Lenovo, India’s No.1 Brand in Tablets, For 10th Successive Quarter: CMR

Share This Post

- 4G Tablets market share in India stands at 61% in 2019

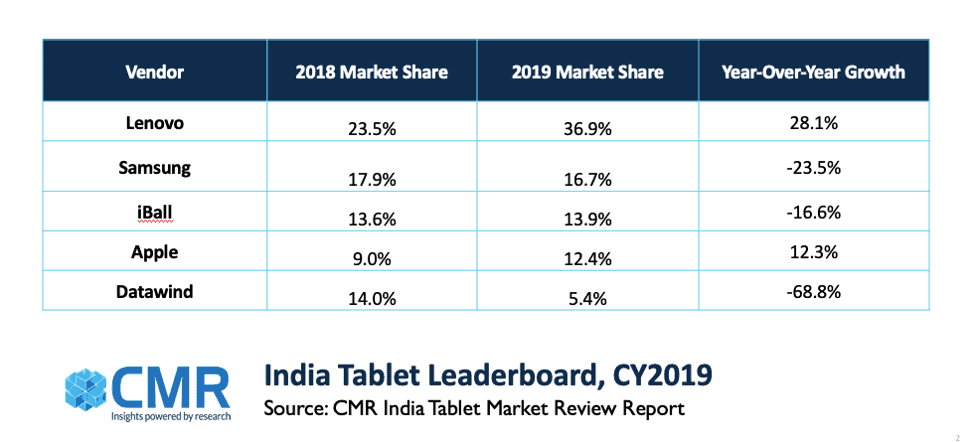

- Lenovo led the tablet market with a 37% market share, and reigned India for tenth consecutive quarter

- With launch of iPad 7, Air & Mini, Apple registered strong growth in CY2019, also had the largest share in the premium segment (> INR 30,000).

New Delhi/Gurugram, 27th Feb 2020: According to CMR’s Tablet PC Market Report Review for 4Q CY2019 released today, Lenovo reigned India’s Tablet PC Market for tenth consecutive quarter. While the tablet market declined 18% year-on-year (YoY), 4G Tablets grew sequentially by 22% YoY.

According to Kanika Jain, Manager, Client Device Research, Industry Intelligence Group (IIG), CMR, “During the course of 2019, the average sales value (ASV) for Tablets in India increased, indicating a latent demand from enterprise players for variants with higher-end spec. While Lenovo grew 28% YoY in 2019, all other Tablet brands saw their market share erode, with the notable exception of Apple.”

“Enterprise use cases are driving the tablet market forward, with 4G Tablets now dominating the India market. While we are currently witnessing 5G transition of the India smartphone market, owing to hypercompetitive smartphone players seeking to establish their tech leadership, it would be tough to imagine the first wave of 5G-enabled Tablets hitting the market anytime soon, before end 2020, or early 2021,” said Prabhu Ram, Head-Industry Intelligence Group, CMR.

Shipments of Tablets with 6-7 inch displays constituted 39% of the overall shipments in the India market. On the other hand, Tablets with 10-inch and above displays contributed to 35% of the shipments.

Vendor Highlights

Lenovo extended its lead in the tablet market, growing 28% YoY. In 2019, it continued to show innovation with launch of E, M, P & V series Tablets. Its M10 (HD & FHD) series garnered 16% market share.

Samsung launched several Tablets in 2019, including the Tab A 10.1, Tab A8.0, Tab S5e & S6. However, Samsung’s tablet shipments declined by 24% YoY. Across all the tablet launches from Samsung, the Tab A 10.1 was the most successful, accounting for a massive 32% share across the Samsung tablet portfolio.

iBall regained the third position for CY2019 with 14% market share and declined 17% YoY.

Apple’s newly launched iPad 7, Air 2019 & Mini 2019 series helped it to register a YoY growth of 12% during the year.

Future Outlook

In CY2020, the tablet market is likely to start on a slower note. Given that Chinese OEMs control 40% of the Indian tablet market, the reliance on China would see a negative impact on overall tablet shipments. Though OEMs typically stock tablet inventories to tide over the Chinese New Year holidays, the Coronavirus outbreak-caused disruption has led to an extended closure. This, in turn, implies the chances for a potential dent in Tablet shipments in Q2 2020 of upto 6-8%.

“Traditionally, Q1 has been a slow quarter for the tablet market in India owing to the Chinese New Year holidays. However, with the coronavirus outbreak impacting manufacturing supply chain, we are, in effect, looking at an unexpected situation, wherein we believe, tablet shipments would see a further dip towards end of Q1, and more realistically in Q2 2020.” added Prabhu.

Share This Post

CyberMedia Research conducts the Budget Smartphones Channel Audit to capture the perspectives, preferences, challenges and dislikes of retailers around ‘value for money’ (INR <10,000) smartphone brands, capturing a compelling picture of smartphone brands in the market.

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

More To Explore

No posts found!