- Desktop DRAM continues to lead with a 71% market share.

- DDR4 DRAM holds 67% of the market share in shipment.

- 8GB DRAM remains the preferred choice, contributing 59% of the total market.

Gurugram/New Delhi, March 20, 2025 – According to the latest India DRAM Market Review by CyberMedia Research (CMR),the consumer DRAM market witnessed a significant robust 12% QoQ growth in Q4 2024, driven by increased demand for DRAM across PC and Gaming segment.

Mukesh Sharma, Senior Analyst, Industry Intelligence Group (IIG), CyberMedia Research (CMR), Commented, “The consumer DRAM market is on a steady growth path, driven by rising desktop demand and sustained expansion in the laptop segment. The gaming category is accelerating DDR5 adoption, alongside increasing demand for higher-capacity memory. Additionally, lesser-known brands are gaining traction, capturing 32% of the market in Q4 2024. With advancements in AI and gaming technologies, consumer demand for faster, more reliable memory solutions continues to rise.”

Q4 DRAM Market Highlights

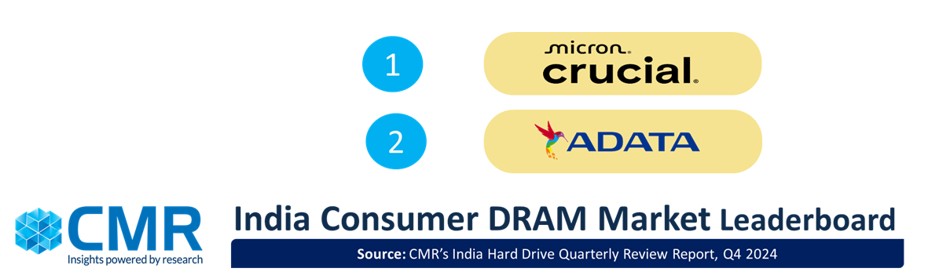

Crucial retained its market leadership with a 29% share, registering a 44% QoQ growth.

Adata secured the second position with a 17% market share in Q4 2024.

Looking Ahead:

As per CMR estimates, the DRAM consumer market is poised for a rebound, with projected 7 to 9% YoY growth in CY2025.

“The future of the DRAM market will be driven by rapid DDR5 adoption, increasing demand for higher capacities (16GB, 32GB, and beyond), and advancements in AI, gaming, and data center technologies. The rise of AI PCs, edge computing, and high-performance workloads will accelerate the need for low-latency, high-bandwidth memory solutions like HBM, which is gaining traction in gaming, AI processing,” added Pankaj Jadli, Analyst – Industry Intelligence Group (IIG), CMR.