- 5G tablets posted 44% YoY growth, reflecting strong and accelerating adoption.

- Tablets with 6GB RAM grew 262%, while 12GB RAM models rose 166%, highlighting premium momentum

- LCD displays grew 28% year-on-year, strengthening the value-for-money tablet segment.

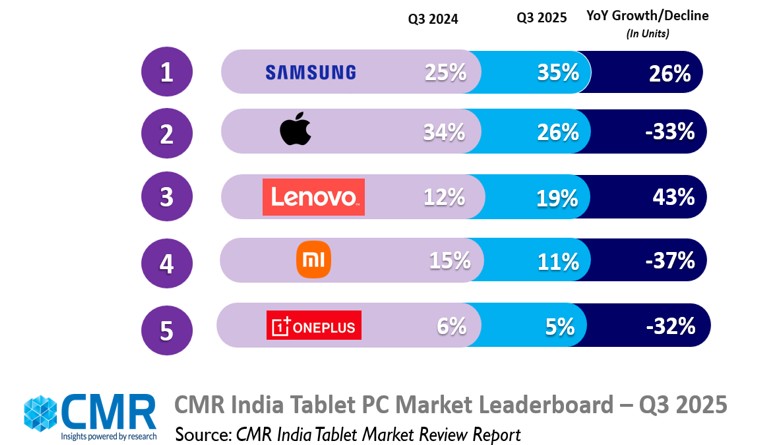

New Delhi/Gurugram, 01 Dec 2025: As per CyberMedia Research (CMR)’s Tablet PC India Market Report Review for Q3 2025, the Indian tablet market staged a strong 33% quarter-on-quarter (QoQ) rebound signalling renewed consumer momentum. Samsung led with a 35% market share, followed by Apple (26%) and Lenovo (19%). Despite this recovery, overall shipments fell 11% year-on-year (YoY), weighed down by last year’s high base, softer enterprise and government demand, and delayed consumer upgrades.

Premium tablets (priced above ₹20,000) surged 71% QoQ, driven by festive season purchases and rising interest in high-performance, productivity-focused devices. The 11-inch segment dominated the market with a 59% share, reflecting consumer preference for tablets suitable for both work and entertainment.

According to Menka Kumari, Senior Analyst – Industry Intelligence Group (IIG), CyberMedia Research (CMR), “The premium tablet segment posted a healthy growth fuelled by strong consumer demand for tablets with enhanced performance, immersive displays, and seamless productivity during the festive season sales. While consumer adoption of larger devices accelerated, commercial demand slowed in the absence of major government and education deals.”

5G tablets posted 44% YoY growth, reflecting strong momentum and the rapid adoption of next-generation connectivity. Tablets with 6GB RAM jumped 262%, and 12GB RAM models grew 166%, highlighting a clear shift toward higher-performance devices for smoother multitasking. At the affordable and value-for-money tablet segment,tablets with LCD displays rose 28% YoY.

Tablet Brand Dynamics:

Samsung retained leadership with 35% market share, growing 26% YoY, powered by Galaxy A-series and Tab S-series tablets.

Apple held 26%, with the Apple iPad 11 series contributing to 69% of shipments, maintaining dominance in the premium segment. Apple iPad shipments declined 33%.

Lenovo captured 19% market share, and posted a strong double-digit growth, expanding on the back of demand in value-for-money segment across consumer, education, and enterprise segments.

Xiaomi held 11% market share, and a 37% decline, facing stiff competition in the value-for-money segment.

OnePlus accounted for 5% market share and witnessed a double-digit decline.

Chipset Brand Dynamics:

Qualcomm led the tablet market with 24% growth in CY2025, driven by premium tablet adoption.

MediaTek grew 15%, maintaining its strength in value-for-money tablets.

Market Outlook

CyberMedia Research (CMR) forecasts a steady 10-15% growth for the tablet market in CY2025.

“We expect the premium and 5G tablets to steer growth in the year ahead. Strong adoption in both consumer and institutional segments, especially larger, higher-memory devices, will support rising average selling prices and continued growth in high-performance, productivity-focused tablets.,” added Menka.