- Premium smartphone (INR 25,000- INR 50,000) shipments grew by 57% YoY.

- The Value-for-Money (VFM) segment (INR 7,000 – INR 24,999) saw 66% YoY growth.

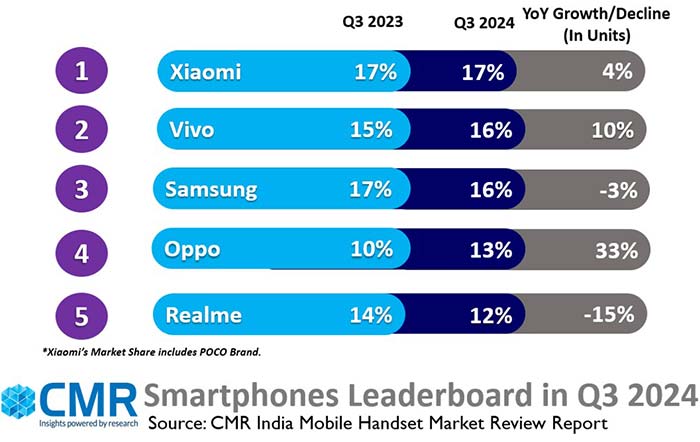

- In overall smartphone market, Xiaomi captured the top spot followed by Vivo.

- 5G Smartphone shipments grew 49% YoY, driven by Vivo and Samsung.

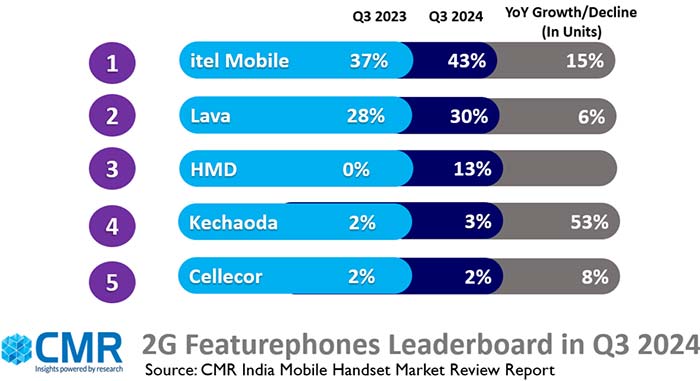

- Feature phone shipments declined 14% YoY, with iTel Mobile leading the segment.

New Delhi/Gurugram, 8th Nov 2024: According to CyberMedia Research (CMR)’s India Mobile Handset Market Review Report for Q3 2024 released today, India smartphone market incline 3% YoY. Despite global economic challenges, consumer demand in India remains robust, driven by an increase in mid-range and premium smartphone preferences.

The 5G smartphone shipments share increased to 82%, marking a notable 49% YoY growth. During the quarter, 5G smartphones in the price band of INR 10,000 to INR 13,000 grew by >100% YoY. Vivo led the 5G smartphone market with a 18% market share, followed by Samsung at 17% during the quarter.

Xiaomi (17%), Vivo (16.3%) and Samsung (16.2%) captured the top three spots in the smartphone leaderboard in Q3 2024, followed by OPPO (13%) and Realme (12%).

Commenting on the overall market conditions in Q3 2024, Menka Kumari, Analyst- Industry Intelligence Group, CyberMedia Research (CMR), “India’s smartphone market is demonstrating remarkable adaptability, with consumer preferences increasingly focused on 5G adoption and premium features. The continued growth of 5G smartphones, coupled with strong demand in the INR 10,000 to INR 13,000 price band, signals a growing consumer base for high-performance devices at accessible price points. Additionally, the premiumization wave continues to stay strong, with the premium segment (>INR 25,000) witnessing a 26% YoY growth.”

The Value-for-Money (VFM) segment (INR 7,000 – INR 24,999) grew 66% YoY, driven by demand among value-conscious consumers for smartphones with 5G and premium features at accessible price points.

Feature Phone Market in Q3 2024

The feature phone market in India saw a 14% YoY decline in Q3 2024, primarily driven by a significant 46% drop in 4G feature phone shipments. Meanwhile, 2G feature phones showed a more modest decline of 1% YoY, highlighting the continued, though shrinking, demand for basic mobile phones, particularly in rural and semi-urban India.

Key Market Highlights

- Xiaomi secured the top spot in the smartphone market with a 17% share, driven by models like Redmi 13C 5G and Redmi 13 5G. Additionally, Xiaomi’s sub-brand, POCO, experienced an 8% YoY growth in shipments.

- Vivo secured the second spot in the smartphone market with a 16 % share, featuring top models like Vivo T3x and Vivo T3.

- Apple marked a notable increase, with shipments rising 27% YoY.

- Nothing has experienced impressive growth of approximately 646%.

- Motorola has shown remarkable performance with a growth of about 74%, focusing on value-driven offerings.

- MediaTek led India’s smartphone chipset market with a 53% share. Qualcomm led the premium segment (>INR 25,000) with a 38% share.

Future Market Outlook

CMR estimates the India’s smartphone market to grow 7-8% in 2024, driven by strong demand for premium, 5G and AI smartphones.

According to Pankaj Jadli, Analyst-Industry Intelligence Group (IIG), CyberMedia Research (CMR), “Looking ahead, the mobile handset market in India is expected to maintain steady growth. As brands focus on bridging technology gaps and introducing affordable 5G devices, the competition will likely intensify. The new wave of AI-capable devices will continue to fuel consumer preferences in the coming quarters.”