- Vivo Leads Smartphone Market with 20% Share; Tops 5G Shipments

- Apple Posts 25% YoY Growth, Strengthens Position in Super and Uber-Premium Segments

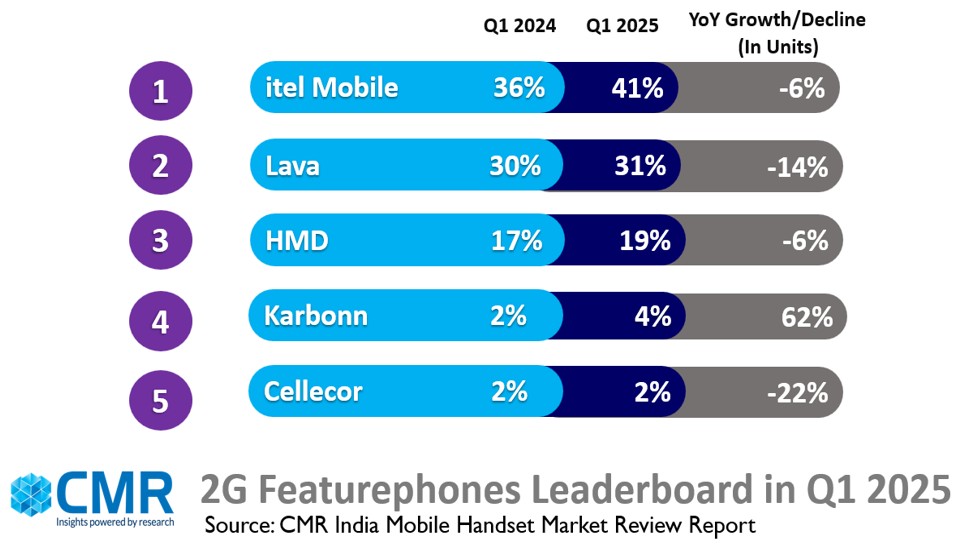

- Feature phone shipments declined 37% YoY, with iTel Mobile leading the segment.

New Delhi/Gurugram, 5th May 2025: According to the CyberMedia Research (CMR) India Mobile Handset Market Review Report for Q1 2025 released today, India’s smartphone market declined by 7% year-on-year (YoY) in Q1 2025, amid shifting consumer preferences and intensified competition. However, the premium segment continued to grow, buoyed by strong demand for 5G-enabled and AI-ready smartphones.

5G smartphone shipments accounted for 86% of the overall market in the quarter, marking a 14% YoY increase. Notably, 5G smartphones priced between INR 8,000 and INR 13,000 recorded over 100% YoY growth, reflecting surging demand for affordable 5G access.

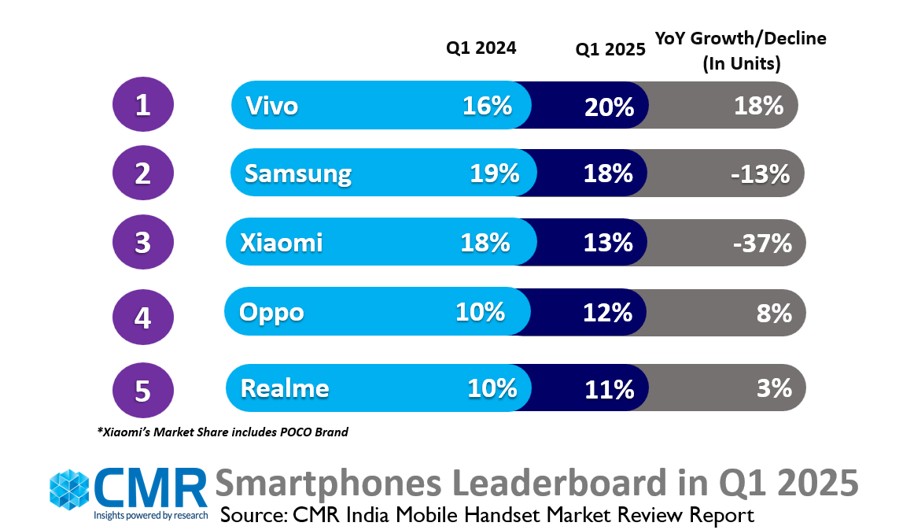

Vivo led the 5G smartphone market with a 21% market share, followed by Samsung at 19%. In overall smartphone market, Vivo (20%) retained the top spot, followed by Samsung (18%), Xiaomi (13%), OPPO (12%) and realme (11%).

Commenting on the market dynamics, Menka Kumari, Senior Analyst at CyberMedia Research (CMR) said, “The <INR 10,000 5G smartphone segment witnessed over 500% YoY growth in Q1 2025. This reflects strong consumer appetite for affordable 5G smartphones. Brands such as Xiaomi, POCO, Motorola, and Realme are leading this surge. On the other hand, the 2G feature phone segment fell 17% YoY, while 4G feature phones declined sharply by 66% YoY.”

While the affordable smartphone segment (<INR 7,000) grew a modest 3% YoY, the value-for-money segment (INR 7,000 – INR 25,000) declined by 6%, reflecting a continued shift toward premium smartphones.

Feature Phone Segment

In Q1 2025, the 2G feature phone segment was dominated by Itel Mobile (41%), Lava (31%) and HMD (19%).

Q1 2025: Key Smartphone Market Highlights

Vivo captured the top spot with 20% market share. The Vivo Y29, Vivo T3 Lite, Vivo T3X and Vivo T4X models accounted for 43% of their 5G shipments.

Samsung secured second spot with 18% overall market share. However, in the Value-for-money segment, the company experienced a 13% YoY decline. The S25 series has helped Samsung maintain a strong presence in the premium Android segment, especially with the Ultra model leading the charge.

Xiaomi fell to third place, holding a 13% market share, and declining 37% YoY, the sharpest among the top five, reflecting challenges in both affordable and value-for-money smartphone portfolios.

OPPO reached 12% market share, with shipments increasing by 8% YoY, led by the OPPO A3X, OPPO K12X, and OPPO A3 Pro models.

Motorola registered a stellar 53% YoY growth, fueled by its strong product differentiation, including hardware and software, and a competitive 5G portfolio. Over the past seven quarters, Motorola has posted a strong double-digit growth in six.

Transsion Group witnessed a 13% YoY decline, as it faced intensified competition from aggressively priced, value-for-money smartphones offered by established and emerging players in the budget segment.

Nothing recorded an impressive +200% YoY growth. The brand’s diversification strategy is evident with newer launches like the Nothing Phone (3a) Pro and Nothing Phone (3a) collectively adding another ~20% to the Q1 2025 mix.

MediaTek dominated India’s smartphone chipset market with 46% market share. Qualcomm led the premium smartphone segment (>INR 25,000) with a 35% share.

Apple posted a 25% growth YoY, and captured an 8% market share, driven by strong demand for premium smartphones and a broader retail presence in India. The iPhone 16 series, including the iPhone 16e, significantly contributed to this growth, with Apple’s market share in the super-premium segment (INR 50,000 – INR 1,00,000) rising 28% YoY and the uber-premium segment (>INR 1,00,000) up 15% YoY.

Future Outlook

In CY2025, CMR anticipates the Indian smartphone market to witness moderate growth, with shipments growing in single digits.

“In the quarters ahead, India’s smartphone market will be shaped by three converging forces: the mainstreaming of affordable 5G, the rapid infusion of on-device AI, and the growing acceleration for supply chain localization. As the premium segment accelerates on the back of AI integration, brands that fail to evolve beyond price-based competition in the value-for-money segment will face margin and relevance pressures. Concurrently, affordable 5G is a growing baseline expectation, amidst intensifying competition. With geopolitical shifts accelerating local manufacturing, India is poised to become both a key market and a critical node in the global smartphone value chain,” added Prabhu Ram, VP at CyberMedia Research (CMR).