Market moving towards LCD technology, higher brightness levels; XGA projectors replacing SVGA

Education sector emerges as the major driver of sales

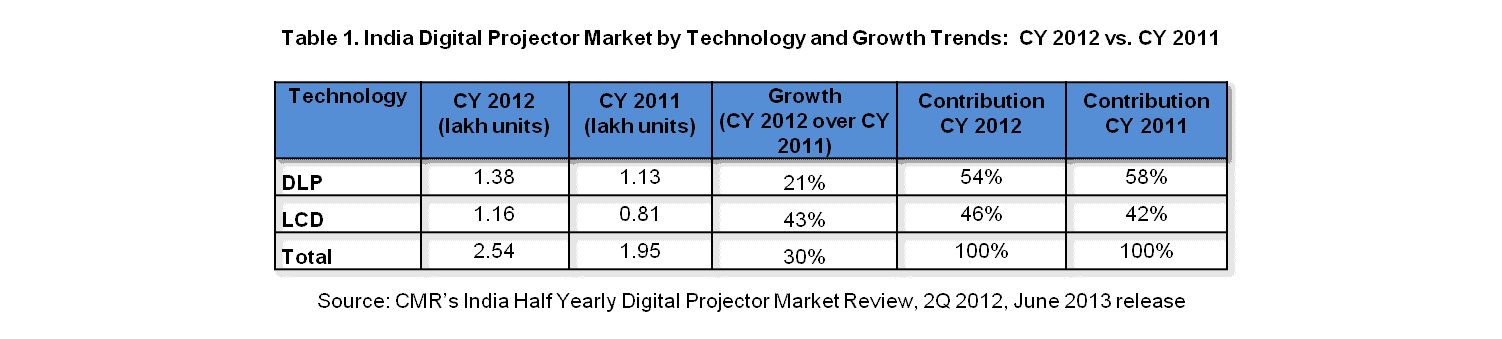

The India digital projector market continued its growth trajectory in CY2012 with a year-on-year (YoY) growth of 30% in terms of unit shipments achieving nearly 2.54 lakh unit shipments (sales). Education sector continued to be the biggest driver of digital projector sales, followed by mid-size and small business segments. This was revealed in the CyberMedia Research report CMR’s India Half Yearly Digital Projector Market Review, 2Q 2012, June 2013 release.

India Digital Projector market by unit shipments: BenQ dislodged last year’s leader InFocus from its top position with an 18% share, followed by Epson with 16% and Hitachi with 12% share in unit shipment terms. Panasonic, with a 9% share jumped to fourth spot this year from last year’s No. 8. InFocus, witnessing channel and top management restructuring during 2012, lost share and slipped to fifth position in terms of unit shipments.

India Digital Projector market by revenue: In revenue terms the India market touched Rupees 6.9 billion in CY2012, witnessing a growth of 23% over the previous year. However, the average sales value (ASV) of digital projectors in the country declined by 5% over CY2011.

Technology

In terms of technology, the market continued its shift towards LCD due to better quality of projection and lower power consumption as well as less heat generation as compared to DLP. The proportion of shipments for DLP projectors declined to 54% in CY2012 as against 58% in CY2011.

Brightness: The India projector market is moving towards higher lumens categories. The 2501-3000 lumens category replaced last year’s leader, the 2001-2500 lumens category.

Resolution: XGA projectors received greater preference over SVGA projectors in 2012. Of late, the reducing price gap between XGA and WXGA has helped the latter increase its footprint in the market.

Segments

Education segment continued to be largest buyer of projectors in India, accounting for 40% of all shipments in 2012.

“India’s education sector is moving towards the digital age. Educational SIs are booming in India and helping to cater to the growing requirement of audio-visual equipments. Currently, the market is very fragmented with players like Educomp, Edurite, Extramarks, Tata Interactive and NIIT Technologies facilitating private as well as government educational institutions to set up their digital and multimedia classrooms”, stated Sumanta Mukherjee, Lead Analyst, CMR InfoTech Practice.

“The India digital projector market in the corporate segment was traditionally dominated by large businesses. However, the market has slowly witnessed a shift towards mid-size and small business segments, particularly after the 2008 global economic slowdown. Increased penetration of mobile computing devices like notebook PCs in the SMB sector has also contributed to new use cases emerging for projectors”, Sumanta added.

“The India home / SOHO segment holds potential for uptake of digital projectors, especially with the launch of models that support features like HD, short-throw, 3D, Wi-Fi etc. Vendors like Epson, BenQ, Panasonic and others hope to encash this opportunity, however, the prevailing low consumer sentiments are acting as a barrier to growth”, Sumanta concluded.

Role of Distribution Partners

There was an increase in product movement through VAR / SI partners, who contributed around 20% of projector shipments in India during the same period.

“Growth in business from VAR / SI partners can be mainly attributed to increased penetration of projectors in the small and mid-size business segment. The VAR / SI community has played a key role in facilitating penetration of affordable business solutions amongst India’s SMB enterprises. Over a period of time, to make up for reduced profits from hardware sales and increased competition, traditional distribution partners have evolved from being mere ‘box pushers’ to foray into value added services such as system integration”, stated Narinder Kumar, Analyst, InfoTech and Channels Research Practices, CyberMedia Research.

Future Trends

Computing products which serve as source devices for projectors are undergoing a transformation. Traditional desktop PCs have given way to notebook PCs, ultrabooks / hybrids and the next level of transformation to smartphones and tablets is already underway. These devices are capable of independently serving the portable computing needs of a modern user.

“Computing product form factor transformations are challenging projector technologies to keep pace with them, thus creating the need of faster technological innovations. As source devices and their usage patterns change and evolve, features like mobile / network connectivity, portability, compatibility with integrated environments will become ‘must have’ features on projectors”, Narinder proffered.

“Technological enhancements along with the preference for integrated solutions is increasing the acceptance of interactive projectors. This trend is expected to grow in the future as 3D projectors, which were earlier confined to niche areas like animation, engineering and architecture, are likely to move beyond these to home entertainment and gaming segments in the future”, Narinder concluded.

Notes for Editors

- CyberMedia Research (CMR) is a pioneering market intelligence and consulting firm that runs a comprehensive half yearly market update on the India Digital Projector market. CMR’s India Half Yearly Digital Projector Market Review consists of projectors below or equal to 6000 lumens brightness rating. It does not include parallel imports, ‘grey’ market or refurbished projectors.

- CMR uses the term ‘shipments’ to describe the number of projectors leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term shipment has been interchangeably used with ‘sales’ in the press release, but this reflects the market size in terms of units of projectors and not their absolute value. In the case of digital projectors imported into the country, it represents the number leaving the first warehouse to OEMs, distributors and retailers.

- CMR estimates the total revenues of digital projectors shipped (sold) in the India market on the basis of average sales value (ASV) or ‘street price’ which the end customer pays for the product.