Why Indian Handset Brands Should Change their Roadmap for 2017?

Share This Post

In 2016, about 382 new handsets were unveiled, out of these 267 were 4G Smartphones, 78 3G Smartphones and four were 2G Smartphones. The Indian brands were too active in launching a plethora of devices with the domestic firms launching about 320 handsets and the global brands close to 60 devices only.

Intex was seen launching highest number of models at around 60, followed by companies such as Lava and LYF, which launched about 25-18 models. But at the same time, hardly any model has created any sort of ripple in the market.

Now, taking a look at other handset vendors–in the first week of March, Xiaomi came out with its Redmi Note 3, Mi 5, Redmi 3S and Redmi 3S Prime, and so far last year till November, over 2 million shipments were recorded only for Redmi Note 3, and Redmi 3S Prime posted shipments at 1.2 million. This indicates how the new models from the Chinese vendors are creating the right notes in the market.

Let’s also not deny the fact that the perception about cheap quality Chinese handsets has taken a backseat, with companies like Xiaomi, LeEco, Oppo, Vivo, OnePlus creating waves in the market, offering better specs at affordable prices. 2016 saw aggressive marketing campaign by these brands, which helped them a lot.

While the Indian handsets were seen performing well in their niche markets, but what they are lagging behind is getting into the INR 10K price point for smartphones, where there’ a lot of potential for growth as maximum switches and upgrades are taking place in this arena.

The contribution of Indian handsets vendors in the INR 10K-15K price band is very less.

Chinese brands shipped around 8.7 million smartphones till November 2016 in this price point, global handset players shipped about 7.5 million smartphones, while domestic firms recorded only 1.4 million shipments.

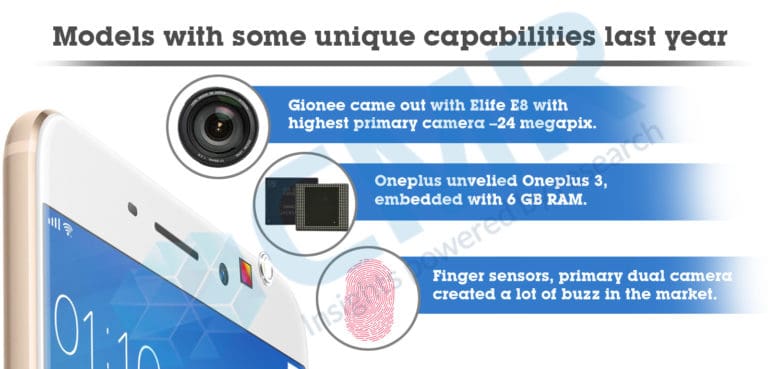

In fact, the global brands, including the Chinese Vendors, were seen introducing the highest RAM, pixel camera, etc.

One Plus came out with its highest 6GB RAM with One Plus 3 this year, while Gionee Elife E8 unveiled its highest primary camera of 24 megapix with resolution of 4224×5632.

With the changing times, Indian consumers are getting matured and the era of affordable handset, where Indian brands majorly focus, seems bleak.

Indian brands need to break the barrier and should come out with only few but some strong features in their devices. And of course, it is high time that they should increase their focus in the INR 10K-15K price point.

A number of launches will not help the Indian brands but of course, a concrete strategic roadmap will in the near future.