Seagate LED The External HDD Market in CY2019: CMR

Share This Post

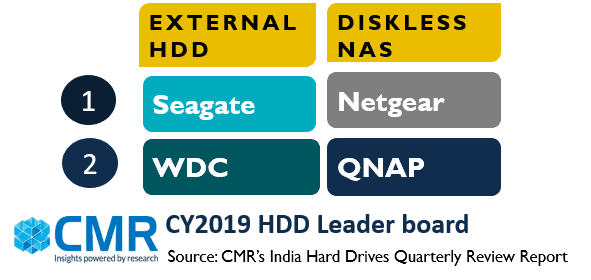

- Seagate and WDC together contributed 84% to the overall market.

- 5” External HDD market grew by 30%.

- 1TB and 2TB capacities collectively contributed 77% market share.

Gurugram/New Delhi,Mar 27, 2020: According to CMR’s India External Hard Drive Market Review for CY2019 released today, the India External HDD(2.5”&3.5”) market stood at 1.7 Mn Units at the end of CY2019, with a 11% year-on-year (YoY )decline.

“The primary cause for the market decline remain the 2.5” HDDs that been struggling to maintain their foothold in the consumer market. The market shift to SSD sat more affordable points has also contributed to this trend. The demand for HDDs continues to be high in the enterprise data center. Slowdown of laptop and desktop market has also affected the hard drive sales,”observed Shipra Sinha, Lead Analyst, CyberMedia Research.

“The shipments of 3.5” hard drives grew 30% YoY. Seagate and WD were the top two leaders in this category. There has been significant contribution by LaCie (owned by Seagate) as well. Due to their large form factor and high capacity at affordable price points, the market opportunity has been significantly less for substitutes. Low maintenance and hassle-free data storage experience led to this growth,”added Shipra Sinha.

NAS and Wireless

Overall, the NAS market also witnessed a 40% YoY decline. NAS consumer market has always been small as they are the high-end network drives required by a category called “Prosumers”. They can be professionals, gamers, consumers working on large data sets etc. In addition, they are costly when compared to other traditional HDDs. Net gear continued to dominate the disk less NAS market. Dual Bay disk less NAS was most favored capturing 48% market share.

WD was the only contributor in the wireless market.Its shipments declined by 80% when compared to CY2018.

Future Trends

According to Shipra,“We anticipate shipments in CY2020 to top 1.6 Mn units. Consumer HDD market will almost remain flat in terms of shipments.However, as the market shifts towards higher capacities, there will be an upward trend in revenues. Shipments of 1TB capacity HDDs are expected to reduce and 2TB and 4TB shipments will grow in H2 2020.”

“Owing to the COVID-19 pandemic, we foresee supply as well as demand constraints in H1 2020. Consumer sentiment will remain muted during this time, and will spike in H2 2020,”added Shipra.

Share This Post

CyberMedia Research conducts the Budget Smartphones Channel Audit to capture the perspectives, preferences, challenges and dislikes of retailers around ‘value for money’ (INR <10,000) smartphone brands, capturing a compelling picture of smartphone brands in the market.

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

More To Explore

No posts found!