flash Memory Market Review, 4Q CY 2015, February 2016 release

Quarterly View

The India Consumer Storage Flash Memory market comprising Micro SD cards, SD cards and Flash drives grew sequentially by 21% in 4Q 2015. This was revealed in CMR’s India Quarterly Consumer Storage Flash Memory Market Review, 4Q CY 2015, February 2016 release.

Market Leadership

In the overall India Consumer Storage Flash Memory market SanDisk remained the top vendor with a 37% market share in 4Q CY 2015 in terms of unit shipments. Samsung was at number two spot, followed by Strontium at number three position. One of the key reasons for the market revival is that shipments of unbranded MicroSD cards recorded 143% hike quarter-on-quarter versus a 48% decline in the previous quarter. The ‘Top Five’ branded vendors contributed to two-thirds of overall shipments in 4Q CY 2015.

Capacity Trends

While suppliers of unbranded MicroSD cards were mainly focused on 4 GB and 8 GB capacity, the established players moved up the value chain to 8 GB and above.

8GB capacity was the most favoured segment with a 46% market share in terms of unit shipments in 4Q CY 2015. The market continued the trend of movement towards higher capacity segments. Shipments of 16GB capacity grew sequentially by 14% in 4Q CY 2015. SanDisk’s 8GB capacity constituted 17% of overall shipments in 4Q CY2015.

Prognosis for CY 2016: Smartphones to Drive Growth

“Overall CY2015 ended below expectations. While 2Q CY 2015 was affected by imposition of anti-dumping duty on Pen drives, a large influx of grey market MicroSD card units in 3Q CY 2015 hampered the growth in shipments during the second half,” Narinder further added.

“CY 2016 is expected to be better than CY 2015. Growth in MicroSD cards due to a growing base of 3G and 4G smartphones will be a key driver of growth of the market. However, the recent imposition of additional customs duty on imports in 1Q CY 2016 is likely to slow down the growth engine temporarily, particularly for suppliers of branded cards,” Narinder concluded.

Notes for Editors

- CyberMedia Research (CMR) is a pioneering market intelligence and consulting firm that runs a comprehensive quarterly market update on the India Consumer Storage market. CMR’s India Quarterly Consumer Storage Flash Memory Market Review covers Micro SD cards, SD cards and Flash drives sold via distributors and retail outlets. The report accounts for ‘legal’ shipments, but does not include bundled or ‘grey’ market shipments or units brought from abroad by individuals as a part of personal baggage.

- CMR uses the term “shipments” to describe the number of consumer storage flash memory devices leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term ‘shipment’ is sometimes replaced by “sales” in the press release, but this reflects the market size in terms of units of consumer storage flash memory devices and not their absolute value. In the case of flash memory devices imported into the country, it represents the number leaving the first warehouse to OEMs, distributors and retailers.