- The Passenger Vehicle market recorded 3% YoY growth with Maruti Suzuki maintaining its leadership.

- Overall Passenger Vehicle exports grew by 16% YoY

- SUV’s market share increased from 56% in Q1 2024 to 58%

New Delhi/Gurugram 26 May 2025: As per CyberMedia Research (CMR) India Passenger Vehicle (PV) Technology Report for Q1 2025, the Indian EPV market recorded a significant 25% year-on-year (YoY) growth.

Tata Motors dominated the EPV market with 36% market share with Tata Nexon EV model accounting for 72% share within the overall Tata Motors portfolio. The overall passenger vehicle (PV) market recorded a modest 3% YoY growth with Maruti Suzuki leading the market with 41% share.

According to Shipra Sinha, Analyst – Smart Mobility Practice, CyberMedia Research (CMR), “During the quarter, the Connected EPV market grew by 25% YoY, with EPVs featuring ADAS technology seeing a >400% YoY increase from a small base. Additionally, EPVs with digital cockpits grew by 67% YoY. This technological rise is fuelled by consumer demand for safety, connectivity, and convenience, with features like digital cockpits, ADAS, and over-the-air updates becoming standard as automakers shift toward software-defined vehicles.”

Market Highlights for Q1 2025

- Market Leadership:

- Tata Motors led theEPV market with 36% market share.

- MG Motors recorded an impressive >265% YoY growth and captured 29% market share. MG Motor’s MG Comet and MG ZS EV contributed to the EPV growth.

- Mahindra also recorded notable 72% YoY growth capturing 23% share. Mahindra XEV 9e and Be6 accounted for the major EPV segment market share.

- Connected Growth: The connected EPV segment grew by 25% YoY, with 94% of EPVs equipped with connected technology.

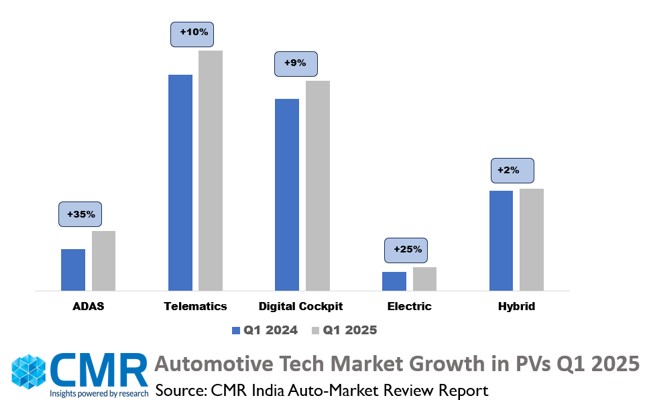

- Digital Cluster Adoption: The digital cluster segment recorded 9% YoY growth in the overall PV market with its adoption rising from 28% in Q1 2024 to 30% in Q1 2025. The EPVs with digital cluster recorded notable 67% YoY growth.

- ADAS: There was a notable 35% YoY growth with adoption rising from 6% in Q1 2024 to 8% in Q1 2025 in the overall PV market. The EPVs with ADAS recorded remarkable >400% YoY growth on a small base.

Future Market Outlook

Based on CMR estimates, CMR anticipates the overall Indian passenger vehicle market to grow at a single-digit YoY rate by the end of CY2025. Meanwhile, CPVs and PVs equipped with digital clusters are expected to capture 35%-40% of the market share each in CY2025.

“We forecast the transition towards electric, connected, and software-defined vehicles to further gain momentum, with rising demand for features like ADAS, digital cockpits, and over-the-air updates. Consumers are increasingly prioritizing safety, intelligence, and sustainability in their mobility choices. At the same time, policy incentives, expanding EV infrastructure, and the push for greener transportation are accelerating this evolution,” added Divya Maurya, Analyst – Smart Mobility Practice, CyberMedia Research (CMR).