- H1 2021 records highest smartphone shipments in last three years.

- 40% of all new smartphones launched in Q2 2021 were 5G-capable ones.

- realme shipped the most 5G phones during Q2.

- 76% of Value for Money smartphones launched in Q2.

- Apple shipments recorded remarkable 138% YoY growth in Q2 2021.

New Delhi/Gurugram, 09 August 2021: According to CMR’s India Mobile Handset Market Review Report for Q2 2021 released today, total smartphone shipments in India in the three months ending June grew 85% YoY. Driven by the strong consumer demand, 4G smartphones accounted for 87% market share. However, on a QoQ basis, the smartphone market dropped down by 11%.

According to Shipra Sinha, Analyst-Industry Intelligence Group, CMR, “While the overall market dropped down by 31% QoQ, there was a significant YoY growth with shipments up by 72%. Regional lockdowns, during April and May, in response to the second pandemic wave contributed to the decline. However, shipments bounced back in June. Xiaomi replaced Samsung at the top in terms of overall shipments for the second time in the last 3 years. 5G smartphone shipments recorded significant growth, primarily in the Value for Money smartphone (INR 7,000-INR 25,000) segment.”

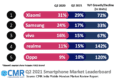

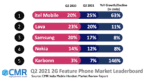

Xiaomi (29%), Samsung (17%) and Vivo (15%) captured the top three spots in the smartphone leaderboard in Q2 2021. realme and OPPO shipments grew by 142% and 120% respectively YoY. realme led the 5G smartphone segment with 24% market share followed by OnePlus at 21%. The 5G smartphone shipments accounted for 13% of the overall smartphone shipments in Q2 2021.

The feature phone segment increased 44% YoY due to low base effect. itel became the third player to introduce 4G feature phone. The 2G feature phone segment grew 27% YoY, with itel (25%), Lava (20%) and Samsung (17%) capturing the top three spots.

Q2 2021: Key Market Highlights

Xiaomi captured the top spot with 72% YoY growth in shipments. Redmi 9A, Redmi Note 10 and Redmi 9 Power were the most popular models, accounting for 55% of its overall shipments. During Q2 2021, Xiaomi launched five new smartphone models with three new 5G models including the Mi 11 Ultra. POCO recorded 528% YoY growth in Q2 due to low base effect. The Poco M3 accounted for >40% of its shipments. POCO launched its first 5G handset, the POCO M3 Pro. Xiaomi accounted for 33% of the Value for Money Handsets (INR 7000-25000) during Q2.

Samsung grew 33% YoY, accounted for 17% market share, and stood at the second spot in the smartphone market. During Q2, Samsung launched five new models with the Samsung M02, Samsung M12 and Samsung A12, accounting for 40% of its shipments. It captured the second position in the premium smartphones with 24% share (INR 25000-50000), just behind OnePlus.

Vivo garnered 15% market share, with its shipments growing by 67% YoY. vivo launched five new models including the vivo V21 and V21e in the premium smartphone segment. The vivo Y12s, Y20G and Y1s constituted almost half of its shipments.

realme shipments recorded a remarkable 142% YoY growth. It launched nine new models, with the realme C20, realme C21 and realme Narzo 30A series contributing 40% of its share. realme continued to drive 5G smartphone accessibility and affordability by introducing the realme 8 5G in the sub-15,000 segment. 94% of realme 5G smartphones were value for money smartphones.

OPPO shipments grew 120% YoY with 10% market share. In Q2 2021, OPPO launched 4 new models, including the OPPO A54, OPPO F19 and new 5G models OPPO A53s and OPPO A74. The OPPO A15 series and newly launched OPPO A54 accounted for 50% of its shipments.

OnePlus shipments recorded a significant growth of >200% YoY. OnePlus refreshed it annual lineup by launching three new models with the OnePlus 9R capturing 40% share. In the 5G premium segment, OnePlus 9 series captured 33% share.

Apple shipments recorded 138% growth YoY. Apple enjoyed a significant 70% market share in the super-premium Smartphone Segment (INR 50000-100000). Apple iPhone 11 accounted for two-thirds of its shipments. Apple’s remarkable growth was primarily driven by the start of the academic season, and new bundled offers that Apple aggressively promoted.

Transsion Group brands (itel, Infinix and Tecno) overall shipments grew 130% YoY. Its smartphone shipments grew a massive 314% YoY. itel continues to democratize smartphone access with shipments recording 843% YoY growth. The itel A23 Pro tie-up with Jio contributed significantly to the high growth. Similarly, Tecno smartphone shipments grew 160% YoY, while Infinix increased 458% YoY.

Future Outlook

As per CMR estimates, the smartphone market is expected to stay resilient and bounce back in Q3 2021 and beyond. For the entire year, CMR estimates point to a potential 5-8% YoY growth in smartphone shipments.

“We remain cautiously optimistic about the smartphone market in H2 2021. We expect smartphone shipments to be robust, driven by the early festive sales, attractive offers and continued consumer demand for smartphones as a major life enabler amidst the pandemic. The fragile supply chain and a potential third COVID wave are variables at play that may hurt the market recovery,” added Anand Priya Singh, Analyst- Industry Intelligence Group, CMR.

– ENDS –

About CyberMedia Research and Services Ltd

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

For queries, please contact Shipra Sinha, ssinha@cmrindia.com