The cashless (Digital) India initiative was launched by the Government of India to empower the society digitally. There are many advantages of a cashless economy which can be witnessed all over India. Cashless means – faceless, paperless and most importantly “Touchless”. This brings in more convenience as people do not need to use tangible cash to pay for various goods and services. At CyberMedia Research (CMR), we have focused on capturing the performance of various digital payment apps in our “Alpha Brands 2021” study.

The cashless (Digital) India initiative was launched by the Government of India to empower the society digitally. There are many advantages of a cashless economy which can be witnessed all over India. Cashless means – faceless, paperless and most importantly “Touchless”. This brings in more convenience as people do not need to use tangible cash to pay for various goods and services. At CyberMedia Research (CMR), we have focused on capturing the performance of various digital payment apps in our “Alpha Brands 2021” study.

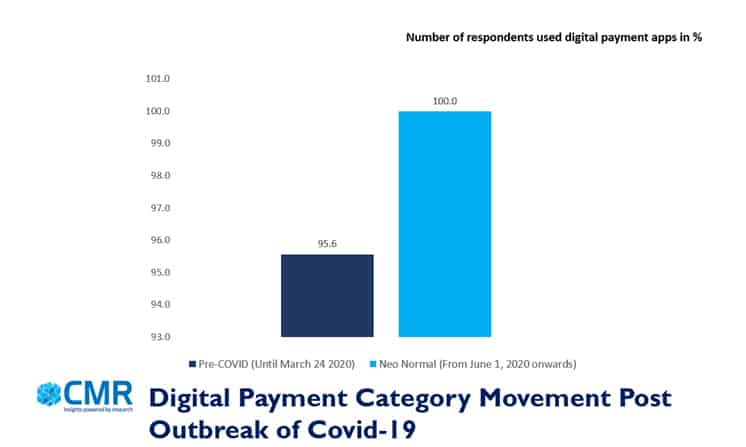

The severe second pandemic wave has caused a drastic decline in cash usage due to the risk of contamination. Over the past eight to twelve months, the country has seen the use of cash decline even further, and that’s a trend we’re going to see continue.

The unprecedented surge in the demand for contactless payment has also led to outstanding performances for major companies offering mobile wallet apps.

The Alpha Brands 2021 research is based on a comprehensive digital survey covering 2164 respondents across top seven cities of India, namely New Delhi, Mumbai, Kolkata, Chennai, Hyderabad, Bangalore and Ahmedabad. It shows how different categories and brands were performing last year and were they able to maintain their position during lockdown & in new normal. How people adopted categories and brands according to their changing needs after the outbreak of covid-19.

The Alpha Brands have been arrived at on the basis of their performance across four major components, including brand’s users, key decision makers, NPS score, and the overall brand trust quotient. The brand quotient was arrived at, on the basis of consumer satisfaction and brand advocacy.

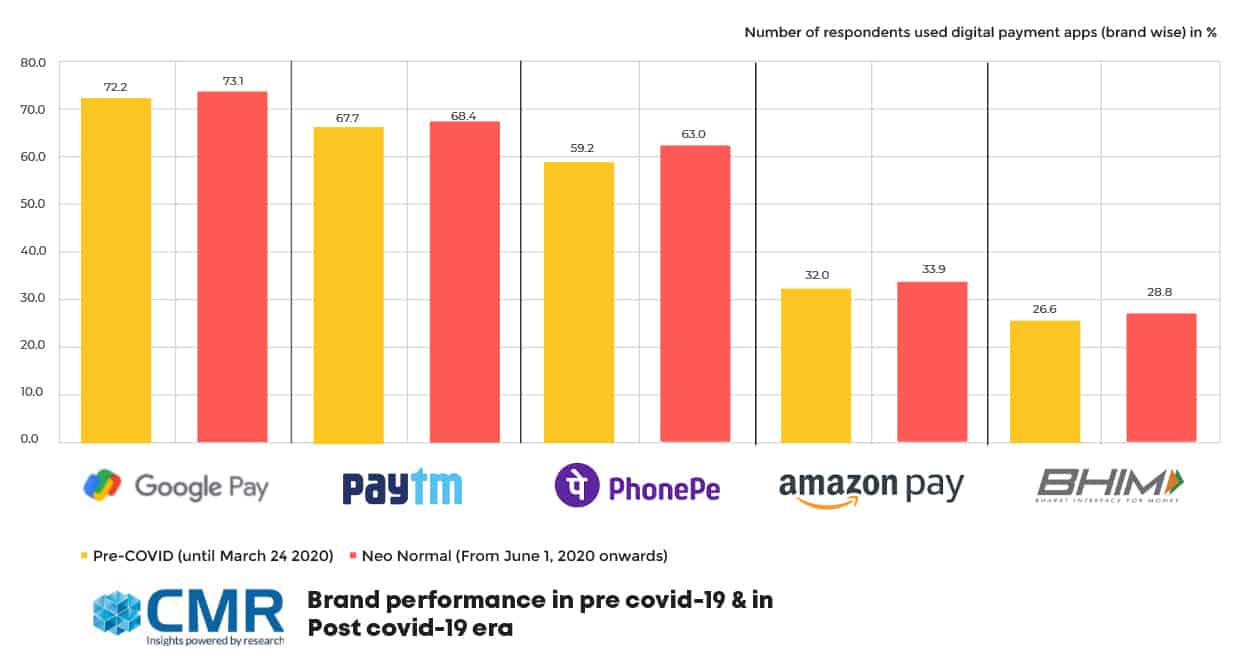

Google Pay, Paytm and PhonePe are the top three digital payment brands. Consumers are using more than one digital payment apps at same time. This is basically a resultant of offers and availability of payment platforms with different vendors.

Going forward, digital payments will continue to gain in traction over the next year, beyond Tier II and Tier III. The pandemic has accelerated the digital shift. Most of the consumers are accessing online services thus enhancing the digital payment market. With the growing digital consumer base, consumer-friendly e-Wallets play a pivotal role in providing accessible digital transaction facilities through smartphones to both the urban and rural population. Although a large portion of the rural population still lacks internet access, India is on the road to build a robust digital economy.

The study can be accessed online at http://cmrindia.com/shelf/alpha-brands-2021-most-trusted-brands-amidst-the-pandemic/