53% growth registered in Premium Segment Smartphones through 2015.

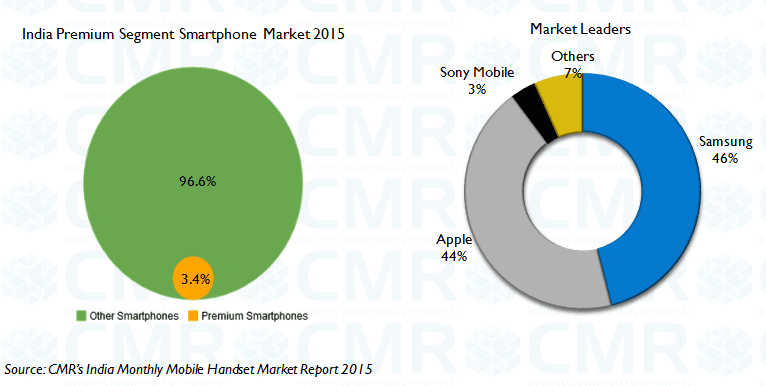

₹30,000 or above Smartphones accounted for 3.4% of the total shipments.

- Samsung, Apple and Sony Mobile are the top three premium brands.

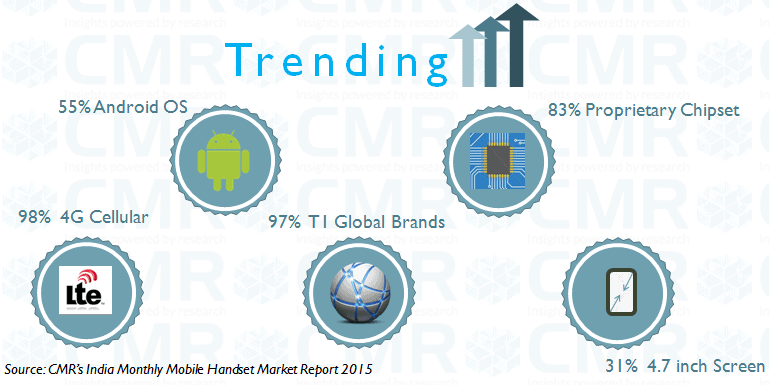

- Nearly 98% premium Smartphones support 4G.

- Android and iOS account for 99% of the OS share.

- Phablets (5 inch or more) constitute 63% of the premium Smartphones.

- Merely 17% of the chipsets are from Fabless 3rd party vendors. Qualcomm is the default choice with 79.5% share.

New Delhi/Gurgaon: Announcing its Premium Smartphone Report for India, CMR today said that 3.3 million premium Smartphones were shipped in 2015, of the total 96.4 million Smartphones during the period. This accounted for 3.4% of the total Smartphone shipments.

Commenting on the results, Faisal Kawoosa – Lead Analyst Telecoms, CMR, said, “This is an encouraging indicator that the premium segment is exhibiting such growth. As the Indian market moves from a volume game to value market, premium segment becomes significant for the industry where you sell lesser units for higher value.”

“To mark the next level of growth, the India Mobile Handset brands need to leverage the premium segment as the units market shrinks,” Faisal added.

The research on the premium Smartphones further reveals that spending more might not necessarily result in getting the latest of the specifications. For instance, across Operating Systems, merely 13% of the devices were shipped with the latest version of the operating system.

Krishna Mukherjee – Analyst Telecoms, CMR, said, “Unfortunately, so far none of the Indian brands have been able to establish itself in the premium segment. While their focus continues to be the affordable price points of Smartphones, it is high time that they start foraying into the premium segment as well.”

“This is also going to affect the entire ecosystem. For instance, once we see more of Indian as well as Chinese brands entering this space, the proportion of 3rd party Fabless chipset companies are going to rise considerably,” Krishna further added.

CMR Guidance

The premium Smartphone shipments are likely to touch 5-million mark in 2016 in India; although this will show a marginal contribution, 3.5-4% of the total Smartphones shipped.

Apple will benefit most from this growth owing to its strong positioning as a premium segment brand. However, the recent launch of iPhoneSE will not be the centre-piece for Apple’s growth in India. It would be challenging for Android to keep its supremacy in OS in this segment despite several vendors committed to it. This will essentially amplify, if and when the Indian brands foray into the premium Smartphones category.

Google needs to develop a closed loop premium segment solution where it would be required to work very closely with the ODMs to have a microscopic detailing of the entire premium Smartphones–hardware, software and other elements. For this, Google might also go with a premium brand extension of Android (say Android X), that would essentially focus on increasing the user experience and to primarily compete with Apple iOS.

Notes for Editors

- Smartphones priced Rs 30,000 or above are defined as a Premium Smartphone.

- CyberMedia Research (CMR) uses the term “shipments” to describe the number of handsets leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term shipments is sometimes replaced by ‘sales’ in the press release, but this reflects the market size in terms of units of mobile handsets and not their absolute value. In the case of handsets imported into the country it represents the number leaving the first warehouse to OEMs, distributors and retailers. CyberMedia Research does not track the number of handsets brought on their person by individual passengers landing on Indian soil from overseas destinations or ‘grey market’ handsets. These are, therefore, not part of the CyberMedia Research numbers reported here.