- Hero MotoCorp led the overall 2W market with 27% share, closely followed by Honda at 26%

- TVS retained leadership in the Electric Two-Wheeler (E2W) segment, followed by Ather and Bajaj

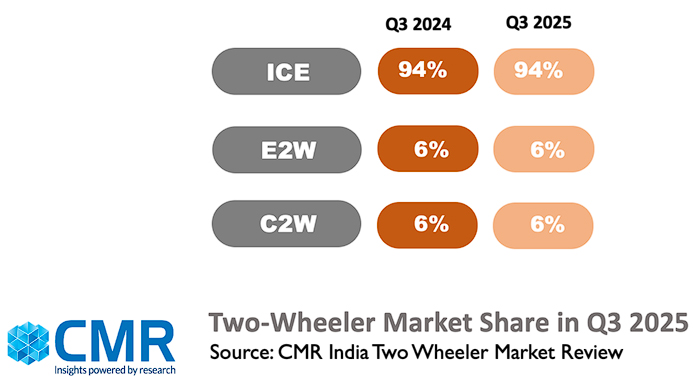

- ICE 2Ws continued to dominate, accounting for 94% of the market, with 7% YoY sales growth

- 2W exports registered 15% YoY growth

New Delhi/Gurugram, 6 Nov 2025: India’s 2W market maintained its steady upward trajectory, growing 7% YoY in Q3 2025, according to CyberMedia Research (CMR) in its latest India Two-Wheeler Market Review. The Electric 2W (E2W) market remained flat YoY, contributing 6% to the overall 2W market.

“India’s 2W market continues to demonstrate strong consumer confidence and technological progression,” said Shipra Sinha, Senior Analyst – Smart Mobility Practice, CMR. “Improved affordability post-GST rationalization, festive optimism, and growing consumer appetite for tech-enhanced mobility are reshaping the segment. One in four electric models now featuring removable battery systems reflects growing consumer demand for flexibility, faster turnaround, and independence from fixed charging networks. Riders today are seeking experiences defined by intelligence, convenience, and personalization — signalling a steady shift toward smarter mobility,”

The government’s decision to retain a 5% GST on EVs and simplify input tax credits for ICE 2Ws has improved overall affordability and dealer liquidity. This policy clarity has led to a 5–7% price benefit in entry-level models and strengthened retail momentum in the sub-₹1 lakh segment. Moreover, GST credit availability accelerates OEM localization timelines by lowering production costs, improving cash flow, and enabling suppliers to invest in local manufacturing of auto components and battery packs

Technology Trends and Market Leaders in Q3 2025

- Market Leadership:

- Hero MotoCorp led the 2W market with 7% YoY growth driven by popularity of its Splendor model capturing 58% share within Hero MotoCorp.

- TVS Motor Company led India’s E2W segment in Q3 2025 with a 24% market share, reflecting sustained consumer confidence in its iQube lineup and expanding distribution network.

- Ather Energy, with a 19% share, recorded an impressive 54% YoY surge, powered by the success of its Rizta and 450X series.

- Bajaj Auto followed with 17% share, benefiting from growing demand for the Chetak as an urban commuter EV.

- Connected Growth: The connected E2W segment grew 7% YoY, with 84% of electric models now offering in-built navigation, and smartphone integration features

- Digital Cluster Adoption: About 33% of total 2Ws sold featured digital instrument clusters, reflecting steady consumer demand for tech interfaces.

- Touchscreen: Notably, 29% of E2Ws were equipped with touchscreen displays, with 93% of them offering 7-inch panels, enhancing ride intelligence and user interaction.

Future Market Outlook

In CY2025 and beyond, CMR remains optimistic about the continued growth of EV in India and increasing adoption of connected technology. CMR anticipates E2Ws to capture 7-8% share in the overall 2W market by the end of CY2025.

“The government’s sweeping GST reforms have slashed entry barriers, while ambitious EV incentives are accelerating demand like never before. India’s 2W sector stands at an inflection point, powered by the convergence of affordability, cutting-edge innovation, and urgent sustainability goals. The next phase of growth will see smart, connected E2Ws — featuring battery-swapping and advanced technology — transition from niche to mainstream, transforming mobility norms across urban and rural India,” said Amit Sharma, Senior Analyst – Smart Mobility Practice, CMR.