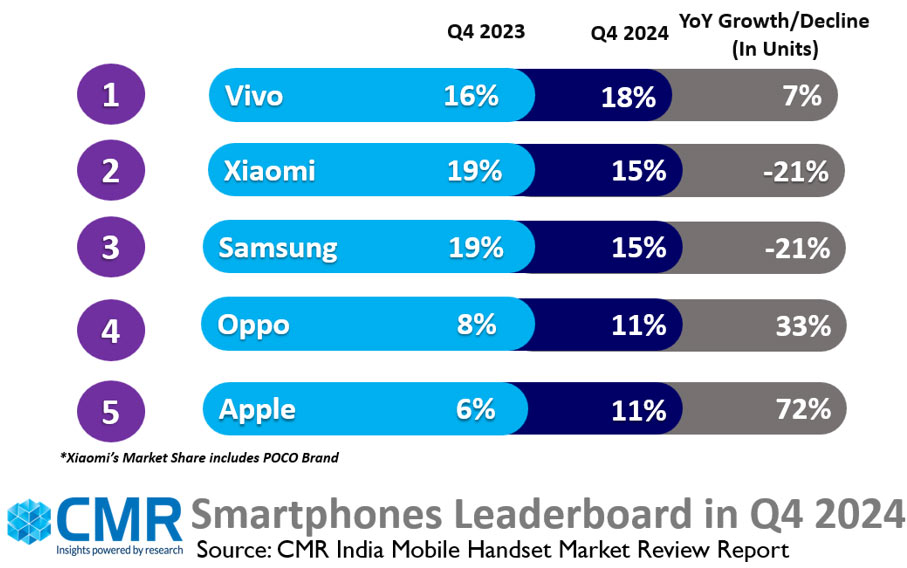

- Vivo topped the smartphone market in Q4 2024

- Apple breached the top five smartphone leaderboard in Q4 2024

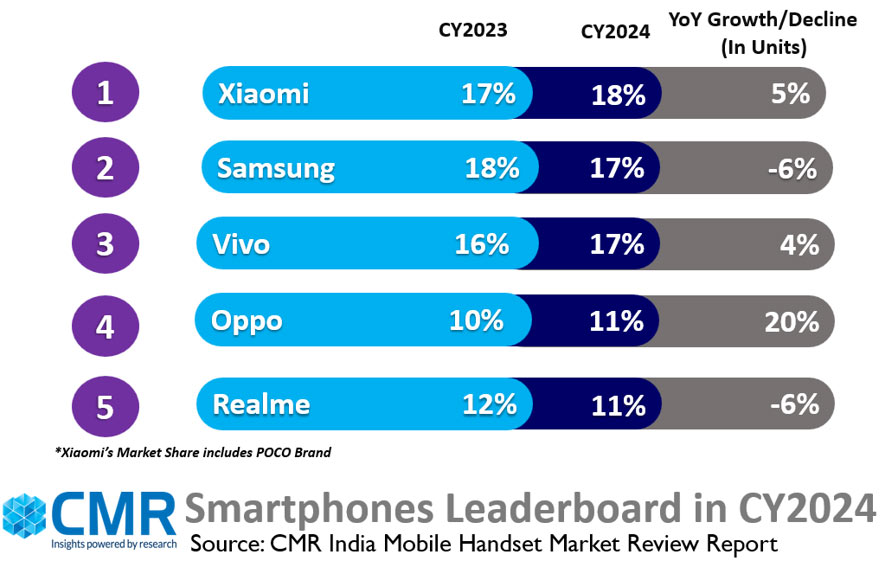

- Samsung led the overall mobile market in CY2024.

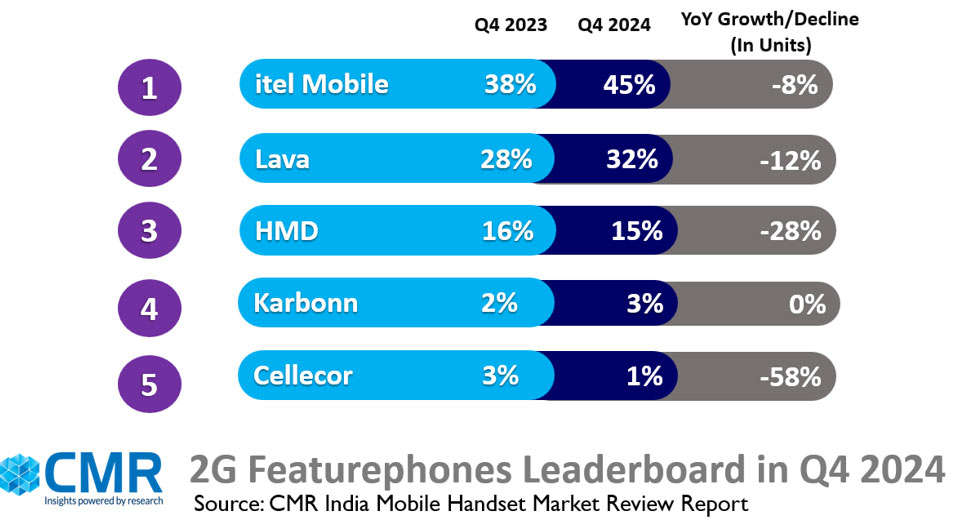

- The feature phone market declined by 8% YoY in Q4 2024.

New Delhi/Gurugram, 4th February 2025: According to the CyberMedia Research (CMR) India Mobile Handset Market Review Report for CY2024, released today, India’s premium smartphone segment (INR 25,000 – INR 50,000) continued its double-digit growth momentum. Similarly, the super-premium smartphone segment (INR 50,000 – INR 1,00,000) and uber-premium segment (>INR 1,00,000) posted impressive gains, up 10% and 25%, respectively, as consumers continue to invest in premium smartphones for their technological features, as well as lifestyle statements. The sub-₹10,000 5G segment saw 80% YoY growth in CY2024, driven by new launches and rising demand for affordable, feature-rich smartphones.

In Q4 2024, Vivo (18%), Xiaomi (15.2%) and Samsung (15.1%) captured the top three spots in the smartphone leaderboard followed by OPPO (11.4%) and Apple (11%).

According to Menka Kumari, Senior Analyst-Industry Intelligence Group (IIG), CyberMedia Research (CMR), “In CY2024, India’s smartphone market presents a complex picture of a heterogeneous consumer base. On one end, the premium segment continues to expand, reflecting a shift toward high-performance lifestyle statements. On the other hand, <INR 10,000) segment is experiencing green shoots of recovery. Across price segments, affordability and accessibility initiatives are empowering consumer aspirations and driving market growth.”

Apple, for the first time, secured a spot among the top five smartphone brands in India in Q4 2024, recording a remarkable 72% YoY growth and capturing an 11% market share. Apple’ market share in the super-premium segment (INR 50,000 – INR 1,00,000) segment skyrocketed by 82% YoY, while the uber-premium segment (>INR 1,00,000) surged by 32% YoY. Aggressive marketing, deep festive discounts, and strong demand for both latest and previous-generation iPhones enabled this market growth.

Competitive Market Dynamics in CY2024:

The India smartphone market in CY2024 saw mixed trends across segments. While the Affordable segment (Sub INR 7,000) grew slightly by 1% YoY, the Value-for-Money segment (INR 7,000 – INR 25,000) declined by 7%, reflecting a shift toward premium smartphones.

Xiaomi (18%), Samsung (16.9%) and Vivo (16.7%) were placed in the top three in the Smartphone leaderboard in CY2024.

Vivo led the 5G smartphone segment with a 19% market share, closely followed by Samsung with an 18% market share. In the premium smartphone segment (>INR 25,000), Samsung (28%), Apple (25%) and Vivo (15%) were placed the top three.

Feature Phone Segment

In Q4 2024, the 2G feature phone segment declined by 22% YoY, while the 4G feature phone segment saw a significant 59% YoY decline. This reflects shifting consumer preferences and the growing transition towards affordable smartphones.

Key Smartphone Market Highlights in Q4 2024

Vivo captured the top spot with 18% market share. The Vivo T3X, Vivo Y28s and Vivo T3 Lite models accounted for 45% of its 5G shipments.

Xiaomi secured 15.2% market share. Redmi 13C 5G, Redmi A3X, and Redmi A4 were the top models, with Poco C61 leading its sub-brand, accounted for 44% of its Q4 shipments.

Samsung achieved a 15.1% overall market share. However, in the value-for-money smartphone segment, the company experienced a 27% YoY decline in Q4 2024. This drop was largely due to intense competition.

OPPO reached 11% market share, with shipments increasing by 33% YoY, led by the Oppo A3 Pro, Oppo A3X, and Oppo A3 models.

Lenovo (Motorola) posted wholesome gains, growing a stellar 48% YoY driven by its strong product differentiation and a growing consumer base.

Transsion Group (Itel, Infinix, and Tecno) recorded a 13% YoY decline, facing stiff competition from aggressively priced affordable and value-for-money smartphones.

Nothing recorded an impressive +800% YoY growth, driven by strong demand for the Nothing 2a series and CMF, Nothing’s sub-brand. In CY2024, Nothing grew +200% YoY, albeit from a small base, showcasing its growing market traction.

MediaTek dominated India’s smartphone chipset market, achieving a record-high 52% market share, while Qualcomm secured the second position with 26% share. In the premium smartphone segment (>INR 25,000), Qualcomm Snapdragon powered approximately one in every three smartphones sold.

Future Outlook

For CY2025, CMR estimates the market conditions to remain tough in H1 2025, with smartphone shipments for the entire year growing in single digits. Smartphone OEMs will continue to push premium smartphone offerings, with a focus on GenAI.

“As India’s smartphone market evolves in 2025, the premium segment (>INR 25,000) will continue to grow, driven by rising consumer demand. Smartphone OEMs will reposition their product strategies from primarily hardware-centric to GenAI-centric product strategies with a simultaneous focus on innovating in the value-for-money and affordable smartphone segments to cater to mass-market demand,” added Pankaj Jadli, Analyst – Industry Intelligence Group (IIG), CyberMedia Research (CMR).