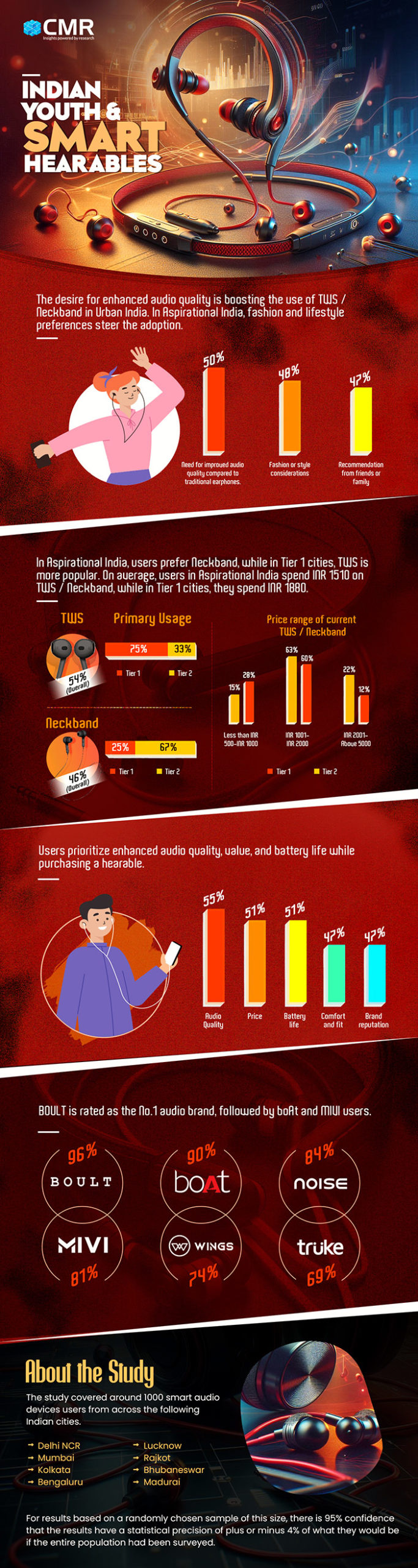

- Audio quality (53%), value (51%) and battery life (51%) are top three considerations for consumers in TWS/Neckbands.

- Young Indian consumers prioritize style, including sporty designs (45%) and classic colours (28%), for a blend of aesthetics and comfort.

- Top three audio brands that lead user preferences include BOULT (96%), boAt (90%), and Noise (84%).

New Delhi, 13 May 2024: CyberMedia Research (CMR), a leading Indian technology market research firm, has released its latest study on smart hearables adoption, including TWS earbuds/neckbands, by Indian youth.

Young Indian consumers prioritize style in their smart hearables, gravitating towards sporty designs (45%) and classic colours (28%) for a blend of aesthetics and comfort. Lifestyle and fashion choices are significant factors for smart hearable adoption, with (42%) of consumers in Aspirational India seeking TWS earbuds/neckbands that align with their personal style.

The comprehensive CMR survey on smart hearables delved into consumer preferences around TWS earbuds and neckbands in Urban and Aspirational India, exploring user experience, design choices, product quality, and future purchasing behaviours, segmented by region and demographics.

Over two-thirds (70%) of users listen to their audio devices for 1-3 hours daily, emphasizing the importance of features like audio quality (prioritized by 53% of users), innovation (44%), and reliability (43%) when choosing a brand. When it comes to the consumer preferences around hearables, the top three audio brands driving consumer preferences, BOULT comes first with 96%, boAt follows with 90%, while Noise is placed third with 84%.

According to Sugandha Srivastava, Senior Manager – Industry Consulting Group (ICG), CyberMedia Research (CMR), “The survey results paint a clear picture of a growing trend – consumers are gravitating towards audio brands that seamlessly blend style and technological prowess. Notably, among young Indian consumers, BOULT emerges as the No 1 rated brand. Their success can be attributed to a trifecta of factors: superior audio quality (rated at 59% by users), bold and dynamic designs (rated 56%), and an inclusive brand image that resonates with a broad audience (rated 49%).”

Here are the key study findings illustrating the current state of play in the Indian hearables industry:

- Consumer Preferences: TWS vs Neckbands: Neckbands dominate Aspirational India (67% preference), while Tier 1 cities favor TWS earbuds (75%). Spending also differs, with Tier 1 cities spending more (INR 1,880) compared to Aspirational India (INR 1,510).

- Value Reigns Supreme: 89% of users seek TWS or neckband devices priced between INR 1,001 and INR 2,000. This is the sweet spot for pricing hearables. It also highlights a strong demand for premium features amongst value-conscious consumers.

- Preferred Design and Material Choices: Consumers prioritize a blend of style and functionality. Sporty designs are most popular (45%), followed by classic colours (28%) and comfortable materials like soft silicone (23%). Notably, a quarter (26%) are influenced by fashion trends.

- Upgrade Intent: A significant portion (44%) of consumers surveyed plan to upgrade their TWS/Neckbands within the next three months.

- Discovery and Purchase: Discovering New TWS/Neckbands: Social media reigns supreme (48%) as the top source for discovering new hearables, followed by recommendations from loved ones (45%).

- Distribution Channels: Young Indian consumers are comfortable buying smart hearables online and offline. Interestingly, BOULT (55%) and boAt (52%) are mostly purchased online. On the other hand, Noise has a stronger offline presence (51%).

“The Indian smart hearables market is exploding thanks to a perfect mix of style, affordability, and function. Our new study shows that young Indian consumers, especially in aspirational Tier II cities, prioritize fashion alongside tech specs. This trend is driving the demand for premium hearables at accessible price-points. Audio brands like BOULT, boAt, and Noise are perfectly positioned to win over the hearts (and ears) of this discerning young demographic,” added , Himanshi Pant, Analyst-Industry Consulting Group (ICG), CyberMedia Research (CMR).

xxxx

Note to Editors:

The CMR primary survey covered around 1000 consumers across Delhi, Mumbai, Kolkata, Bengaluru, Lucknow, Rajkot, Bhubaneswar, and Madurai.

There is 95% confidence that the findings have a statistical precision of plus or minus 5%, accurately reflecting the sentiments of the broader population.