- SATA SSDs accounted for 76% of the market, while NVMe SSDs grew 6% sequential, reaching 24% adoption.

- External SSDs shipments declined 28% QoQ in Q4 2024.

Gurugram/New Delhi, March 7, 2025. According to the CMR India Consumer SSD Market Review Report for Q4 2024, the internal SSD market in India witnessed a robust 29% quarter-on-quarter (QoQ) growth in shipments, reflecting strong consumer demand for faster and more efficient storage solutions. In contrast, the external SSD segment saw a decline of 28% QoQ and 14% year-on-year (YoY), indicating shifting consumer preferences and a slowdown in demand.

According to Mukesh Sharma, Senior Analyst, Industry Intelligence Group (IIG), CyberMedia Research (CMR), “”The long-term demand for storage solutions—both internal and external SSDs—remains strong. The surge in internal SSDs was primarily driven by entry-level capacities (128-256 GB), which accounted for 71% of total shipments, supported by competitive pricing from mid-tier vendors. However, the 42% YoY decline in internal SSD bit shipments signals a shift in storage preferences, influenced by rising cloud adoption and the continued presence of HDDs, which offer cost and capacity advantages.”

SSD Flash Market Highlights Q4 2024:

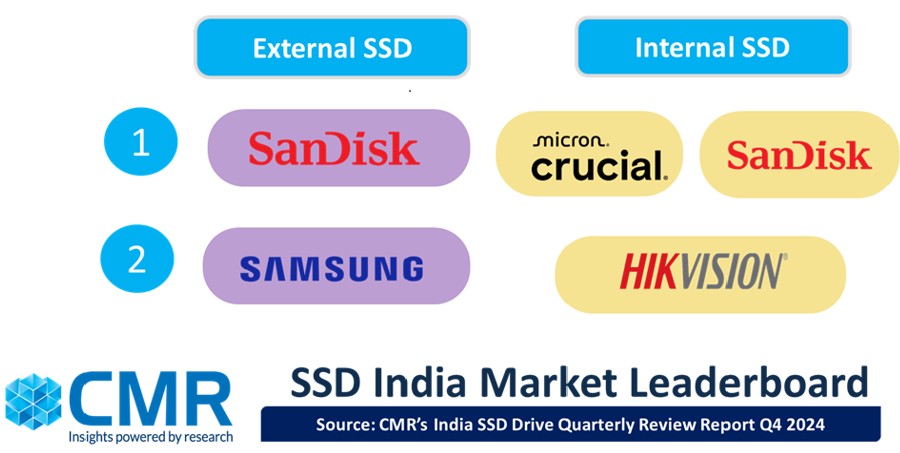

Internal SSD Market: Crucial and Sandisk tied for the top position, each capturing 13% market share. Crucial dominated the SATA SSD segment, while SanDisk led in NVMe SSDs. Hikvision secured the third spot with 7%. The lesser-known brands collectively captured 49% share in Q4 2024.

External SSD Market: Sandisk maintained its leadership with a 65% market share, followed by Samsung in second place with 14% market share.

Looking Ahead

As the consumer SSD market progresses into 2025, demand is expected to rise steadily, driven by several key factors.

According to CMR estimates, the consumer SSD market in CY2025 is anticipated to witness 8-10% growth in internal SSD shipments, as more consumers replace traditional HDDs with SSDs for enhanced performance. Meanwhile, external SSD shipments are expected to grow by around 18%, reflecting rising demand for portable, high-speed storage solutions, particularly among professionals and content creators.

The increasing affordability of SSDs is making them more accessible across diverse consumer segments, while the ongoing transition from HDDs to SSDs continues to gain momentum, fueled by faster boot times, improved performance, and lower latency. Additionally, there is a growing preference for dual SSD setups, enabling consumers to efficiently manage larger data volumes across multiple drives.

“SSD flash will continue to benefit from long-term structural tailwinds, driven by the AI-powered data cycle and the industry’s focus on innovative storage solutions. The rising demand for large-scale data storage, along with the transition from SATA to high-performance NVMe and PCIe protocols, is pushing storage capabilities to new heights. These advancements enhance data security, improve accessibility, and unlock new business opportunities. The consumer SSD flash storage market remains strong and resilient, consistently delivering industry-leading solutions while expanding its market presence,” added Bhaskar Negi, Analyst-Industry Intelligence Group (IIG), CyberMedia Research (CMR).