- Maruti Suzuki continues to lead the overall PV market

- MG Motor and Mahindra both recorded triple-digit YoY growth in EPV segment on a small base

- PV exports rose 21% YoY in Q3 2025

New Delhi/Gurugram, 10 Nov 2025: India’s Electric Passenger Vehicle (EPV) market surged 152% YoY in Q3 2025, driven by festive season demand and a growing consumer shift toward connected and feature-rich models, according to CyberMedia Research’s (CMR) latest Passenger Vehicle Market Review for Q3 2025.

Tata Motors maintained its leadership in the EPV market with 38% market share with Nexon EV model capturing 62% share within Tata Motors EVs. However, overall PV market remained flat.

According to Shipra Sinha, Senior Analyst – Smart Mobility Practice, CyberMedia Research (CMR),“The government’s recent GST reforms played a pivotal role in energizing market dynamics during the JAS quarter. EVs continued to benefit from a low 5% GST rate, while the rate for smaller ICE vehicles was reduced from 28% to 18%, narrowing the tax gap and improving affordability across segments. This move spurred fresh demand, with automakers responding through limited-period offers, exchange bonuses, and attractive financing schemes, particularly during the festive season. The tax cuts translated into notable on-road price reductions, driving purchase momentum and faster dealer inventory turnover. It will be interesting to see if the fillip is short-lived, or the momentum is sustained through Q4 and beyond.”

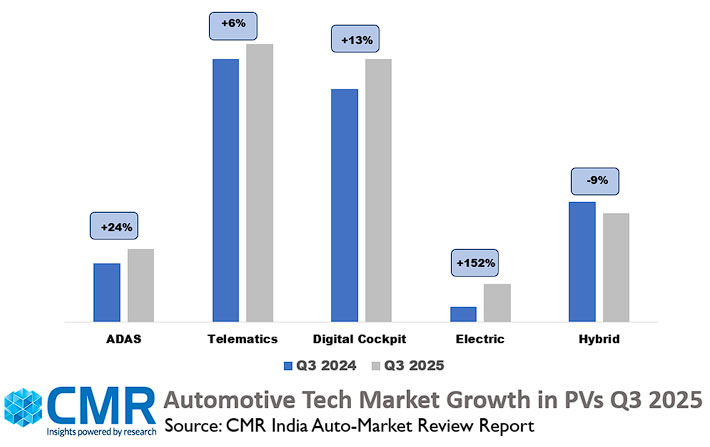

According to insights from CMR, the festive quarter saw ICE vehicles retain dominance with 81% market share, underscoring their strong consumer base. However, Electric SUVs surged 151% YoY, reflecting the rising preference for feature-rich, connected, and premium vehicles. ADAS Level 2 adoption grew 22% YoY, with 91% of PVs now equipped with advanced safety technologies such as adaptive cruise control, lane-keep assist, and autonomous emergency braking—signalling the trickle-down of innovation from luxury to mainstream models.

Tesla’s entry ahead of the festive season accelerated EV buzz, while Maruti Suzuki’s new Victoris, the first model in its lineup to feature Level 2 ADAS, combines advanced connectivity with next-gen safety, setting a new standard in the mass-market segment.

Market Highlights for Q3 2025

- Market Leadership:Tata Motors led the EPV market with 38% market share. MG Motors recorded notable >250% YoY growth on a small base capturing 27% share. Similarly, Mahindra also recorded an impressive >580% YoY growth and captured 25% market share

- Tata Motors expanded the Nexon EV lineup with new connected and ADAS features, targeting tech-savvy buyers.

- MG Motor’s ZS EV gained traction in the mid-premium SUV space, while Mahindra’s XEV 9e capitalized on demand for feature-rich electric SUVs.

- Together, Nexon EV, ZS EV, and XEV 9e emerged as the top three EPV models, commanding a 52% collective market share in the quarter.

- BYD and Hyundai posted impressive growth in the EPV segment over 100% and 1000% YoY, respectively on a smaller base. The Hyundai Creta EV attracted budget-conscious buyers, while the BYD Seal solidified its standing in the premium EV segment.

- Luxury and premium brand BMW recorded a 26% YoY growth, attributing it to GST-driven price rationalization and festive demand

- Connected Growth: The connected EPV segment grew significantly by 152% YoY, with 94% of EPVs equipped with connected technology.

- Digital Cluster Adoption: The digital cluster segment recorded 7% YoY growth in the overall PV market with its adoption rising from 34% in Q3 2024 to 37% in Q3 2025.The EPVs with digital cluster recorded significant 184% YoY growth.

- ADAS: There was a 24% YoY growth with ADAS adoption rising from 7% in Q3 2024 to 9% in Q3 2025 in the overall PV market. The EPVs with ADAS recorded remarkable >600% YoY growth on a small base.

- Digital Cockpit: PVs equipped with digital cockpit grew by 13% YoY adoption rising from 29% in Q3 2024 to 33% in Q3 2025 in the overall PV market.

Future Market Outlook

CMR estimates that EVs will make up around 6–7% of India’s passenger vehicle market by end-2025. The overall PV market is expected to see single-digit year-on-year growth, while connected vehicles are slated to capture 35–40% of the market share in 2025.

“India’s PV market is set for steady growth in the coming quarters, aided by the wedding season demand. With the GST cut impact stabilizing, growth may moderate slightly. Rural markets are emerging as key growth drivers, backed by rising aspirations, better road networks, and wider product access. Consumers will increasingly prefer tech-rich, connected, and safer models. Automakers are expected to focus on premiumization, connected features, and safety technologies like ADAS to attract buyers. The government’s ₹2,000 crore allocation under the PM E-DRIVE Scheme to expand EV charging infrastructure will further strengthen EV adoption. Despite softer tax incentives, improving infrastructure and broader EV choices will sustain momentum,” added Amit Sharma, Senior Analyst – Smart Mobility Practice, CyberMedia Research (CMR).