Gurugram/New Delhi, Dec 28, 2024. According to the CMR India Enterprise Storage Market Review Report for Q3 2024, shipments of Enterprise HDDs increased by 21% quarter-over-quarter (QoQ). In contrast, the Enterprise SSD market experienced a significant decline, with shipments dropping 50% year-over-year (YoY) during the same period.

According to Mukesh Sharma, Senior Analyst, Industry Intelligence Group (IIG), CyberMedia Research (CMR), “The enterprise storage market is at a pivotal stage, driven by the exponential growth of data generation, the rise of cloud computing, and evolving enterprise IT requirements. While Enterprise HDDs continue to hold a significant share of the storage market, especially for cold storage, their lower cost per TB and suitability for bulk data storage make them indispensable. On the other hand, the Enterprise SSD market, though witnessing a slight drop in demand recently, is on the cusp of substantial growth. This growth will be fueled by increasing demand from data centers, cloud service providers, and enterprises seeking high-performance storage solutions.”

Q3 2024 Enterprise storage Market Highlights

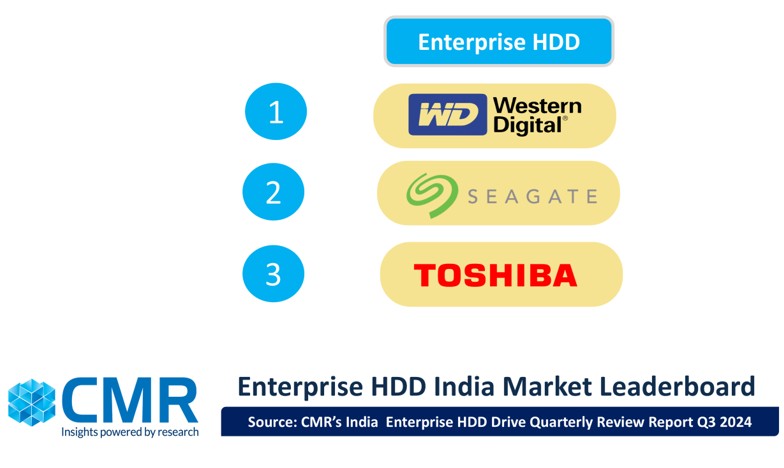

Enterprise HDD Market: Western Digital solidified its leadership in the Enterprise HDD market, capturing a dominant 60% market share. Seagate followed as the second-largest player with a 27% share, while Toshiba secured third place with 13%, reaffirming its strong foothold in the segment.

Enterprise SSD Market: Key players in India’s enterprise SSD market include Samsung, Western Digital, Micron, and Kingston, among others, offering a diverse range of high-performance storage solutions tailored to enterprise needs.

Looking Ahead

The Enterprise SSD market is projected to recover strongly, with an anticipated YoY growth of 10–12% by the end of 2024. High-speed performance and expanding cloud ecosystems continue to drive demand.

Enterprise HDDs will maintain their relevance, particularly for large-scale data environments like cloud and video storage. While growth may be in single digits YoY, high-capacity HDDs remain critical for handling vast amounts of data efficiently.

“The growing affordability of NVMe SSDs, the rapid expansion of data centers, and the adoption of high-capacity models for real-time data processing are driving significant shifts in the enterprise storage landscape. Technological advancements, such as AI, generative AI, and advanced analytics, are revolutionizing both SSD and HDD solutions. These innovations boost performance, lower costs, and meet evolving storage demands, ensuring scalability and operational efficiency. Collectively, these factors are setting the stage for sustained market growth in the years ahead.” added Preet Kaur, Analyst-Industry Intelligence Group (IIG), CyberMedia Research (CMR).

Notes for Editors

- Cyber Media Research (CMR) is a pioneering market intelligence and consulting firm that runs a comprehensive quarterly market update on the India Enterprise Storage market. CMR’s India Quarterly Hard Drives Market Review covers Enterprise SSD and Enterprise HDD sold via distributors and enterprises. The report accounts for ‘legal’ shipments, but does not include bundled or ‘grey’ market shipments or units brought from abroad by individuals as a part of personal baggage.

- CMR uses the term “shipments” to describe the number of hard drive devices leaving the factory premises for OEM sales or stocking by distributors. For the convenience of media, the term ‘shipment’ is sometimes replaced by “sales” in the press release, but this reflects the market size in terms of units of hard drive devices and not their absolute value.