- 81% of Tablets Shipped in Q4 2025 Were Productivity-Focused

- Wi-Fi Tablets Grow 93% YoY on Education Demand

- Tablet Market to Grow 10-12% in CY2026

New Delhi/Gurugram, 19 Feb 2026: According to CyberMedia Research (CMR)’s India Tablet PC Market Review for Q4 2025, the Indian tablet market grew 41% year-on-year (YoY) in Q4 2025, driven by festive demand, year-end promotions, and increased enterprise and education procurement.

The growth reflects a structural shift in tablet usage, with demand increasingly centred on productivity, learning, and professional applications. In Q4 2025 alone, performance-oriented devices accounted for 81% of total shipments, underscoring the market’s transition beyond entry-level consumption.

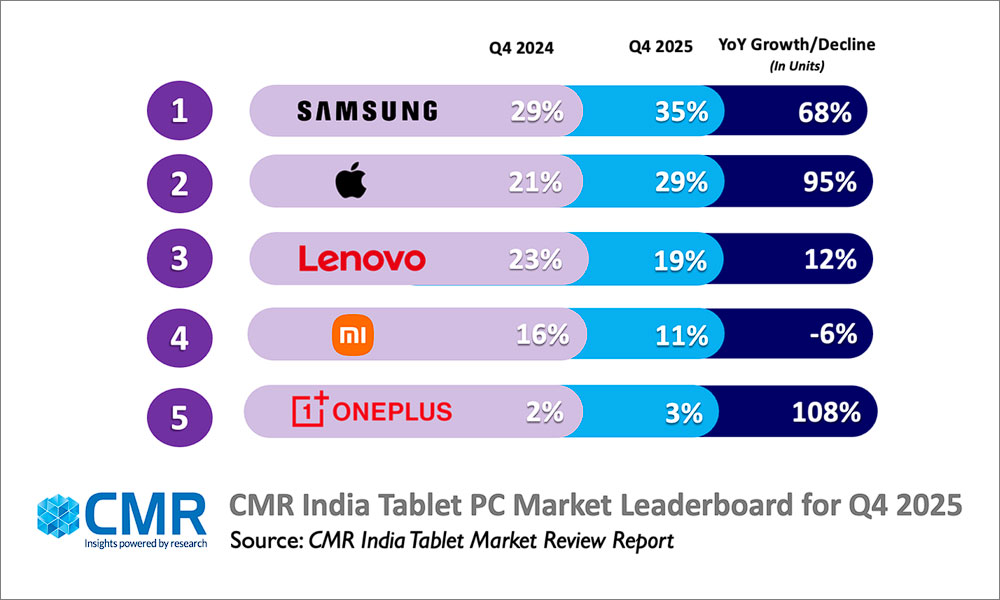

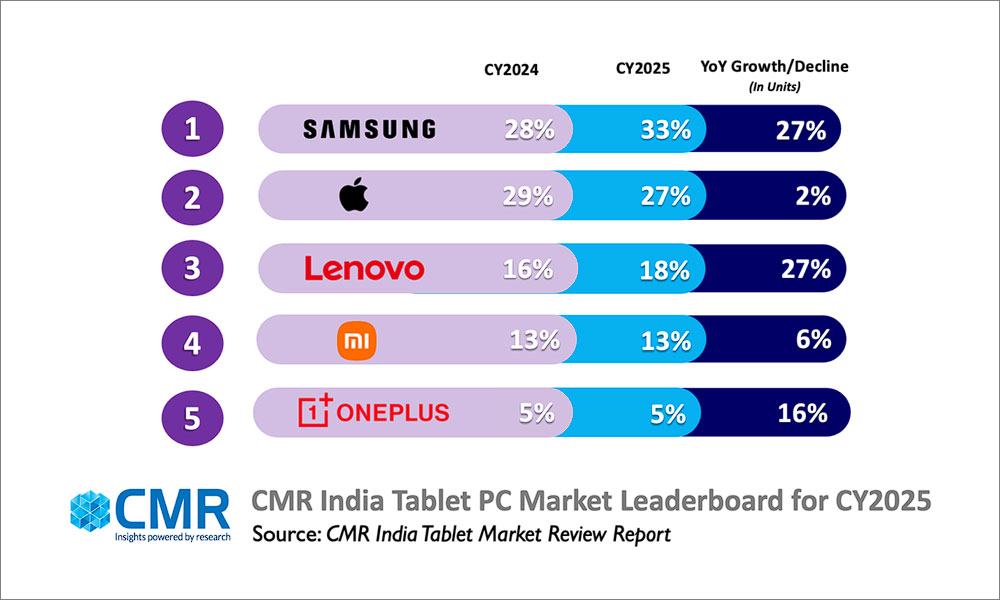

In Q4 2025, Samsung led the market with a 35% share, followed by Apple (29%) and Lenovo (19%). On a sequential basis, shipments declined 26% quarter-on-quarter (QoQ), reflecting typical post-festive seasonality.

Large-screen tablets above 11 inches accounted for 85% of shipments, signalling strong preference for devices suited for multitasking, digital classrooms, content creation, and business use cases.

According to Menka Kumari, Senior Analyst – Industry Intelligence Group (IIG), CyberMedia Research (CMR), “Tablets are increasingly evolving into shared productivity platforms across households and workplaces. Growth momentum is being driven by performance upgrades, larger displays, and use cases spanning education, hybrid work, creative tasks, and small business operations. Simultaneously, the rise in Wi-Fi tablets highlights their expanding relevance in classrooms and value-conscious households.”

Wi-Fi tablets recorded a robust 93% YoY growth, led by education deployments and home-learning demand. 5G tablets grew 21% YoY, reflecting rising preference for faster connectivity. Performance-led configurations further accelerated market momentum, with 6GB RAM tablets growing 656% YoY and 12GB RAM variants expanding 1359% YoY, highlighting increased demand for enhanced multitasking capabilities. In the affordable segment, LCD-display tablets grew 198% YoY, strengthening the value-for-money proposition through accessible large-screen offerings.

Tablet Market Dynamics in Q4 2025:

- Samsung retained leadership with 35% market share, growing 68% YoY, driven by its Galaxy A-series and Tab S-series portfolio.

- Apple captured 29% share, delivering the fastest growth among leading players at 95% YoY, with the iPad 11 series contributing 76% of shipments.

- Lenovo secured 19% market share, posting strong double-digit growth across consumer, education, and enterprise segments.

- Xiaomi held 11% market share, declining 6% YoY amid intensified competition in the value segment.

- OnePlus accounted for 3% share, growing 108% YoY on a smaller base.

Market Outlook

CyberMedia Research (CMR) forecasts the Indian tablet market to grow at 10–12% in CY2026.

“India’s tablet demand is expected to remain anchored in performance-driven and institutional segments. While higher component and supply-chain costs may lead to selective price adjustments, brands are likely to prioritise portfolio optimisation and margin discipline over aggressive discounting,” added Menka.