Smartphones are integral part of our daily lives and these are used because of their enhanced features e.g.web connectivity, increased storage capacity, computing power, upload capabilities, and attractive interface.

While the adoption is increasing among new smartphone users, existing smartphone users are contributing to the growth by changing the way they interact with their devices. The falling smartphone costs and thus the price points are lowering barriers to smartphone adoption. Every time a consumer buys smartphone, the consumer enjoys an upgraded and more capable device experience. The enhanced capabilities encourage consumers to do more with their device further entrenching and normalizing usage and encouraging users to think more about spending a little more to further enhance their smartphone’s capabilities.

In the midst of all the hype, and all the analysis, one key trend was overlooked, or rather under reported. How are Memory trends changing?

As per data from recent CMR Mobile Industry Consumer Insights (MICI) Survey, 79%& 72% of those surveyed amongst millennials, indicated the RAM and ROM respectively, as key for their smartphone purchase.

Now, most smartphone brands also have been focused on driving value propositions around memory, with the fight centred around RAM and ROM. Given the memory war has reached a zenith, it is no wonder that smartphone brands are now looking at RAM and ROM set-ups as the next battleground.

The increasing need of app installations on mobile devices demands a lot of memory. The limited size of the memory puts restrictions on the number of applications that one can install on a mobile device at any given instance of a time.

While initially it was premium, we have now seen mass adoption of high memory phones, across price bands, with various spec configurations.

Random Access Memory (RAM)

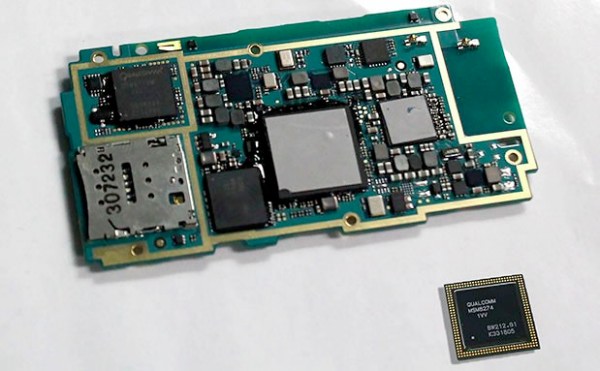

RAM acts as a middleman between the file system, which is stored on the ROM, and the processing cores, serving any sort of information as quickly as possible. Essential files that are needed by the processor are stored in the RAM, waiting to be accessed. These files could be things such as operating system components, application data and game graphics; or generally anything that needs to be accessed.RAM that is used in smartphones is technically DRAM, with the D standing for dynamic. The structure of DRAM is such that each capacitor on the RAM board stores a bit, and the capacitors leak charge and require constant “refreshing”; thus the “dynamic” nature of the RAM.

In Affordable smartphones (<INR 7000) segment, 2GB smartphones with 58% are the most dominated with the help of Xiaomi Redmi 6A and Realme C2.

In Value for Money (INR 7000 – 25000) with 43% and Uber Premium (>INR 100000) with 76%, 4GB enabled smartphones was the key contributor mainly contributed by Samsung and iPhone’s respectively.

For 6GB smartphones, Premium (INR 26000 – 50000) segment was the sweet spot with 46% contribution, brands including One Plus and Samsung dominating in this segment.

8GB smartphones mostly contributing in Super Premium smartphones (INR 51000 – 100000) segment with 38% driven by Samsung Galaxy S10 plus smartphone.

12GB smartphones are the mostly contributing in Uber Premium (>INR 100000) segment with 24% and mainly driven by Samsung Galaxy S10 Plus.

Future Forward

CMR estimates that high-end RAM enabled smartphones such as 6GB, 8GB, 10GB and 12GB will grow in line with increased demand from millennials. More the RAM on a smartphone, the more apps and files it will be able to fit, and which in turn, would translate into smooth functioning and for better gaming experience.

Read only memory (ROM)

Like RAM, ROM is critical to a smartphone’s operation; without any place to store the operating system and critical files there would be nothing for the phone to do.Depending on the operating system loaded on the device, and the device itself, there are multiple storage chips inside the device. These chips may then be partitioned into several areas for different purposes, such as application storage, cache and system files.

In Affordable smartphones (<INR 7000) segment, 16GB smartphones with 57% are the most dominated with the help of Xiaomi Redmi 6A and Samsung Galaxy A2 core.

For 64GB smartphones, Value for Money (INR 7000 – 25000) was the sweet spot with 44% contribution, brands including Xiaomi Redmi Note 7 Pro and Samsung Galaxy A50 dominating in this segment.

In Premium (INR 26000 – 50000) segment with 65% and Super Premium (INR 51000 – 100000) with 41%, 128GB enabled smartphones was the key contributor mainly contributed by Samsung Galaxy A70 and Apple iphone XR respectively.

256GB smartphones mostly contributing in Uber Premium smartphones (>INR 100000) segment with 50% driven by Apple iphones.

512GB and 1TB smartphones are the mostly contributing in Uber Premium (>INR 100000) segment and mainly driven by Apple iphones and Samsung Galaxy S10 Plus.

Future Forward

CMR estimates that 128GB, 256GB and 512GB ROM enabled smartphones expected to grow in 2020 because they are no longer reserved for the top flagships and new release of Android or iOS the size of the OS software has kept on increasing, many OEMs partner with a number of app developers to pre install or bundle multiple apps or games as promotional offers which consumers cannot be uninstalled.

Conclusion

As smartphone users continue to rise on smartphone usage curve, they will be expecting more from their mobile devices than ever before.Billions of consumers will look to upgrade to smartphones not only with advanced software capabilities, but also to higher capacity storage. And need for higher capacity storage highly complements the other upgrades.