- Maruti Suzuki maintained its dominant position in the overall PV market

- Q2 2025 saw a 13% YoY increase in PV exports

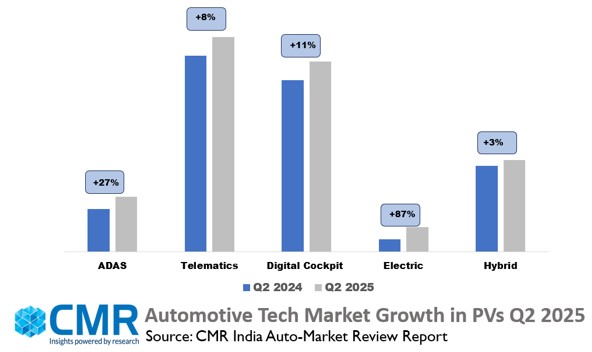

- Hybrid vehicle sales recorded a modest 3% YoY growth in Q2 2025

New Delhi/Gurugram, 11 Aug 2025: According to the latest insights from CyberMedia Research’s (CMR) Automotive Market Report Review for Q2 2025, the Indian EPV market recorded significant growth of 87% YoY. Tata Motors continued its dominance in the EPV market with 33% market share with Nexon EV model capturing 78% share within Tata Motors EVs. However, overall PV market registered a marginal 1% YoY decline.According to Shipra Sinha, Senior Analyst – Smart Mobility Practice, CyberMedia Research (CMR), “The Indian Electric Passenger Vehicle market is witnessing rapid acceleration, with Tata Motors maintaining its leadership, driven predominantly by the strong performance of the Nexon EV. The notable growth from established players like Mahindra and MG Motors signals a broadening competitive landscape, reflecting healthy market expansion beyond traditional frontrunners. The rising adoption of digital clusters and virtual cockpits underscores how Indian consumers increasingly view advanced digital interfaces as essential features rather than premium add-ons. Simultaneously, the growing uptake of ADAS—especially within EPVs—demonstrates heightened awareness and acceptance of advanced safety technologies, bolstered by supportive regulatory developments. While hybrid vehicle growth remains modest, the overall market trajectory clearly favours full electric vehicles as the cornerstone of India’s future mobility ecosystem.”

Market Highlights – Q2 2025

- Market Leadership:Tata Motors led theEPV market with 33% market share. Mahindra recorded notable >900% YoY growth on a small base capturing 29% share. MG Motors also recorded an impressive >155% YoY growth and captured 27% market share.

- Tata Motor’s Nexon EV, MG Motor’s ZS EV and Mahindra’s XEV 9e were the top three EPV models sold, collectively capturing 56% market share.

- Connected Growth: The connected EPV segment grew by 87% YoY, with 94% of EPVs equipped with connected technology

- Digital Cluster Adoption: The digital cluster segment recorded 10% YoY growth in the overall PV market with its adoption rising from 32% in Q2 2024 to 36% in Q2 2025.The EPVs with digital cluster recorded significant 127% YoY growth.

- ADAS: There was a notable 27% YoY growth with adoption rising from 7% in Q2 2024 to 9% in Q2 2025 in the overall PV market. The EPVs with ADAS recorded remarkable >450% YoY growth on a small base.

Future Market Outlook

Based on CMR’s estimates, EVs are projected to account for approximately 6% of India’s PV market. CMR anticipates the overall Indian PV market to grow by single-digit YoY at the end of CY2025. Meanwhile, CPVs are expected to capture 35%-40% of the market share in CY2025.

“The Indian passenger vehicle market is expected to experience moderate growth through 2025, with electric vehicles steadily gaining a more significant presence. This growth is driven by increasing consumer preference for cleaner mobility solutions, supportive regulatory policies, and strategic investments from leading automotive OEMs. At the same time, the rising adoption of connected technologies and ADAS is reshaping buyer expectations, making safety and digital integration key factors in vehicle choice. The trajectory clearly indicates that electrification and connectivity will become fundamental to the evolution of India’s automotive landscape in the near future,” added Amit Sharma, Senior Analyst – Smart Mobility Practice, CyberMedia Research (CMR).