- Tata Motors retained its leadership in the EPV market

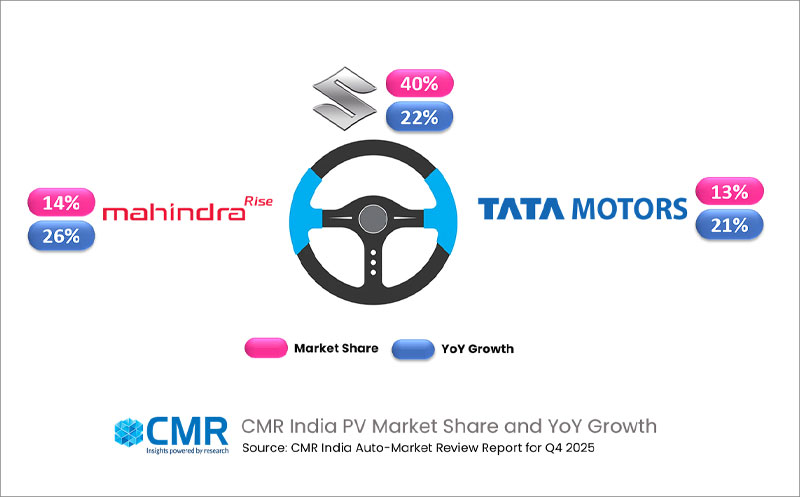

- Maruti Suzuki maintained its leadership in the overall PV market

- ICE PVs captured 90% share and recorded 32% YoY increase

- PV exports surged 12% YoY in Q4 2025

New Delhi/Gurugram, 05 Feb 2026: India’s Electric Passenger Vehicle (EPV) market recorded a sharp 77% year-on-year growth in Q4 2025, significantly outperforming the broader PV market, which grew 21% YoY, according to CyberMedia Research’s (CMR) Passenger Vehicle Market Review for Q4 2025.

The surge in EPVs was driven by rising adoption of electric SUVs, tech-rich models, growing competition, and supportive government policies. The connected EPV segment grew 96% YoY, with 99% of vehicles equipped with telematics, OTA updates, and cloud-based features appealing to tech-forward buyers.

Tata Motors retained its leadership in the EPV segment with a 40% market share, led by the Nexon EV, which contributed 48% of the company’s EV volumes during the quarter.

According to Shipra Sinha, Senior Analyst – Smart Mobility Practice, CyberMedia Research (CMR), “India’s PV market ended Q4 2025 on a strong footing, with EPVs growing nearly four times faster than the overall market. Lower financing costs, renewed consumer confidence, and a clear preference for SUVs drove growth. SUVs accounted for 60% of PV sales, growing 22% YoY, while ADAS Level 2 penetration in EPVs reached 99.8%, supported by regulatory momentum and declining sensor costs.”

Key Technology Highlights

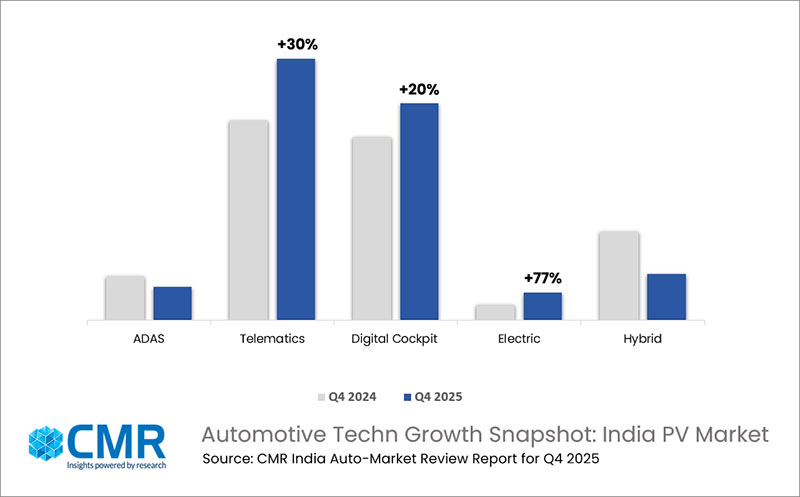

- Digital Cluster Adoption: The digital cluster segment recorded 37% YoY growth in the overall PV market with its adoption rising from 35% in Q4 2024 to 40% in Q4 2025 reflecting consumers’ hunger for modern interfaces. EPVs with digital cluster also recorded significant 87% YoY growth.

- ADAS: EPVs equipped with ADAS grew more than two-fold YoY, with ADAS Level 2 adoption surging to 99.8% compared to 50% in Q4 2024

- Digital Cockpit: PVs with digital cockpits grew 20% YoY, while overall adoption remained at 30%, reflecting maturing demand for immersive, fully digital interfaces including integrated clusters, infotainment, and heads-up displays.

Key Market Highlights

- Mass-market PVs (ex-showroom price <INR 30L) dominated the market, accounting for 97% of total sales, while luxury PVs (ex-showroom price >INR 30L) contributed the remaining 3%. Within the mass-market segment, vehicles priced between INR 5–20L captured a commanding 93% share. In the luxury segment, entry-level luxury PVs (INR 30–50L) led with a 50% share, followed by mid-size luxury PVs (INR 50–80L) at 37%

- VinFast’s debut in H2 2025 added competitive intensity to the EPV market, targeting premium and mid-size segments by leveraging its global EV expertise even as Tata continued to anchor the segment. VinFast plans to significantly diversify its India portfolio in 2026, leveraging local production in Tamil Nadu and expanding its dealership operations.

- Tata Motors led the EPV market with a 40% share in Q4 2025, while Mahindra recorded sharp momentum, posting 762% YoY growth on a low base to secure the second position with a 25% share.

- MG Motor followed closely, registering 16% YoY growth and capturing a 24% market share in the EPV segment

- MG Windsor led EPV sales, followed by Tata Nexon EV and Mahindra XEV 9e. The top three models accounted for 54% of EPV sales during the quarter. Mahindra’s born-electric SUVs, XEV 9e and BE.6, contributed nearly 95% of its EV volumes, underscoring demand for tech-rich, versatile offerings.

- Kia and Hyundai posted strong YoY growth of over 700% and 1200%, driven by Carens Clavis EV and Creta EV. Kia appealed to family buyers with its spacious layout, while Hyundai attracted value-conscious urban consumers in the sub-₹20 lakh SUV segment.

- BYD strengthened its premium EV presence, with Atto 3 and Seal capturing 50% market share.

- BMW recorded 106% YoY growth on a small base.

Future Market Outlook

CMR estimates EVs will make up 7–8% of India’s PV market by end-2026, while connected vehicles are projected to capture 35–40% of market share.

“India’s PV market in 2026 is poised for steady growth, driven by recovering rural demand, rising household incomes, and a shift toward premium, tech-rich, and connected models. SUVs and EVs will continue to lead, supported by falling battery costs, Level 2 ADAS adoption, and enhanced digital connectivity. Government initiatives, including the PM E-Drive scheme’s ₹1,500 crore subsidies extended to 2028 and Union Budget 2026 incentives for EV batteries, will sustain EPV penetration. Competition from incumbents and new market entrants will further spur innovation and consumer choice,” added Amit Sharma, Senior Analyst – Smart Mobility Practice, CMR.