- 2.5” External HDD continued to dominate at 90% market share.

- 3.5” External HDD shipments sequential Growth by 230%.

- NAS market sequential growth by 97% and 3% decline YoY.

Gurugram/New Delhi, May 16, 2024: According to CMR’s India External Hard Drive Market Review for Q1 CY2024, the India External HDD (2.5” & 3.5”) market shipments witnessed a YoY drop down to 17%. However, on a QoQ basis, the market shipments showed a notable increase of 193% during the same period.

“The increasing demand for SSDs have posed significant challenges to the External HDD market. Consumers still purchase External HDDs for high-capacity storage needs, such as video editing and data archiving. Additionally, 2.5-inch External HDDs are gaining popularity for their compact size and 1TB-1.5TB Capacity segment is top contributor with 41% market share in terms of shipments and 2TB capacity segment contributed 41% in Q1 2024 observed Bhaskar Negi, Analyst – Industry Intelligence Group, Cyber Media Research.

In Q1 CY2024, the overall NAS shipments experienced a slight decline of 3% YoY, on a relatively smaller base. The Dual Bay NAS emerged as the most preferred choice, closely followed by the 4Bay NAS.

Q1 CY2024 Highlights

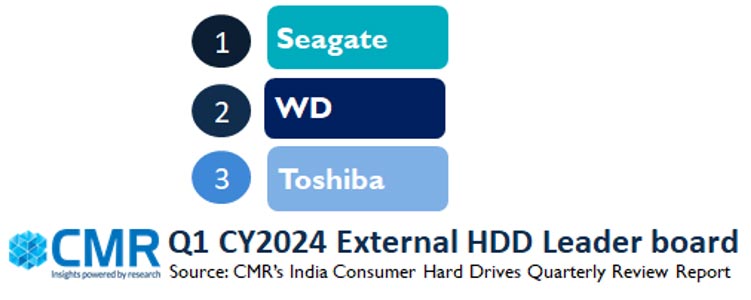

In the overall India External HDD market, Seagate to secure the top spot in the market, commanding a substantial 45% market share. WD secure second position with 33% market share with sequential growth of 308% in terms of shipment. Toshiba claimed the third position with a respectable 19% market share.

Future Trends

By the end of CY2024, shipments of External HDDs (2.5″ and 3.5″) are anticipated to experience single-digit growth in terms of volume on other side revenue trends seems growth and continued demand for External HDDs due to their features, such as large storage capacity and cost-effectiveness compared to SSDs.

“As we enter Q1 2024, CMR anticipates that shipments of External HDDs will witness growth. The demand for HDD storage solutions is projecting steady growth in areas like surveillance, backup, and archival storage. However, it’s important to note that the ongoing shift in demand and consumer preference towards SSDs will continue to impact modest but slowing growth. On the other hand increase in adoption of NAS devices to store large volumes of data on personal clouds is expected to drive the future growth,” added Bhaskar.

Notes for Editors

- Cyber Media Research (CMR) is a pioneering market intelligence and consulting firm that runs a comprehensive quarterly market update on the India Consumer Storage market. CMR’s India Quarterly Hard Drives Market Review covers External HDD, NAS, Surveillance HDD sold via distributors and retail outlets. The report accounts for ‘legal’ shipments, but does not include bundled or ‘grey’ market shipments or units brought from abroad by individuals as a part of personal baggage.

- CMR uses the term “shipments” to describe the number of hard drive devices leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term ‘shipment’ is sometimes replaced by “sales” in the press release, but this reflects the market size in terms of units of hard drive devices and not their absolute value.