- Apple crosses 50% export share as OEMs deepen integration into India’s supply chain; Samsung holds steady despite softer global demand

- PLI-led premium production scales further, with early diversification emerging from entry and value brands

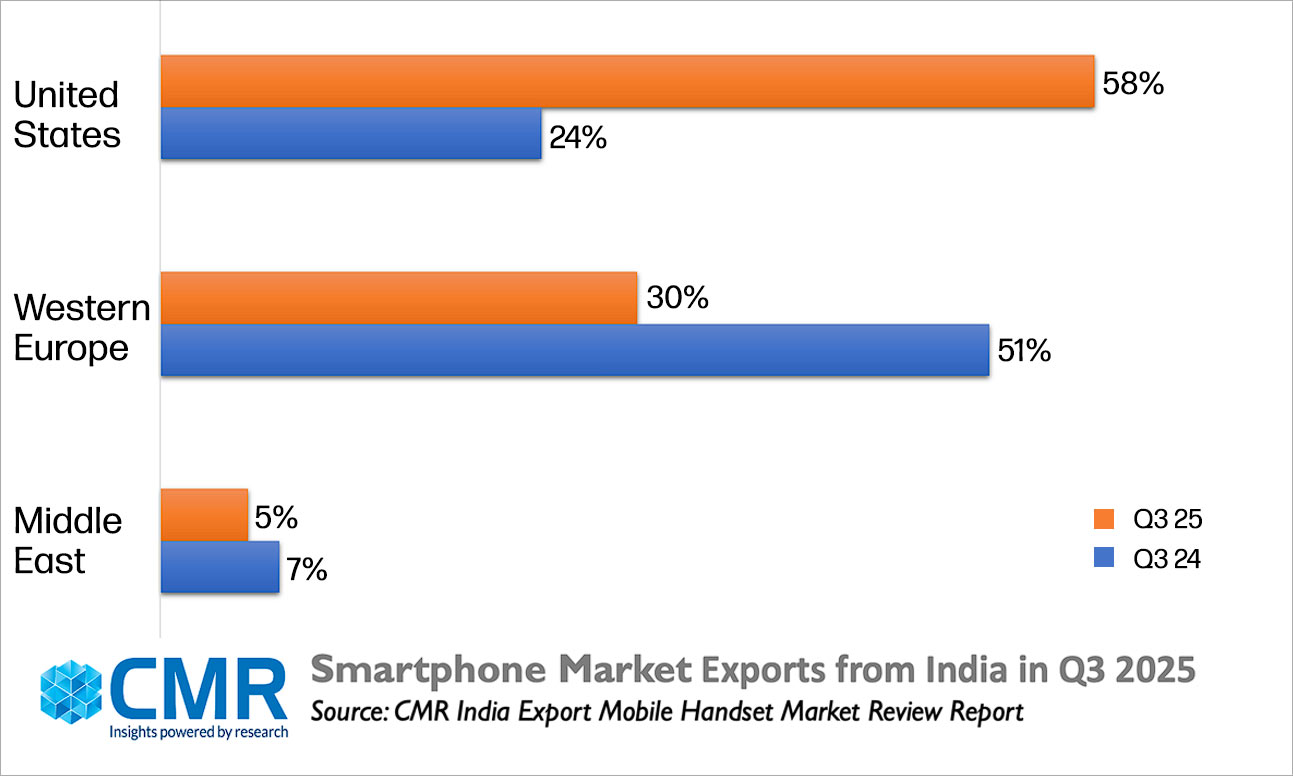

- U.S. drives triple-digit growth in India-made smartphone shipments while Europe and Middle East see demand normalization

New Delhi/Gurugram, 15 Dec 2025: India’s mobile phone export engine continued to strengthen in Q3 2025, posting an 8% year-on-year (YoY) growth, according to the latest CyberMedia Research (CMR) India Mobile Handset Export Review. The gain underscores India’s fast-expanding role as a high-quality global manufacturing hub, led by accelerating premium production under the Production Linked Incentive (PLI) framework.

According to Menka Kumari, Senior Analyst – Industry Intelligence Group (IIG), CMR, “India’s mobile phone export trajectory reflects a clear structural strengthening of its manufacturing ecosystem. The rapid scale-up of premium production, coupled with deeper integration of global OEMs into local supply chains, is reshaping India’s export profile. The sustained momentum from Apple, in particular, highlights growing international confidence in India’s ability to deliver at scale and with consistency. As PLI-driven capabilities mature and export markets broaden, India is positioned to assume a more consequential role within the global mobile manufacturing value chain.”

Export Market Highlights: Q3 2025

- United States leads the surge: Its share jumped from 24% (2024) to 58% (2025), translating into a massive 164% YoY growth, driven by soaring global demand for India-made iPhones as OEMs diversify beyond China.

- Western Europe softens: Share dropped from 51% to 30% (–38% YoY) due to weaker demand and slower 5G momentum.

- Middle East normalizes: Share eased from 7% to 5% (–21% YoY), reflecting post-boom stabilization and slower premium uptake.

Brand Performance: Q3 2025

- Apple: Apple’s export contribution increased from 42% to 54%, supported by a 39% YoY rise in shipments. This reflects India’s growing role within Apple’s global supply chain as premium manufacturing scales further.

- Samsung: Samsung maintained its position as the second-largest exporter with a 45% share, despite a 12% YoY decline driven by softer global demand and ongoing production adjustments.

- Entry and Value Brands: Entry-level and value-oriented brands, including Itel, recorded incremental gains, indicating the beginning of broader diversification within India’s export-oriented manufacturing base.

Future Outlook

CMR expects India’s mobile handset export ecosystem to maintain strong double-digit growth through CY2025, supported by premium-led manufacturing scale-up and expanding global demand.

“The momentum in India’s export landscape is set to strengthen further,” added Menka Kumari. “As supply chains diversify and local capabilities deepen, India will play an even more strategic role in the global smartphone production network.”