Featurephones as well as Smartphones show upward trend during the second quarter

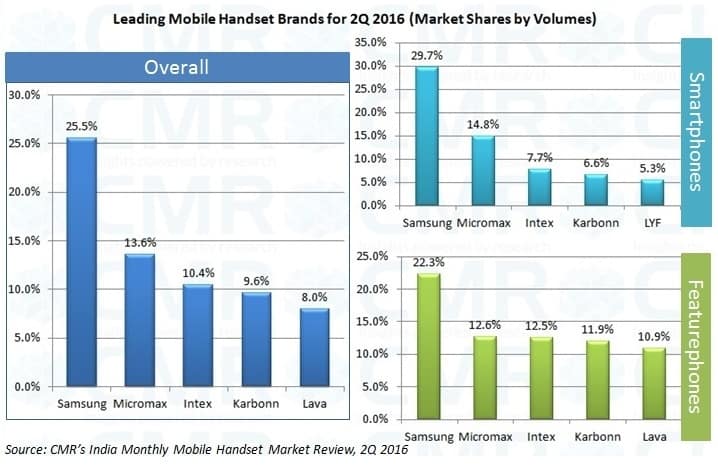

- Samsung, Micromax and Intex lead the market in Overall, Featurephones and Smartphones segments.

- Reliance’s LYF continues to excite the space and holds 5th position within Smartphones.

- Transsion Holding’s Itel garners close to 2% market share in Featurephones category in its first quarter of operations, holding 6th rank.

- ZTE makes a comeback after zero shipments in 1Q’16.

- Chinese brands flex muscles in Featurephones category as well. Brands like iKall, Kimfly and Kekai figure in top 20 Featurephone brands for the period.

- 3Q’CY 16 to see record breaking performance due to several factors, including increased disposable income due to good monsoon and pay commission implementation for central government employees and pensioners.

Gurugram/Delhi: After witnessing a disappointing start, the mobile handset market made a quite healthy comeback in the second quarter of 2016, owing to an upward movement in both Featurephones as well as Smartphones. This was stated in CMR’s India Monthly Mobile Handset Review, released today.

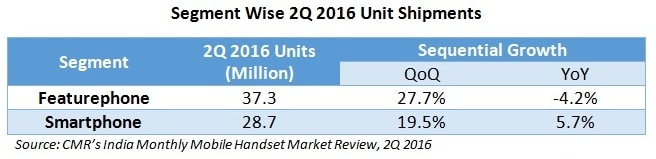

As per the report, a total of 65.9 million handsets were shipped during the period, of which 56.5% where Featurephones. The proportion was slightly higher than the previous quarter, where Featurephones contributed 54.9% to the overall shipments.

The mobile handset shipments are likely to surpass 75-million mark per quarter for the first time in 3Q’CY16, attributable to several factors ranging from festive season impact, increased disposable income, new product launches and the ensuing intense competition within the telecom operators as RJio inches closer to its commercial launch.

Commenting on the main trends witnessed during the period, Faisal Kawoosa, Lead Analyst for Telecoms at CMR said, “Now onwards we are going to see a clear demarcation between new customer acquisition and the refresh among existing users of the phones. As the telecom services data indicates, new customers are being acquired in far-flung areas of the country giving impetus to the Featurephones and the existing users are due for refresh (upgrade) of the phones. Many users in the Tier I and Tier II markets had purchased their Smartphones around 2013 to mid of 2014 and it’s now their turn to go for an upgraded Smartphone. At the same time, as the mobile base expands to rural and tertiary regions of the country, we expect good traction for the Featurephones as well.”

“I see China brands replicating their Smartphone strategy for the Featurephones now. The strategies they adopted for their wider reach in the Smartphone market of the country will be replicated for Featurephones too. This is why we are seeing a spur in the growth of Chinese Featurephone brands, besides existing getting stronger,” Faisal added.

In case of Smartphones, the report suggests, though less than Rs 2,000 saw over 200% growth in shipments in 2Q over the previous quarter, an interesting thing to witness was strong growth registered in the price bands above Rs 15,000.

The High-end Smartphone segment, which lies above Rs 20,000 price band, has registered a 35% growth during the quarter, with Oppo, LeEco, Asus, LG and Huawei benefiting the most in this category.

Tanvi Sharma, Analyst for Mobile Handsets market at CMR explained, “As regards Smartphones, we are now seeing replacement becoming synonymous to upgrades. Hence, people refreshing their Smartphones are also jumping to a higher price range causing higher order growth in such price bands.”

With respect to Featurephones, Tanvi added, “The demand is increasing even for Featurephones. Users want more feature sets and capabilities even within Feature phones. Some of them include a Selfie camera, higher battery capacity and a decent multimedia support.”

“It is now high time for India brands to focus on improving their Featurephones portfolio and ponder upon the value for money for this segment. The proliferation of Chinese brands within Featurephones can open up a stiff competition arena in this category. China brands were quick to bring innovations in the Smartphone space that gave them growth beyond acceptability and the same can now happen in Featurephones, if India brands don’t resort to sound counter strategy,” Tanvi cautioned while concluding.

NOTES TO EDITORS

- This release is a part of the CyberMedia Research (CMR) Smart Mobility Market Review Programme.

- CyberMedia Research (CMR) uses the term “shipments” to describe the number of handsets leaving the factory premises for OEM sales or stocking by distributors and retailers. For the convenience of media, the term shipments is sometimes replaced by ‘sales’ in the press release, but this reflects the market size in terms of units of mobile handsets and not their absolute value. In the case of handsets imported into the country it represents the number leaving the first warehouse to OEMs, distributors and retailers. CyberMedia Research does not track the number of handsets brought on their person by individual passengers landing on Indian soil from overseas destinations or ‘grey market’ handsets. These are, therefore, not part of the CyberMedia Research numbers reported here.

- CyberMedia Research (CMR) tracks shipments of mobile handsets on a monthly basis. However, as per convention, the market size is reported on a calendar quarter basis where appropriate to the context; in all such cases this refers to an aggregated number for the three calendar months in the quarter to which the press release refers.